Karora Announces 334% Increase in Proven and Probable Mineral Reserves to 1.33 Million Ounces and 167% Increase in Measured and Indicated Mineral Resources to 2.52 Million Ounces

- Consolidated gold Proven and Probable Mineral Reserves increase by 334 % to 1.33 million ounces

- Consolidated gold Measured and Indicated Mineral Resources increase by 167% to 2.52 million ounces

- The new Consolidated gold Mineral Resources and Reserves will form the basis of Karora’s organic growth profile to be announced in the first quarter of 2021

- Due to the very strong drilling results only recently received, an updated Spargos Reward Mineral Resource and Reserve will be completed in the first half of 2021 to incorporate the new high grade zone announced on November 18, 2020.

- New Beta Hunt nickel Measured and Indicated Mineral Resource, the first since 2016, of 16,100 nickel tonnes

- At Higginsville (HGO), re-estimation by Karora in 2020 of Westgold’s Historical Mineral Resources and Reserves1. has enabled these historical estimates to be classified as part of Karora’s current Mineral Resource and Reserve Inventory

Karora Resources Inc. (TSX: KRR) ("Karora" or the “Corporation" https://www.commodity-tv.com/…) is very pleased to announce a 334% increase in consolidated gold Proven and Probable (“2P”) Mineral Reserves to 1.33 million ounces for its Beta Hunt and Higginsville operations in Western Australia. The updated Mineral Resource and Reserve estimate is effective as of September 30, 2020.

The Corporation is also pleased to announce new consolidated Measured and Indicated (“M&I”) gold Mineral Resources of 2.52 million ounces, representing a 167% increase. The Mineral Resource and Reserve update announced today does not include the high grade Spargos Reward Project, which is expected to be completed in the first half of 2021.

Paul Andre Huet, Chairman & CEO, commented: “The 334% increase in the 2P gold Mineral Reserves to 1.33 million ounces and 167% increase in gold Mineral Resources to over 2.5 million ounces is an outstanding achievement for Karora. This update marks the establishment of our very first consolidated Mineral Resource and Reserve estimate across our two primary assets in Beta Hunt and Higginsville, completed on schedule despite significant drilling delays associated with COVID-19 precautions during the middle of the year. Importantly, the very large increases are net of mining depletion through to the end of the third quarter of 2020.

At Beta Hunt, where we announced our maiden Karora Mineral Reserve estimate last year, we added 176,000 ounces, representing a strong 57% increase over 2019. Grades remained robust, however we are certainly excited to further define the newly discovered high grade Larkin Zone announced in mid September which will be included in our 2021 estimate next year.

At Higginsville, when compared to the previous historical estimate completed by Westgold Resources in 2018, our 2020 drilling and re-estimation efforts added nearly 500,000 ounces, increasing 2P Mineral Reserves by 130%.

At Higginsville Central, where mining will be focused over the short and medium term, we have outlined a Reserve of 218,000 ounces at high open pit grades of 2.0g/t. This Reserve is backed by a high grade M&I Mineral Resource of 382,000 ounces at 2.8g/t, which we expect to be further bolstered by mid- 2021 via the addition of feed from our high grade Spargos Reward open pit into the Higginsville plant.

Due to the very strong recent drilling results announced in November, we now expect to have an updated Mineral Resource and Reserve estimate completed at Spargos in the first half of 2021. Next year will also see further drilling across all main projects, including the highly prospective targets at Lake Cowan and the first of the underground mines at Higginsville. After our first year of ownership, Higginsville is certainly shaping up to be both a high grade and long-lived operation.

While this is an outstanding start to our Mineral Resource and Reserve growth plan, I am even more encouraged by the exciting exploration targets we have selected for drilling in 2021. Moving forward, this updated Mineral Resource and Reserve estimate will form the basis for Karora’s organic growth strategy which I look forward to outlining to the market during the first quarter of next year.”

