Osisko announces Multiple New High-Grade Gold Discoveries Adjacent to Maiin Deposits at the Cariboo Gold Project

Sean Roosen, Chair and CEO of Osisko, commented: “Since Osisko first got involved in the Cariboo project we have been firm believers in its potential scale and importance within the sector. Recent drill results continue to confirm our thesis that Cariboo is not just a mining project, but a mining camp. In a separate release, we have announced that Cariboo will become the flagship asset in the newly formed Osisko Development Corp. I look forward to leading the team that advances Cariboo towards intermediate producer status.”

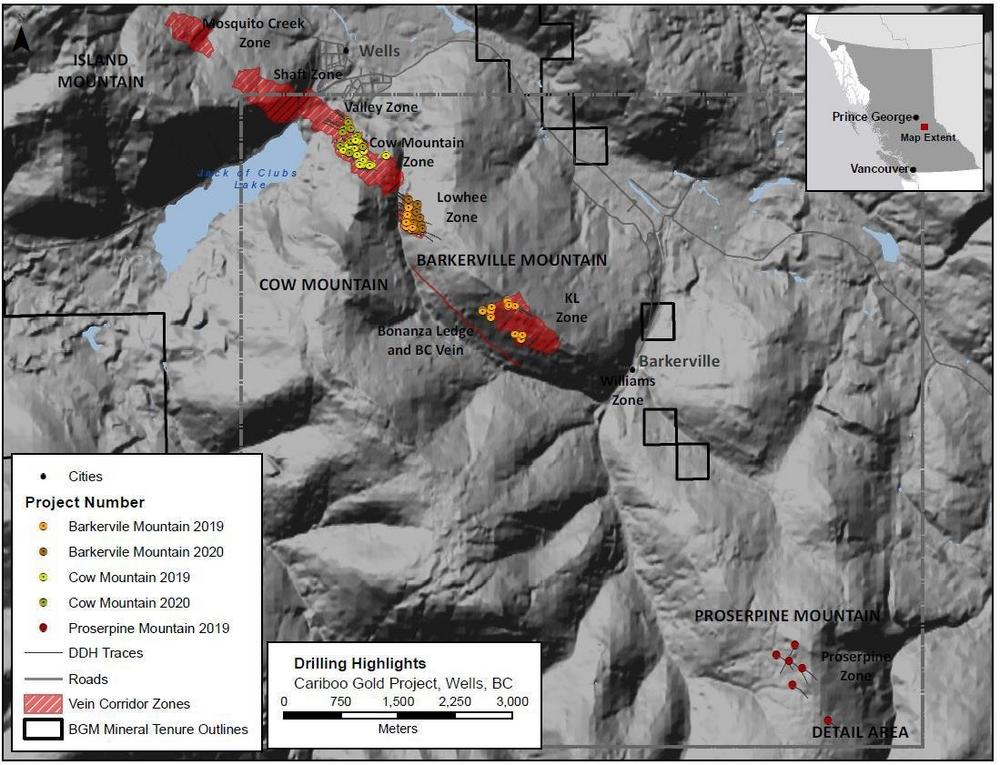

In 2019, drilling at Cariboo successfully intersected down dip extensions of mineralized vein corridors to a depth of 700 meters and confirmed high-grade intercepts within the current resource. The Company also made multiple new discoveries by stepping out along strike from the known deposits to define a strike length of 15 kilometers of the mineralized system (Figures 1 and 2). These new discoveries will be followed by the drill programs described below with the aim of adding significant resources to Cariboo with continued success.

This year, we began a 40,000-meter diamond drilling campaign focused on the expansion of the Lowhee Zone and further delineating the Cow and Valley deposits (Figure 1). After a COVID-19 related delay, three drill rigs are currently active at Cariboo, increasing to eight in October.

At Cow, a total of 16,000 meters were drilled in 72 holes in 2019. Year-to-date, 4,350 meters have been drilled in 22 holes (Figure 4). Drilling continues to define the high-grade vein corridors demonstrated by CM-20-009 that intersected 25.79 g/t Au over 6.30 meters and included a higher-grade sample of 99.8 g/t Au over 0.55 meter. Recently, 6,530 g/t Au over 0.50 meter was intersected 10 meters down dip from a modelled vein corridor in hole CM-20-018, representing the highest-grade assay intersected in all drilling to date at the Cariboo Gold Project.

