Karora Resources Announces New Gold Footwall Zone and Nickel Zone at the Beta Hunt Mine; Regional Gravity Survey at Higginsville

- Underground drilling has identified a new gold footwall zone and high grade nickel intercepts at the northern end of the Western Flanks resource1. Significant gold intersections include:

New Footwall Zone

- WFN-106exp: 6 g/t over 9.4 m

- WFN-115: 0 g/t over 5.3 m

- WFN-134: 4 g/t over 23.3 m, including 6.3 g/t over 6.0 m;

- WFN-131exp: 0 g/t over 8.6 m

Infill Drilling

- WFN-130: 1 g/t over 6.6 m, including, 13.7g/t over 3.3 m

- WFN-090: 8 g/t over 9.9 m;

- New nickel drilling highlights at Western Flanks North:

- WFN-103A: 2% over 1.2 m;

- WFN-135: 2% over 0.8 m;

- WFN-118: 1% over 2.2 m

- Estimated true thickness

Karora Resources Inc. (TSX: KRR) ("Karora" or the “Corporation" – https://www.commodity-tv.com/ondemand/companies/profil/karora-resources-inc/ ) is pleased to provide an update on drilling activities at its Beta Hunt Mine, including new high-grade gold and nickel drilling intercepts over wide zones at Western Flanks North.

Drilling on the northern margin of the Western Flanks resource has discovered new gold mineralization in the footwall striking parallel to and at the top of the existing resource. The new mineralized zone, which has a strike length of over 160 metres, remains open to the north and up-dip, and occurs beneath the basalt / ultramafic contact where new high grade nickel mineralization has also been discovered.

Paul Andre Huet, Chairman & CEO, commented: "Following a short pause in drilling at Beta Hunt due to COVID-19 precautions, we now have two drills operating full time on both gold and nickel targets. We are extremely pleased to announce the early success in expanding our potential mineral resource base. Our drilling in the Western Flanks shear zone, which is one of two gold production zones at Beta Hunt, has returned very strong results to the north, upgrading the existing resource and expanding the known mineralization with the discovery of a new footwall zone. Encouragingly, both of our production zones, Western Flanks and A Zone, remain open to the north and at depth.

Our restarted drilling has also returned some very strong nickel drilling results which sit just above the gold zone at the basalt / ultramafic contact. These strong nickel intercepts could expand our potential nickel resource base and build the case for continued robust nickel by-product credits to our gold AISC costs at Beta Hunt.