Mineral Resource and Reserve Summary

Higginsville

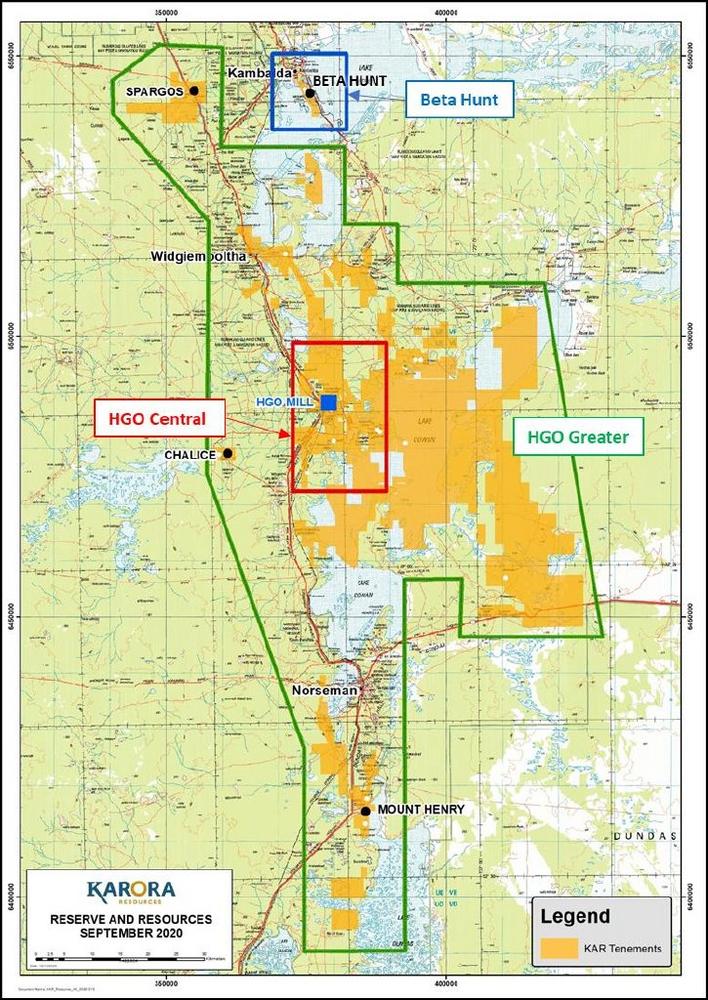

Reporting for the Higginsville Mineral Resource and Reserve inventory is split into two main areas – Higginsville Central and Higginsville Greater. The former covers Mineral Resources within a radius approximately 10 kilometres of the Higginsville mill while Higginsville Greater covers all Mineral Resources that fall outside the Higginsville Central area (see Figure 1).

Higher grade Higginsville Central will form the basis of the short and medium term mine plan at Higginsville which will be outlined as part of Karora’s organic growth plan early next year. Importantly, numerous brownfields opportunities remain to target significant additional high grade, near term additions at Higginsville Central in 2021 including, but not limited to, the Aquarius Project and underground at Two Boys.

During 2020, Karora completed a comprehensive re-estimation of the Higginsville Mineral Resources and Reserves, replacing the historical estimate previously compiled by Westgold Resources as at June 30, 2018. The Higginsville Mineral Resource and Reserves are now part of Karora’s consolidated Mineral Resource and Reserves.

At Higginsville, gold Mineral Reserves increased by 478,000 ounces, or 130% over the previously reported Historical Mineral Reserves of 367,000 ounces (see Karora’s Technical Report dated February 6, 2020 available under Karora’s profile on Sedar.com). Higginsville Central, the focus of near and medium term mining, hosts a high grade Mineral Reserve of 218,000 ounces at 2.0 g/t.

Measured and Indicated gold Mineral Resources at Higginsville increased by 242,000 ounces, or 20%, compared to the Historical Measured and Indicated Mineral Resource of 1,223,000 ounces. At Higginsville Central, Resource grades improved to a strong 2.8g/t (382,000 ounces), highlighting the success of Karora’s early 2020 focus on upgrading the Historical Mineral Resource for short-term production mining options.

For 2021, exploration and resource definition drilling at Higginsville is planned to upgrade and extend short-term mining production targets (<2 years) in Higginsville Central, underpinned by a strong commitment to greenfield exploration targeting significant new discoveries across the 1800km2 property. The latter is demonstrated by the recent expansion of drilling activities on the underexplored Lake Cowan area based on targets identified through regional gravity/aeromagnetic surveys. 2021 will also see a renewed focus on resource definition and exploration drilling at Spargos Reward ahead of initial mining by mid year.

Beta Hunt

Gold

Gold Mineral Reserves at Beta Hunt increased by 176,000 ounces from the November 1, 2019 Mineral Reserve estimate, an increase of 57%.

Gold Mineral Resources at Beta Hunt continued to grow through a well supported and targeted drilling program. Measured and Indicated Mineral Resources increased by 111,000 ounces, or 12% compared to the 2019 Measured and Indicated Mineral Resource estimate.

As with the 2019 estimate, it is important to note that high grade coarse gold discoveries at Beta Hunt associated with the shear zone / Lunnon Sediment intersection horizon, such as the Father’s Day Vein are not represented in the resource model due to the extreme nuggety nature of this type of mineralization.