At Valley Zone, 11,000 meters have been drilled in 57 holes in 2020. This news release discusses the initial assay results returned. Highlights include 9.99 g/t Au over 5.95 meters including 84.5 g/t Au over 0.50 meter in hole CM-20-025. The majority of the drilling proposed for the remainder of 2020 will occur in the Valley Zone vein corridors. The Valley Zone has not been drill tested since 2017, and significant potential exists to add both inferred and indicated resource to the deposit.

On Barkerville Mountain, the newly discovered Lowhee Zone, interpreted to be an offset strike extension of the Cow Mountain Deposit, is rapidly demonstrating high-grade vein corridors with systematic exploration drilling. This news release includes the drill results from the remaining 11 holes drilled at KL in 2019, the remaining 20 holes from Lowhee drilled in 2019 and the first 24 drillholes from Lowhee drilled in 2020 (Figure 5).

At Lowhee Zone, a total of 18,000 meters in 48 holes have been drilled to date. Recent results from Lowhee include 20.66 g/t Au over 12.80 meters with a sample of 352 g/t Au over 0.65 meter located 100 meters from surface in in exploration hole BM-19-105. BM-19-109 intersected 10.53 g/t Au over 18.70 meters. Multiple intercepts greater than 100 g/t Au include 186.5 g/t Au over 0.50 meter in hole BM-19-101, 327 g/t Au over 0.50 meter in BGM-19-111, 159 g/t Au over 0.50 meter in BM-20-013 and 249 g/t Au over 0.55 meter in BM-20-016. The Lowhee Zone has been drill tested to a vertical depth averaging 350 meters along a current strike of 300 meters by 500 meters and is open in all directions.

At KL Zone, located in the footwall of the Bonanza Ledge and BC Vein Deposits, a total of 36,000 meters were drilled in 87 holes in 2019. Recent results from the KL Zone include 11.87 g/t Au over 5.80 meters in BM-19-079 and 8.84 g/t Au over 10.40 meters from BM-19-093. The apparent strike length of this system is 1.5 kilometers, outlined from the recent drill results and the Company’s detailed lithological and structural mapping programs conducted over the last two years. Figure 5 illustrates the location of the drilling on Lowhee and KL.

In 2019, drilling at Cariboo successfully made multiple new discoveries, including Proserpine Mountain, located 6 kilometers south east of the Company’s Bonanza Ledge Mine. Based on detailed geologic mapping and sampling programs carried out in 2019 (Figure 2). A total 2,675 meters were drilled in 6 holes over a strike length of 1 kilometer. One stratigraphic hole was drilled to define the extents of the prospective sandstone unit and five holes explored for mineralized vein corridors.

The program was successful in discovery of high grade, mineralized axial planar veins analogous to those on Cow and Island Mountains in five out of the six holes. Assay highlights include 17.78 g/t Au over 5.60 meters in PSP-19-002 just 50 meters from surface. The drillhole locations are indicated on Figure 6 and drilled at an average spacing of 300 meters. The system is open in all directions and prospective areas remain untested along strike. The Company is currently conducting an additional 6,000 meters of diamond drilling on Proserpine to follow up and expand these initial positive results.

Further highlights from 2019-2020 drilling at Cow Mountain, Valley, Lowhee, KL and Proserpine are presented below.

Select Cow Mountain Highlights:

· CM-19-029: 9.47 g/t Au over 11.40 meters

· CM-19-030: 5.50 g/t Au over 32.55 meters including 25.67 g/t Au over 4.95 meters

· CM-19-044: 20.94 g/t Au over 3.50 meters

· CM-19-055: 15.87 g/t Au over 8.70 meters including 98.20 g/t Au over 0.90 meter

· CM-19-057: 73.80 g/t Au over 0.90 meter

· CM-19-059: 51.90 g/t Au over 1.45 meters

· CM-19-070: 16.56 g/t Au over 5.20 meters

· CM-19-071: 18.70 g/t Au over 7.00 meters

· CM-19-072: 7.75 g/t Au over 9.40 meters

· CM-20-003: 27.21 g/t Au over 5.55 meters including 179.5 g/t Au over 0.80 meter

· CM-20-006: 66.40 g/t Au over 0.65 meter

· CM-20-009: 25.79 g/t Au over 6.30 meters including 99.8 g/t Au over 0.55 meter

· CM-20-009: 18.11 g/t Au over 3.50 meters including 47.7 g/t Au over 1.15 meters

