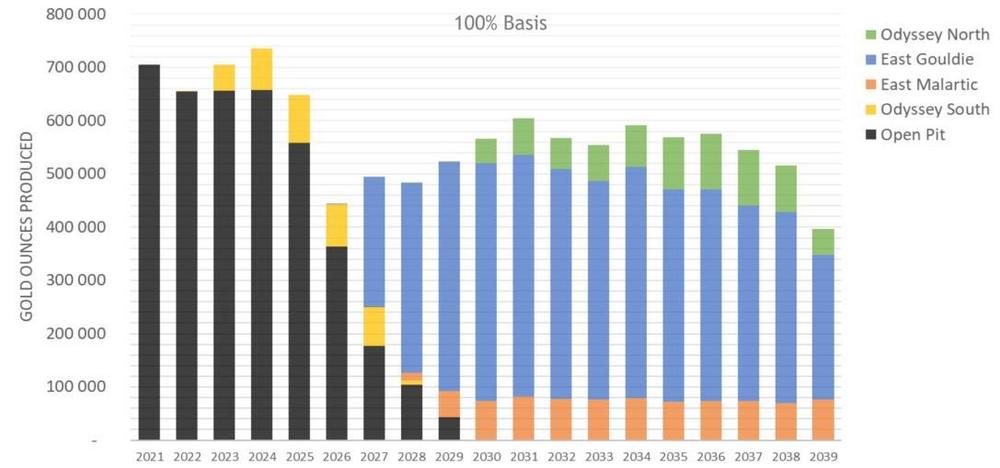

Construction of Canadian Malartic underground approved, increasing life of mine gold production by ~6.9 million ounces

- Royalty payments from underground production at Canadian Malartic beginning in 2023

- Average underground production of 545 koz of gold per annum from 2029 onwards (see Chart 1), higher than previous Partnership disclosure of 400-450 koz gold per annum

- Osisko has a 3-5% net smelter return (“NSR”) royalty on the mineralization contained in the underground mine plan

- Importantly, the majority of production is expected from deposits within Osisko’s 5% NSR royalty boundary

- Mine life extended from 2028 to at least 2039 based on ~50% of current resources in mine plan

- US$30 million of drilling and exploration work planned in 2021 by the Partnership

- East Gouldie remains open with eleven drill rigs focused on definition and extension drilling

- Osisko also holds a C$0.40/tonne processing royalty on any ore from outside its royalty boundaries processed through the Canadian Malartic mill, potentially adding further regional exploration upside

- Additional positive advancements announced by Agnico on the Upper Beaver and Hammond Reef gold projects where Osisko holds a 2% NSR royalty

For more details, please refer to the press releases issued by each of Agnico and Yamana on February 11, 2021 available on their respective websites.

Sandeep Singh, President and CEO of Osisko commented, “The construction decision for the Odyssey underground project by Agnico and Yamana secures the Canadian Malartic mine as Osisko’s flagship asset for decades. It is difficult to over emphasize the importance of this catalyst for Osisko as Canadian Malartic will continue to provide sustainable production until at least 2039, with significant upside beyond. We commend the Partnership for the exploration and engineering efforts that have led to this announcement.”

The Odyssey project hosts three main underground-mineralized zones: East Gouldie, East Malartic, and Odyssey, the latter of which is sub-divided into the Odyssey North, Odyssey South and Odyssey Internal zones. Osisko holds a 5% NSR royalty on East Gouldie, Odyssey South and the western half of East Malartic and a 3% NSR royalty on Odyssey North and the eastern half of East Malartic.

The East Gouldie deposit makes up 70% of the planned underground mining inventory. The Odyssey production forecast only considers about half of the total underground resources comprising inferred resources of 13.58 million ounces (177.5 million tonnes of 2.38g/t gold), as well as indicated resources of 0.86 million ounces (13.3 million tonnes of 2.01g/t gold) using a gold price assumption of US$1,250 per ounce.

Exploration drilling at East Gouldie in 2020 totaled 97,000 meters and increased the inferred mineral resource of the East Gouldie zone by 134%. The total exploration budget for 2021 has increased to 173,400 meters (US$30 million) focusing on further infill and expansion of East Gouldie and regional targets. East Gouldie alone will benefit from 141,400 metres of drilling which is ~80% of the total that has been drilled on East Gouldie to date.

An NI 43-101 Preliminary Economic Assessment technical report for the Canadian Malartic operation is expected to be filed by the Partnership in March 2021 and will include a summary of the Odyssey underground project. More details can be found in the Agnico and Yamana press releases dated February 11, 2021 titled “Agnico Eagle Reports Fourth Quarter and Full Year 2020 Results” and “Yamana Gold Reports Strong Fourth Quarter and Full Year 2020 Results”, respectively.

Upper Beaver and Hammond Reef Updates

Agnico also provided an update on potential growth opportunities beyond 2024, highlighting two projects on which Osisko has a 2% NSR royalty – the Upper Beaver project in Kirkland Lake Ontario and the Hammond Reef project in Northwestern Ontario.

As of December 31, 2020, Upper Beaver has approximately 1.4 million ounces of gold and 20,000 tonnes of copper in underground probable mineral reserves (8.0 million tonnes grading 5.43 g/t gold and 0.25% copper); Agnico Eagle’s Kirkland Lake property also hosts the Upper Canada, AK and Anoki-McBean deposits; which together with Upper Beaver host an additional indicated resource of 1.71 million ounces (17.2 million tonnes of 3.09g/t gold) and inferred resources of 4.07 million ounces (32.2 million tonnes of 3.93g/t).