During 2020, exploration and resource definition activities at Beta Hunt were focused on infill and extensional drilling of the A Zone and Western Flanks. Two new discoveries were announced on September 8 and September 10: a new footwall zone in the main Western Flanks shear and the new high grade Larkin Zone discovered south of the Alpha Isla Fault. The Larkin Zone is similar in style to the A Zone and Western Flanks deposits north of the Alpha Island Fault and is interpreted as the southern fault off-set extension of the Western Flanks. This newly discovered zone requires further drilling before a resource estimate can be completed and is expected to be included in the 2021 update.

For 2021, resource definition drilling at Beta Hunt will prioritize the Larkin Zone as well as continue to extend and upgrade the Western Flanks and A Zone resources building on results from the 2020 program. Exploration drilling at Beta Hunt will test the along-strike continuity of the A Zone north and up-plunge of the existing resource, and the along-strike continuity of the Fletcher Zone, which is interpreted as a structural analogue to Western Flanks.

Nickel

2020 marked the re-invigoration of the nickel by-product opportunity at Beta Hunt. After a four-year pause in nickel focused drilling, a targeted and well-planned exploration drilling program successfully discovered and defined the 30C Nickel Trough located between the two historical work areas of Beta and Beta West. The 30C trough is the first new nickel discovery at Beta Hunt in 13 years (see Karora news release dated September 10, 2020). Although only partially drilled out, this new discovery forms part of the current nickel Mineral Resource.

Technical Report

The Consolidated Mineral Resource and Reserve estimate will be detailed in a technical report prepared in accordance with NI 43-101 to be filed under the Corporation’s SEDAR profile at sedar.com within 45 days of the date of this news release.

Compliance Statement (JORC 2012 and NI 43-101)

Shane McLeay is a mining engineer and a Fellow of the AusIMM. Mr McLeay is an employee of Entech Pty Ltd of Perth, Western Australia, who were employed by Karora to undertake the Gold Mineral Reserve estimate for Beta Hunt. Mr McLeay has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code, 2012 Edition, and fulfils the requirements to be a "Qualified Person" for the purposes of NI 43-101. Mr McLeay has reviewed and approved the disclosure of the scientific and technical information for the Beta Hunt Gold Mineral Reserves included in this news release.

Anton von Wielligh is a mining engineer and a Fellow of the AusIMM. Mr von Wielligh is an employee of ABGM Pty Ltd of Perth, Western Australia, who were employed by Karora to undertake the Gold Mineral Reserve estimate for Higginsville (Central & Greater, excluding Mt Henry). Mr von Wielligh has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code, 2012 Edition, and fulfils the requirements to be a "Qualified Person" for the purposes of NI 43-101. Mr von Wielligh has reviewed and approved the disclosure of the scientific and technical information for the Higginsville (excluding Mt Henry) Gold Mineral Reserves included in this news release.

Ross Cheyne is a mining engineer and a Fellow of the AusIMM. Mr Cheyne is an employee and Director of Orelogy Mine Consulting of Perth, Western Australia, who were employed by Karora to undertake the Gold Mineral Reserve estimate for the Mt Henry Project. Mr Cheyne has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code, 2012 Edition, and fulfils the requirements to be a "Qualified Person" for the purposes of NI 43-101. Mr Cheyne has reviewed and approved the disclosure of the scientific and technical information for the Mt Henry Gold Mineral Reserves included in this news release. The Mt Henry Gold Mineral Reserve is part of the Higginsville Greater Mineral Reserve estimate.

Mr. Stephen Devlin is Group Geologist – Exploration & Growth for Karora, a full time employee of Karora and a Fellow of the AusIMM. Mr Devlin has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code, 2012 Edition, and fulfils the requirements to be a "Qualified Person" for the purposes of NI 43-101. Mr Devlin has reviewed and approved the disclosure of the scientific and technical information for the Beta Hunt and Higginsville Gold Mineral Resource and the Beta Hunt Nickel Mineral Resource included in this news release.

Mr. Ian Glacken is a geologist and geostatistician and a Fellow of the AusIMM. Mr Glacken is an employee of Optiro Pty Ltd, of Perth, Western Australia, who were employed by Karora to undertake the Gold Mineral Resource estimate for the Mt Henry Project. Mr Glacken has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code, 2012 Edition, and fulfils the requirements to be a "Qualified Person" for the purposes of NI 43-101. Mr Glacken has reviewed and approved the disclosure of the scientific and technical information for the Mt Henry Gold Mineral Resource in this news release. The Mt Henry Gold Mineral Resource is part of the Higginsville Greater Mineral Resource estimate.