· CM-20-015: 16.83 g/t Au over 3.60 meters including 117.50 g/t Au over 0.50 meter

· CM-20-018: 6,530 g/t Au over 0.50 meter

· CM-20-022: 13.58 g/t Au over 3.90 meters

Select Valley Zone Highlights:

· CM-20-025: 9.99 g/t Au over 5.95 meters including 84.5 g/t Au over 0.50 meter

· CM-20-029: 6.59 g/t Au over 5.90 meters

· CM-20-031: 6.28 g/t Au over 16.0 meters

· CM-20-031: 5.58 g/t Au over 11.8 meters

Select KL Zone Highlights

· BM-19-079: 11.87 g/t Au over 5.8 meters

· BM-19-094: 9.46 g/t Au over 5.85 meters

Select Lowhee Zone Highlights

· BM-19-093: 8.84 g/t Au over 10.4 meters including 58.10 g/t Au over 0.80 meters and 70.0 g/t Au over 0.50 meter

· BM-19-101: 40.25 g/t Au over 2.50 meters including 186.5 g/t Au over 0.50 meters

· BM-19-102: 5.76 g/t Au over 6.75 meters

· BM-19-105: 20.66 g/t Au over 12.80 meters including 352 g/t Au over 0.65 meters

· BM-19-109: 10.53 g/t Au over 18.7 meters including 109.5 g/t Au over 0.50 meters and 90.1 g/t Au over 0.50 meters

· BM-19-111: 6.82 g/t Au over 9.25 meters including 60.60 g/t Au over 0.50 meter

· BM-19-111: 327 g/t Au over 0.5 meters

· BM-20-001: 44.40 g/t Au over 0.85 meter

· BM-20-004: 4.18 g/t Au over 7.90 meters

· BM-20-007: 44.92 g/t Au over 2.10 meters including 137.5 g/t Au over 0.50 meter

· BM-20-007: 12.07 g/t Au over 7.5 meters including 120.0 g/t Au over 0.50 meter

· BM-20-013: 13.20 g/t Au over 10.60 meters including 159 g/t Au over 0.50 meter

· BM-20-014: 64.00 g/t Au over 0.60 meter

· BM-20-015: 25.29 g/t Au over 2.00 meters including 58.6 g/t Au over 0.80 meter

· BM-20-016: 99.70 g/t Au over 0.50 meter

· BM-20-016: 249.0 g/t Au over 0.55 meter

· BM-20-020: 9.29 g/t Au over 4.65 meters including 68.1 g/t Au over 0.50 meter

· BM-20-020: 18.18 g/t Au over 10.2 meters including 91.4 g/t Au over 0.50 meter

Select Proserpine Assays

· PSP-19-001: 16.70 g/t Au over 0.50 meters

· PSP-19-002: 17.78 g/t Au over 5.60 meters including 112 g/t Au over 0.60 meter and 30.70 g/t Au over 1.00 meter

· PSP-19-002: 26.08 g/t Au over 3.00 meters including 84.90 g/t Au over 0.90 meter

· PSP-19-003: 95.20 g/t Au over 0.50 meter

Mineralized quartz veins on the Cariboo Gold Project are overall sub-vertical dip and northeast strike. Vein corridors are defined as a high-density network of mineralized quartz veins within the axis of the F3 fold and hosted within the sandstones. Vein corridors are modelled at a minimum thickness of 2 meters and individual veins within each corridor range in width from millimeter to several meters. The modelled vein corridors for the resource update includes the internal dilution of the subeconomic sandstone within these vein corridors. These corridors have been defined from surface to a vertical depth averaging 300 meters and remain open for expansion at depth and down plunge. Gold grades are intimately associated with vein-hosted pyrite as well as pyritic, intensely silicified wall rock haloes in close proximity to the veins.

True widths are estimated to be 60 to 75% of reported core length intervals. Intervals not recovered by drilling were assigned zero grade. Top cuts have not been applied to high grade assays. Complete assay highlights are presented in Appendix A.

Complete assay highlights are presented in Appendix A. Please click here.

Qualified Persons

Per National Instrument 43-101 Standards of Disclosure for Mineral Projects, Maggie Layman, P.Geo. Vice President Exploration of Barkerville Gold Mines Ltd, is a Qualified Person and has prepared, validated and approved the technical and scientific content of this news release.