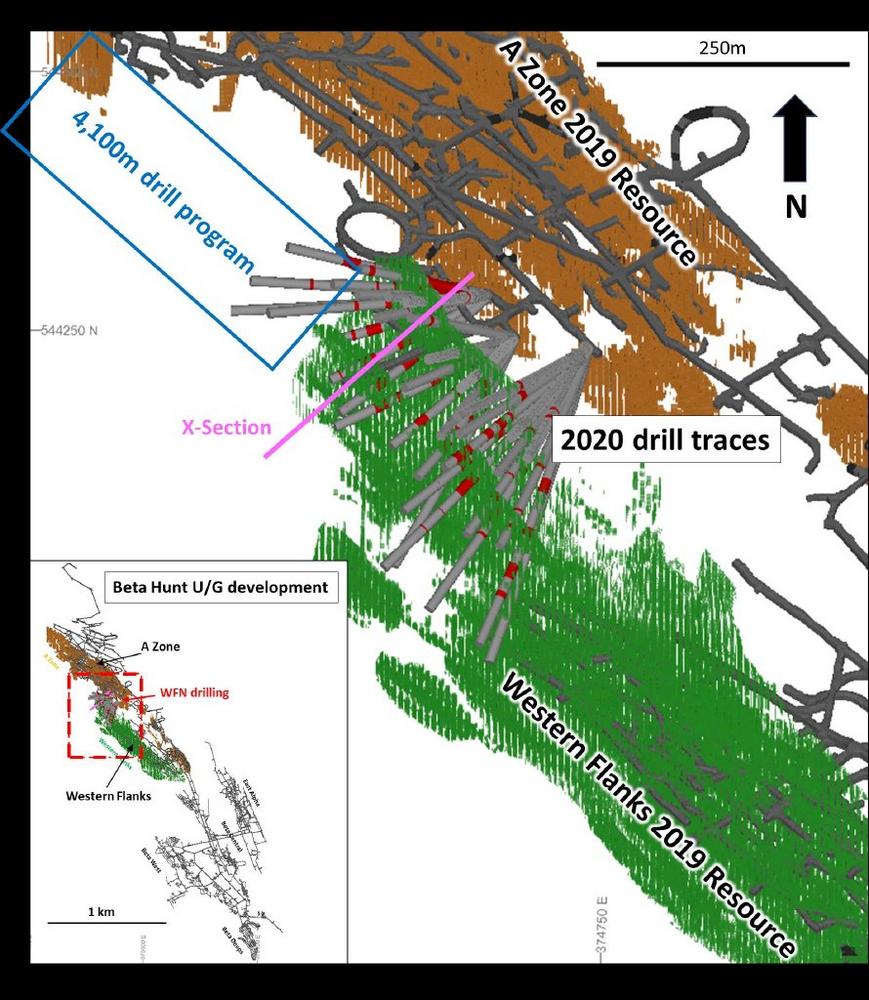

Given the excellent results in our early drilling at Beta Hunt, we have increased our underground drilling budget by 4,100 metres. We plan to continue to test the Western Flanks zone to the north, with the aim of adding up to another 280 metres of strike and 80 metres of depth to the zone.

At Higginsville we were also busy during the period where drilling was paused due to COVID-19 precautions. We recently received the results of a regional gravity survey over a large area of HGO ground which has very little historical exploration. Although still at an early stage, a preliminary review of the data has identified multiple gold targets including typical Higginsville-style primary deposits and potentially large scale paleochannel deposits. A detailed desktop study is underway to rank these target areas to allow for systematic, priority-based drill testing later this year. It is evident from the gravity survey and ongoing exploration target definition that the Higginsville area has one of the most exciting unexplored land packages within the region. We are also continuing an aggressive drill program at HGO with two drills currently turning and plan to add additional drilling capacity in the near future.

Overall I am extremely pleased with our team’s response to the necessary restrictions in place during the first half of the year and look forward to continued drilling results as we get back to exploration drilling at both of our properties.”

Gold Drill Results – Western Flanks North

The Western Flanks North drilling program totaled 36 holes for 6,779 metres comprised of both resource definition and grade control holes. Drilling tested over 240 metres of strike and was aimed at upgrading the existing Inferred mineral resource at the top of northern end of the Western Flanks Resource Model.

Results to date have generally confirmed the existing mineral resource model dominated by a steep west-dipping main shear and east-dipping hanging wall zones. In addition, drilling has now discovered a new, parallel footwall zone of mineralization at the top of the existing resource.

This new zone extends over 160 metres of strike and 50 metres high above the northern end of the drilled area with potential to extend a further 50 metres up-dip to the basalt/ultramafic contact, at depth and further along strike to the north. Drill intersection highlights are listed below:

Main Shear and Hanging wall zone positions1.:

- WFN-090: 3.8 g/t over 9.9 m;

- WFN-100: 3.0 g/t over 17.8 m;

- WFN-106exp: 5.1 g/t over 7.6 m;

- WFN-109: 3.9 g/t over 9.9 m;

- WFN-124: 0 g/t over 12.9 m, including 7.5 g/t over 3.6 m;

- WFN-130: 1 g/t over 6.6 m, including, 13.7g/t over 3.3 m;

Footwall (new zone)1.:

- WFN-106exp: 4.6 g/t over 9.4 m;

- WFN-115: 6.0 g/t over 5.3 m;

- WFN-119A: 4.6 g/t over 6.0 m;

- WFN-123: 2.4 g/t over 4.2 m;

- WFN-125: 4.5 g/t over 3.4 m;

- WFN-128exp: 3 g/t over 4 m;

- WFN-131exp: 0 g/t over 8.6m;