The "JORC Code" means the Australasian Code for Reporting of Mineral Resources and Ore Reserves prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Mineral Council of Australia. There are no material differences between the definitions of Mineral Resources under the applicable definitions adopted by the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM Definition Standards") and the corresponding equivalent definitions in the JORC Code for Mineral Resources.

Detailed Footnotes relating to Mineral Resource Estimates as at September 30, 2020

(1) Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves.

(2) The Measured and Indicated Mineral Resources are inclusive of those Mineral Resources modified to produce Mineral Reserves.

(3) The Mineral Resource estimates include Inferred Mineral Resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is also no certainty that Inferred Mineral Resources will be converted to Measured and Indicated categories through further drilling, or into Mineral Reserves once economic considerations are applied.

(4) The Gold Mineral Resources are estimated using a long term gold price of US$1,600/oz with a US:AUD exchange rate of 0.70.

(5) Gold Mineral Resources were estimated using variable cut-off grades taking into account variable operational costs: underground – 1.3 g/t; open pits, 0.4 g/t to 0.5g/t.

(6) To best represent “reasonable prospects of eventual economic extraction” the mineral resource for open pits has been reported within an optimized pit shells at A$2,285 (US$1,600) and, for underground resources, areas considered sterilized by historical mining are depleted from the Mineral Resource.

(7) The Nickel Mineral Resource is reported above a 1% Ni cut-off grade.

(8) Mineral Resource tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding.

Detailed Footnotes relating to Mineral Reserve Estimates as at September 30, 2020

(1) The Gold Mineral Reserve are estimated using a long term gold price of US$1,400/oz with a US:AUD exchange rate of 0.70.

(2) Cut-off grades for open-pit mineral reserves vary from 0.50g/t to 0.85g/t . The cut-off grade takes into account dilution, mine recovery and operating mining, processing/haulage, sustaining capital and G&A costs. Dilution and recovery factors varied by deposit.

(3) At Beta Hunt, underground mineral reserves are reported at a 1.6g/t incremental cut-off grade. At Higginsville, underground mineral reserves cut-off grades vary between 1.6g/t (modified and diluted grade) to 2g/t (modified/diluted grade). The cut-off grade takes into account Operating Mining, Processing/Haulage and G&A costs, excluding capital.

(4) The Mineral Reserve is depleted for all mining to September 30, 2020.

(5) Mineral Reserve tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding.

About Karora Resources

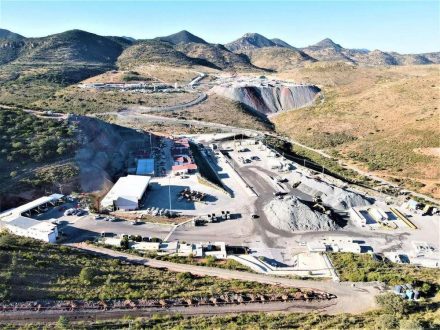

Karora is focused on growing gold production and reducing costs at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations ("HGO") in Western Australia. The Higginsville treatment facility is a low-cost 1.4 Mtpa processing plant which is fed at capacity from Karora’s underground Beta Hunt mine and open pit Higginsville mine. At Beta Hunt, a robust gold Mineral Resource and Reserve is hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial gold Mineral Resource and Reserve and prospective land package totaling approximately 1,800 square kilometers. The Company also owns the high grade Spargos Reward project which is anticipated to begin mining in 2021. Karora has a strong Board and management team focused on delivering shareholder value. Karora’s common shares trade on the TSX under the symbol KRR. Karora shares also trade on the OTCQX market under the symbol KRRGF.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to the timing for the completion of technical studies, liquidity and capital resources of Karora, production guidance and the potential of the Beta Hunt Mine, Higginsville Gold Operation, the Aquarius Project and the Spargos Gold Project.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora ’s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained 10 herein are made as of the date of this news release and Karora disclaims any obligation to update any forwardlooking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Cautionary Statement Regarding the Higginsville Mining Operations

A production decision at the Higginsville gold operations was made by previous operators of the mine, prior to the completion of the acquisition of the Higginsville gold operations by Karora and Karora made a decision to continue production subsequent to the acquisition. This decision by Karora to continue production and, to the knowledge of Karora, the prior production decision were not based on a feasibility study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, which include increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that anticipated production costs will be achieved. Failure to achieve the anticipated production costs would have a material adverse impact on the Corporation’s cash flow and future profitability. Readers are cautioned that there is increased uncertainty and higher risk of economic and technical failure associated with such production decisions.

For more information, please contact:

Rob Buchanan

Director, Investor Relations

T: (416) 363-0649

www.karoraresources.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()