Bluestone Drills 6.2 meters grading 29.0 g/t Gold and 30 g/t Silver at Cerro Blanco and Wide Intercepts including 101.4 meters grading 2.4 g/t Gold

Highlights include the following uncapped intercepts representing true widths of the veins.

- 2 meters grading 7.5 g/t Au and 20 g/t Ag (UGCB20-189)

- 6 meters grading 10.0 g/t Au and 23 g/t Ag (CB20-432)

- 2 meters grading 29.0 g/t Au and 30 g/t Ag (CB20-442)

- 1 meters grading 7.6 g/t Au and 56 g/t Ag (CB20-444)

- 7 meters grading 8.0 g/t Au and 38 g/t Ag (CB20-444)

- 4 meters grading 2.4 g/t Au and 10 g/t Ag (UGCB20-191)

David Cass, Vice President of Exploration, commented, “These latest results are from a variety of holes drilled over the 350-meter vertical profile of the high-grade deposit. Of particular mention are intervals drilled in CB20-432 (5.6 meters grading 10.0 g/t Au) and UGCB20-193 (5.1 meters grading 17.9 g/t Au) that extend the plunge of high-grade mineralization within the main VS_01 vein by approximately 80 meters below the 7.2 meters grading 26.0 g/t Au intercept previously reported in UGCB20-188 (see press release dated December 16, 2020).”

Mr. Cass added, “Also worth noting in these recent results are wide intervals of disseminated and veinlet hosted mineralization drilled while testing for extensions to the major veins outside of the resource envelope in underground holes UGCB20-191 and UGCB20-189. Significant intervals comprising 101.4 meters grading 2.4 g/t Au and 60.3 meters grading 2.8 g/t Au were drilled in these holes. While low grade disseminated gold mineralization (typically 0.5-1.5 g/t Au) is a characteristic of the upper Salinas cap, what is unusual about these intervals is that they are also hosted partly within underlying silicified sandstones belonging to the Mita unit forming a broad zone spanning the contact with the upper Salinas succession.”

In 2020, 15,171 meters of infill drilling was successfully completed in the South Zone of the Project with the goal to improve the definition of key veins in parallel to expanding the mineralization of known veins outside of the current resource envelope. The assays reported in this press release represent approximately one-third of the pending results that were delayed due to issues at the lab caused by the pandemic; results for an additional 17 holes are still to come.

Jack Lundin, CEO, commented, “As expected by these latest results, the 2020 campaign continues to yield high grade shallow intercepts from the South Zone of Cerro Blanco. As mentioned in the January 26th release, the nature of the Cerro Blanco deposit has presented us the opportunity to look into alternative development options which we are finalizing internally and will be updating the market within the next few weeks.”

A full set of assay results, drill hole locations, sections and core photos can be accessed by clicking HERE.

Selected Drill Intercepts and Assays (for a complete assay table refer to link above)

The focus of the 2020 drill program was to improve the definition of key veins in parallel to expanding the high-grade mineralization of known veins outside of the current resource envelope. The work is expected to build on the infill drill program completed in the North Zone of the deposit in 2019.

Drill hole Summary

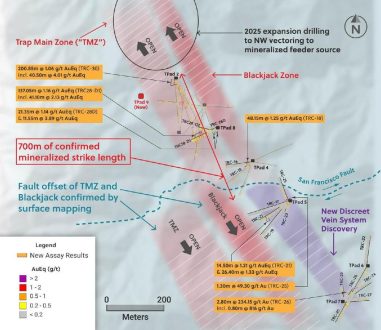

CB20-432, CB20-437, CB20-442, CB20-445 and UGCB20-193 were drilled at various angles from two closely spaced platforms at surface and were designed to test both the principal vein VS_01 and improve definition of a series of sub-vertical veins in the hanging wall of the main vein swarm. All holes reached their objectives, with significant high-grade assays received for all VS_01 intercepts including 6.2 meters grading 29.0 g/t Au and 30 g/t Ag in CB20-442, and 5.1 meters grading 17.9 g/t Au and 24.5 g/t Ag in UGCB20-193. (Refer to Figures 1-4 and cross section A.)