- WFN-132: 2 g/t over 26.7m, including 9.4 g/t over 1.8m;

- WFN-134: 2.4g/t over 23.3m, including 6.3g/t over 6.0m;

- Drillhole intervals are estimated true widths

Nickel Drill Results – Western Flanks North

Selected holes aimed at upgrading the existing gold mineral resource were extended through the basalt/ultramafic contact to test the continuity of the Western Flanks nickel mineralization at this contact position. Drilling has intersected both massive and matrix nickel sulphides on the contact position and a thrusted ultramafic (lower) position within the basalt. Results to date have highlighted the potential for high grade nickel sulphide shoots to occur within the zone of nickel mineralization above the Western Flanks gold mineral resource.

Significant results from testing the nickel contact position are listed below:

Western Flanks Nickel-Upper1.:

- WFN-103A: 7.2% over 1.2m;

- WFN-096: 5.3% over 0.5 m;

- WFN-135: 5.2% over 0.8 m;

WFN-134: 5.6% over 0.7 m;

- WFN-118: 1% over 2.2 m

Western Flanks Nickel-Lower 1.:

- WFN-132: 1.1% over 0.8 m;

- WFN-134: 1.2% over 1.3 m;

- WFN-114exp: 3.9% over 1.0 m and 4.3% over 0.6 m

- Drillhole intervals are estimated true widths

Western Flanks North Background

The Western Flanks Mineral Resource, Measured & Indicated, totals 7,448 kt @ 3.0g/t Au (710,000 ounces) and Inferred 2,481 kt @ 3.1 g/t Au (250,000 ounces) (see Technical Report on the Western Australian Operations – Eastern Goldfields: Beta Hunt Mine (Kambalda) and Higginsville Gold Operations (Higginsville), dated February 6, 2020). The bulk of the Inferred resource is located at the northern end of the resource model. The northern end represents an unrealized short-term mining opportunity given its proximity to the A Zone/AWF Decline. The 2020 resource definition drilling program was prioritized to upgrade and potentially extend the current resource in this area (Figure 1 and 2).

In addition to gold mineralization, the basalt/ultramafic contact above the Western Flanks mineral resource is recognized as a potentially economic nickel trough (see Karora news release dated September 16, 2019) and selected drill holes were designed to test the continuity of this mineralization identified from historic drilling. This mineralization is outside of any nickel mineral resources previously reported by Karora and occurs parallel to the historically-mined D Zone nickel trough (above A Zone gold Mineral Resource) 150 metres to the east.

Higginsville Regional Gravity Survey

As part of Karora’s Higginsville strategy, a high density (200 metre X 100 metre) survey was conducted over a 400 km2 area east of the central Higginsville mine area (Figure 3). The area has little to no historic exploration yet is situated over prospective ground that covers the eastern margin of the Kalgoorlie Terrane. The area contains a number of the main regional faults and has similar geology to many of the major gold deposits within the Kalgoorlie-Kambalda-Norseman area.

The gravity survey covered large areas of the Zuleika shear zone and the western margin of the Boulder Lefroy shear zone. The Zuleika and Boulder Lefroy shear zones and associated subsidiary faults host most of the deposits mined at Higginsville and the adjacent and along strike St Ives gold operation to the north, which has produced over 14 million ounces since 1980.

The bulk of the eastern margin of the Higginsville project area is largely unexplored, sitting under the Lake Cowan salt lake. The impact of the salt lake on the location of historical mining at Higginsville shows a clear bias to land-based deposits compared to deposits located on salt lakes (under-cover). The higher cost and drill-access difficulties have previously deterred explorers from assessing the potential for new gold deposits under the salt lake. Recent salt lake discoveries in the region include Karora’s Baloo deposit (2015 – 264,000 ounces)1 and St Ives’ Invincible deposit (2012 – 1.3 million ounces)2 that highlight the potential that exists under this terrain.

Preliminary observations from the images produced to date show significant, and well-recognised structural trends and fault-offsets known to be associated with economic primary mineralization plus substantial paleochannel systems linked with known resources.