Quality Assurance – Quality Control

Once received from the drill and processed, all drill core samples are sawn in half, labelled and bagged. The remaining drill core is subsequently stored on site at a secured facility in Wells, BC. Numbered security tags are applied to lab shipments for chain of custody requirements. Quality control (QC) samples are inserted at regular intervals in the sample stream, including blanks and reference materials with all sample shipments to monitor laboratory performance. The QAQC program was designed and approved by Lynda Bloom, P.Geo. of Analytical Solutions Ltd.

Drill core samples are submitted to ALS Geochemistry’s analytical facility in North Vancouver, British Columbia for preparation and analysis. The ALS facility is accredited to the ISO/IEC 17025 standard for gold assays and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. The entire sample is crushed, and 250 grams is pulverized. Analysis for gold is by 50g fire assay fusion with atomic absorption (AAS) finish with a lower limit of 0.01 ppm and upper limit of 100 ppm. Samples with gold assays greater than 100 ppm are re-analyzed using a 1,000g screen metallic fire assay. A selected number of samples are also analyzed using a 48 multi-elemental geochemical package by a 4-acid digestion, followed by Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) and Inductively Coupled Plasma Mass Spectroscopy (ICP-MS).

About Osisko Gold Royalties Ltd

Osisko Gold Royalties Ltd is an intermediate precious metal royalty company focused on the Americas that commenced activities in June 2014. Osisko holds a North American focused portfolio of over 135 royalties, streams and precious metal offtakes. Osisko’s portfolio is anchored by its cornerstone asset, a 5% net smelter return royalty on the Canadian Malartic mine, which is the largest gold mine in Canada. Osisko also owns the Cariboo gold project in Canada as well as a portfolio of publicly held resource companies, including a 14.7% interest in Osisko Mining Inc., 17.9% interest in Osisko Metals Incorporated and a 18.3% interest in Falco Resources Ltd.

Osisko’s head office is located at 1100 Avenue des Canadiens-de Montréal, Suite 300, Montréal, Québec, H3B 2S2.

For further information, please contact Osisko Gold Royalties Ltd:

Sandeep Singh

President

Tel. (514) 940-0670

ssingh@osiskogr.com

Forward-looking Statements

Certain statements contained in this press release may be deemed “forward‐looking statements” within the meaning of applicable Canadian and U.S. securities laws. These forward‐looking statements, by their nature, require Osisko to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward‐looking statements. Forward‐looking statements are not guarantees of performance. Words such as “may”, “will”, “would”, “could”, “expect”, “believe”, “plan”, “anticipate”, “intend”, “estimate”, “continue”, or the negative or comparable terminology, as well as terms usually used in the future and the conditional, are intended to identify forward‐looking statements. Information contained in forward‐looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including management’s perceptions of historical trends, current conditions and expected future developments, results of further exploration work to define and expand mineral resources, expected conclusions of optimization studies, that vein corridors continue to be defined as a high-density network of mineralized quartz within the axis of the F3 fold and hosted within the sandstones and that the deposit remains open for expansion at depth and down plunge, as well as other considerations that are believed to be appropriate in the circumstances. Osisko considers its assumptions to be reasonable based on information currently available, but cautions the reader that their assumptions regarding future events, many of which are beyond the control of Osisko, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect Osisko and its business. Such risks and uncertainties include, among others, risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; errors in management’s geological modelling; the ability of to complete further exploration activities, including drilling; property and royalty interests in the Cariboo gold deposit; the ability of the Corporation to obtain required approvals; the results of exploration activities; risks relating to mining activities; the global economic climate; metal prices; dilution; environmental risks; and community and non-governmental actions and the responses of relevant governments to the COVID-19 outbreak and the effectiveness of such responses.

For additional information with respect to these and other factors and assumptions underlying the forward‐looking statements made in this press release, see the section entitled “Risk Factors” in the most recent Annual Information Form of Osisko which is filed with the Canadian securities commissions and available electronically under Osisko’s issuer profile on SEDAR at www.sedar.com and with the U.S. Securities and Exchange Commission and available electronically under Osisko’s issuer profile on EDGAR at www.sec.gov. The forward‐ looking statements set forth herein reflect Osisko’s expectations as at the date of this press release and are subject to change after such date. Osisko disclaims any intention or obligation to update or revise any forward‐looking statements, whether as a result of new information, future events or otherwise, other than as required by law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()