CB20-444, CB20-441 and CB20-438 were drilled to test for extensions to various veins with some success e.g., 8.4 meters grading 8.0 g/t Au and 9.4 meters grading 7.6 g/t Au in CB20-444 (VS_07). Hole CB 20-431 was drilled as a step-out hole to the north-east to confirm whether the high-grade veins drilled in UGCB20-179 extended through into the Upper Salinas unit. Veins intercepted were narrow and low grade, confirmation that the veins thin and dissipate across the contact into the Salinas unit as per the current model. (See Figures 5 and 6 for cross section and core photos.)

UGCB20-189 and UGCB20-191 were drilled from the same platform in the South Ramp of the underground workings with the principal objective of testing for extension of the main VS_01 vein and new veins in the southern part of the orebody, including extensions of previously modelled steeply dipping veins. In UGCB20-189 an intercept of 60.3 meters grading 2.8 g/t Au and 15 g/t Ag was drilled, composed of narrower high-grade intervals e.g., 8.5 meters grading 7.5 g/t Au (60.7-69.2 meters) within a low-grade envelope of mineralization ranging between 0.4-2.5 g/t Au. Similar grades and style of mineralization were also drilled in UGCB-20-191 (2.4 g/t Au over 101.4 meters) consisting of higher grades (e.g., 5.0 meters at 6.6 g/t Au) within lower grade intervals (0.2-3.0 g/t Au) spanning the contact between the Salinas conglomerates and upper part of the Mita sequence (MSS unit). Mineralization is associated with silicification and narrow, often centimeter scale quartz veinlets. (Refer to Figures 6-8 for cross section and core photos.

CB20-429 and CB20-431 were drilled from the same platform. CB20-429 successfully confirmed the extension of VS_07 and drilled 1.0 meter grading 13.1 g/t Au in VS_07 and 2.9 meters grading 9.4 g/t Au in VS_05. CB20-431 targeted the upwards extension of veins to the north-east within Salinas conglomerates; no major veins were drilled with gold values of 2.0 g/t Au associated with silicification and veinlet stockworks.

Precious metal mineralization at Cerro Blanco is associated with classic low sulphidation quartz-adularia epithermal veins and vein swarms hosted in altered sequence of volcanoclastic and sedimentary rocks. Higher grades (>20 g/t Au and >60 g/t Ag) are associated with visible gold, electrum, and silver sulphides in ginguro-style colloform-banded veins.

Quality Analysis and Quality Control

Assay results listed within this release were performed by Inspectorate Laboratories (“Inspectorate”), a division of Bureau Veritas, which are ISO 17025 accredited laboratories. Logging and sampling are undertaken on site at Cerro Blanco by Company personnel under a QA/QC protocol developed by Bluestone. Samples are transported in security-sealed bags to Inspectorate Labs in Managua, Nicaragua for sample preparation. Sample pulps are then shipped to Inspectorate Laboratories in Reno, NV, USA, and assayed using industry-standard assay techniques for gold and silver. Gold and silver were analyzed by a 30-gram charge with atomic absorption and/or gravimetric finish for values exceeding 5 g/t Au and 100 g/t Ag. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material, and replicate samples. Quality control is further assured by Bluestone’s QA/QC program, which involves the insertion of blind certified reference materials (standards) and field duplicates into the sample stream to independently assess analytical precision and accuracy of each batch of samples as they are received from the laboratory. A selection of samples is submitted to ALS Chemex Laboratories in Vancouver for check analysis and additional quality control.

Qualified Person

David Cass, P.Geo., Vice President Exploration, is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 and has reviewed and verified that the scientific and technical information set out above in this news release is accurate and therefore approves this written disclosure of the technical information.

About Bluestone Resources

Bluestone Resources is a mineral exploration and development company that is focused on advancing its 100%-owned high-grade Cerro Blanco Gold and Mita Geothermal projects located in Guatemala. The Company trades under the symbol “BSR” on the TSX Venture Exchange and “BBSRF” on the OTCQB.

On Behalf of Bluestone Resources Inc.

"Jack Lundin"

Jack Lundin | Chief Executive Officer & Director

For further information, please contact:

Bluestone Resources Inc.