In 2021, Agnico plans to drill 36,500 meters at Upper Beaver including additional shallow drilling to test an open pit concept and further deep drilling to convert mineral resources to mineral reserves. An internal technical study at Upper Beaver, incorporating drill results from 2020 and 2021, is expected to be completed by the end of 2021.

At Hammond Reef, an internal technical study was completed by Agnico in 2020, which resulted in the declaration of Agnico Eagle’s first mineral reserves for the project. Open pit mineral reserves are estimated at 3.32 million ounces of gold (123.5 million tonnes grading 0.84 g/t gold). In addition, the project contains 2.3 million ounces of measured and indicated mineral resources (133.4 million tonnes grading 0.54 g/t gold).

The internal study results showed average annual gold production of approximately 272,000 ounces at average total cash costs of US$748 per ounce and average AISC of US$806 per ounce. Using a gold price of US$1,550 per ounce, and a C$/US$ foreign exchange rate assumption of 1.30, the Hammond Reef project has an after-tax IRR of 9.8% and an after-tax NPV (at a 5% discount rate) of approximately $245 million USD.

Agnico will continue to evaluate optimization of the project and potential mining scenarios to further improve project economics.

Qualified Person

The scientific and technical content of this news release has been reviewed and approved by Guy Desharnais, Ph.D., P.Geo., Vice President, Project Evaluation at Osisko Gold Royalties Ltd, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The Partnership’s report includes inferred mineral resources that are too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves and there is no certainty that the forecast production amounts will be realized.

About Osisko Gold Royalties Ltd

Osisko is an intermediate precious metal royalty company focused on the Americas that commenced activities in June 2014. Osisko holds a North American focused portfolio of over 140 royalties, streams and precious metal offtakes. Osisko’s portfolio is anchored by its cornerstone asset, a 5% net smelter return royalty on the Canadian Malartic mine, which is the largest gold mine in Canada.

Osisko’s head office is located at 1100 Avenue des Canadiens-de-Montréal, Suite 300, Montréal, Québec, H3B 2S2.

For further information, please contact Osisko Gold Royalties Ltd:

Heather Taylor

Vice President, Investor Relations

Tel: (514) 940-0670 #105

Email: htaylor@osiskogr.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Forward-looking Statements

Certain statements contained in this press release may be deemed “forward‐looking statements” within the meaning of applicable Canadian and U.S. securities laws. These forward‐looking statements, by their nature, require Osisko to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward‐looking statements. Forward‐looking statements are not guarantees of performance. These forward‐looking statements, may involve, but are not limited to, statements with respect to the timely construction and the expected life of mine production of the Odyssey underground project, and the potential for discovery and further development of additional underground mineral zones; the potential for growth opportunities at Hammond Reef and Upper Beaver properties and the result of any drilling program, future events or future performance, the realization of the anticipated benefits deriving from Osisko’s investments, the general performance of the assets of Osisko, and the results of development exploration and production activities as well as expansions projects relating to the properties in which Osisko holds a royalty, stream or other interest. Words such as “may”, “will”, “would”, “could”, “expect”, “believe”, “plan”, “anticipate”, “intend”, “estimate”, “continue”, or the negative or comparable terminology, as well as terms usually used in the future and the conditional, are intended to identify forward‐looking statements. Information contained in forward‐looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including, without limitation, management’s perceptions of historical trends; current conditions; expected future developments; the ongoing operation of the properties in which Osisko holds a royalty, stream or other interest by the operators of such properties in a manner consistent with past practice; the accuracy of public statements and disclosures made by the operators of such underlying properties; no material adverse change in the market price of the commodities that underlie the asset portfolio; no adverse development in respect of any significant property in which Osisko holds a royalty, stream or other interest; the accuracy of publicly disclosed expectations for the development of underlying properties that are not yet in production; and the absence of any other factors that could cause actions, events or results to differ from those anticipated, estimated or intended. Osisko considers its assumptions to be reasonable based on information currently available, but cautions the reader that their assumptions regarding future events, many of which are beyond the control of Osisko, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect Osisko and its business. Such risks and uncertainties include, among others, that the financial information presented in this press release is preliminary and could be subject to adjustments, the successful continuation of mining activities in Québec and more particularly of the operations underlying the Corporation’s assets, the performance of the assets of Osisko, the growth and the benefits deriving from its portfolio of investments, risks related to the operators of the properties in which Osisko holds a royalty, stream or other interest, including changes in the ownership and control of such operators; risks related to development, permitting, infrastructure, operating or technical difficulties on any of the properties in which Osisko holds a royalty, stream or other interest, the influence of macroeconomic developments as well as the impact of and the responses of relevant governments to the COVID-19 outbreak and the effectiveness of such responses.

For additional information with respect to these and other factors and assumptions underlying the forward‐looking statements made in this press release, see the section entitled “Risk Factors” in the most recent Annual Information Form of Osisko which is filed with the Canadian securities commissions and available electronically under Osisko’s issuer profile on SEDAR at www.sedar.com and with the U.S. Securities and Exchange Commission and available electronically under Osisko’s issuer profile on EDGAR at www.sec.gov. The forward‐ looking statements set forth herein reflect Osisko’s expectations as at the date of this press release and are subject to change after such date. Osisko disclaims any intention or obligation to update or revise any forward‐looking statements, whether as a result of new information, future events or otherwise, other than as required by law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()