A desktop targeting study has commenced with the aim of designing a drill program based on the interpreted priority targets. The targeting is planned for completion next quarter with drilling commencing in the fourth quarter of 2020.

1. Historical mineral resource – part of the Polar Bear Project (see technical report dated February 6, 2020 under Karora’s profile at sedar.com, S2 Resources Ltd, ASX news release February 13, 2017).

2. Gold Fields Australia – Diggers & Dealers Presentation, 2014, https://www.goldfields.com/pdf/investors/presentation/2014/diggers-and-dealers/presentation

Compliance Statement (JORC 2012 and NI 43-101)

The disclosure of scientific and technical information contained in this news release has been reviewed and approved by Stephen Devlin, FAusIMM, Group Geologist, Karora Resources Inc., a Qualified Person for the purposes of NI 43-101.

All drill core sampling is conducted by Karora personnel. Samples for gold analysis are shipped to SGS Mineral Services of Kalgoorlie for preparation and assaying by 50 gram fire assay analytical method. All gold diamond drilling samples submitted for assay include at least one blank and one Certified Reference Material (“CRM”) per batch, plus one CRM or blank every 20 samples. In samples with observed visible gold mineralization, a coarse blank is inserted after the visible gold mineralization to serve as both a coarse flush to prevent contamination of subsequent samples and a test for gold smearing from one sample to the next which may have resulted from inadequate cleaning of the crusher and pulveriser. The lab is also required to undertake a minimum of 1 in 20 wet screens on pulverised samples to ensure a minimum 90% passing at -75µm. Samples for nickel analysis are shipped to SGS Australia Mineral Services of Kalgoorlie for preparation. Pulps are then shipped to Perth for assaying. The analytical technique is ICP41Q, a four acid digest ICP-AES package. Assays recorded above the upper detection limit (25,000ppm Ni) are re-analyzed using the same technique with a greater dilution (ICP43B). All samples submitted for nickel assay include at least one Certified Reference Material (CRM) per batch, with a minimum of one CRM per 20 samples. Where problems have been identified in QAQC checks, Karora personnel and the SGS laboratory staff have actively pursued and corrected the issues as standard procedure.

About the Gravity Survey

The regional gravity survey was designed to cover the eastern margin tenements covering Lake Cowan to the east of Higginsville mill. Data collection was undertaken by Atlas Geophysics Pty Ltd on a 200m by 100m grid using a Scintrex CG-5 gravity meter. The gravity data were reduced to the sea-level datum by standard reductions (Tide, drift, height, temperature, pressure, tilt, free air, and bouguer corrections) using a bouguer density of 2.67 g/cm3 to reflect the underlying geology. The collected data was processed by Resource Potentials Pty Ltd.

About Karora Resources

Karora is focused on growing gold production and reducing costs at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations ("HGO") in Western Australia. The Higginsville treatment facility is a low-cost 1.4 Mtpa processing plant which is fed at capacity from Karora’s underground Beta Hunt mine and open pit Higginsville mine. At Beta Hunt, a robust gold mineral resource and reserve is hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial historical gold resource and highly prospective land package totaling approximately 1,800 square kilometers. Karora has a strong Board and management team focused on delivering shareholder value. Karora’s common shares trade on the TSX under the symbol KRR. Karora shares also trade on the OTCQX market under the symbol KRRGD.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to the potential of the Beta Hunt Mine, Higginsville Gold Operation and Spargos Reward Gold Project.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora ’s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Cautionary Statement Regarding the Higginsville Mining Operations

A production decision at the Higginsville gold operations was made by previous operators of the mine, prior to the completion of the acquisition of the Higginsville gold operations by Karora and Karora made a decision to continue production subsequent to the acquisition. This decision by Karora to continue production and, to the knowledge of Karora, the prior production decision were not based on a feasibility study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, which include increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that anticipated production costs will be achieved. Failure to achieve the anticipated production costs would have a material adverse impact on the Corporation’s cash flow and future profitability. Readers are cautioned that there is increased uncertainty and higher risk of economic and technical failure associated with such production decisions.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Director, Investor Relations

Telefon: +1 (416) 363-0649

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()