Stephen Williams | VP Corporate Development & Investor Relations

Phone: +1 604 757-5559

info@bluestoneresources.ca

www.bluestoneresources.ca

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This press release contains “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). All statements, other than statements of historical fact, that address activities, events, or developments that Bluestone Resources Inc. (“Bluestone” or the “Company”) believes, expects, or anticipates will or may occur in the future including, without limitation: the Company’s plans for 2021; the anticipated results of the PRU and expected optimizations; the Company’s current expectations regarding the mining method and alternative development options; completion of Project financing; anticipated timing and results of exploration, drilling, and assays; increasing the amount of measured mineral and indicated mineral resources; the proposed timeline and benefits of further drilling; the proposed timeline and benefits of the Feasibility Study; statements about the Company’s plans for the development of its mineral properties; Bluestone’s business strategy, plans, and outlook; the future financial or operating performance of Bluestone; capital expenditures, corporate general and administration expenses, and exploration and development expenses; expected working capital requirements; the future financial estimates of the Cerro Blanco Project economics, including estimates of capital costs of constructing mine facilities, and bringing a mine into production, and of sustaining capital costs, estimates of operating costs and total costs, net present value and economic returns; proposed production timelines and rates; funding availability; resource estimates; and future exploration and operating plans are forward-looking statements. These forward-looking statements reflect the current expectations or beliefs of the Company based on information currently available to Bluestone and often use words such as “expects”, “plans”, “anticipates”, “estimates”, “intends”, “may”, or variations thereof or the negative of any of these terms.

All forward-looking statements are made based on Bluestone’s current beliefs as well as various assumptions made by Bluestone and information currently available to Bluestone. Generally, these assumptions include, among others: the presence of and continuity of metals at the Cerro Blanco Project at estimated grades; the availability of personnel, machinery, and equipment at estimated prices and within estimated delivery times; currency exchange rates; metals sales prices and exchange rates assumed; appropriate discount rates applied to the cash flows in economic analyses; tax rates and royalty rates applicable to the proposed mining operations; the availability of acceptable financing; the impact of the novel coronavirus (COVID-19); anticipated mining losses and dilution; success in realizing proposed operations; and anticipated timelines for community consultations and the impact of those consultations on the regulatory approval process.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of Bluestone to differ materially from those discussed in the forward-looking statements and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, Bluestone. Factors that could cause actual results or events to differ materially from current expectations include, among other things: potential changes to the mining method and the current development strategy; risks and uncertainties related to expected production rates; timing and amount of production and total costs of production; risks and uncertainties related to the ability to obtain, amend, or maintain necessary licenses, permits, or surface rights; risks associated with technical difficulties in connection with mining development activities; risks and uncertainties related to the accuracy of mineral resource estimates and estimates of future production, future cash flow, total costs of production, and diminishing quantities or grades of mineral resources; risks associated with geopolitical uncertainty and political and economic instability in Guatemala; risks related to global epidemics or pandemics and other health crises, including the impact of the novel coronavirus (COVID-19); risks and uncertainties related to interruptions in production; the possibility that future exploration, development, or mining results will not be consistent with Bluestone’s expectations; uncertain political and economic environments and relationships with local communities and governmental authorities; risks relating to variations in the mineral content within the mineral identified as mineral resources from that predicted; variations in rates of recovery and extraction; developments in world metals markets; and risks related to fluctuations in currency exchange rates. For a further discussion of risks relevant to Bluestone, see “Risk Factors” in the Company’s annual information form for the year ended December 31, 2019, available on the Company’s SEDAR profile at www.sedar.com.

Any forward-looking statement speaks only as of the date on which it was made, and except as may be required by applicable securities laws, Bluestone disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results, or otherwise. Although Bluestone believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance, and accordingly, undue reliance should not be put on such statements due to their inherent uncertainty. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

Non-IFRS Financial Performance Measures

The Company has included certain non-International Financial Reporting Standards (“IFRS”) measures in this news release. The Company believes that these measures, in addition to measures prepared in accordance with IFRS, provide investors an improved ability to evaluate the underlying performance of the Company and to compare it to information reported by other companies. The non-IFRS measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These measures do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to similar measures presented by other issuers.

All-in sustaining costs

The Company believes that all-in sustaining costs (“AISC”) more fully defines the total costs associated with producing gold.

The Company calculates AISC as the sum of refining costs, third party royalties, site operating costs, sustaining capital costs, and closure capital costs all divided by the gold ounces sold to arrive at a per ounce amount. Other companies may calculate this measure differently as a result of differences in underlying principles and policies applied. Differences may also arise due to a different definition of sustaining versus non-sustaining capital.

AISC reconciliation

AISC and costs are calculated based on the definitions published by the World Gold Council (“WGC”) (a market development organization for the gold industry comprised of and funded by 18 gold mining companies from around the world). The WGC is not a regulatory organization.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()