Solid Results from La India Open Pit Infill Drilling, highlighted by 17.4 m @ 3.27 g/t gold, including 2.1 m @ 15.13 g/t gold

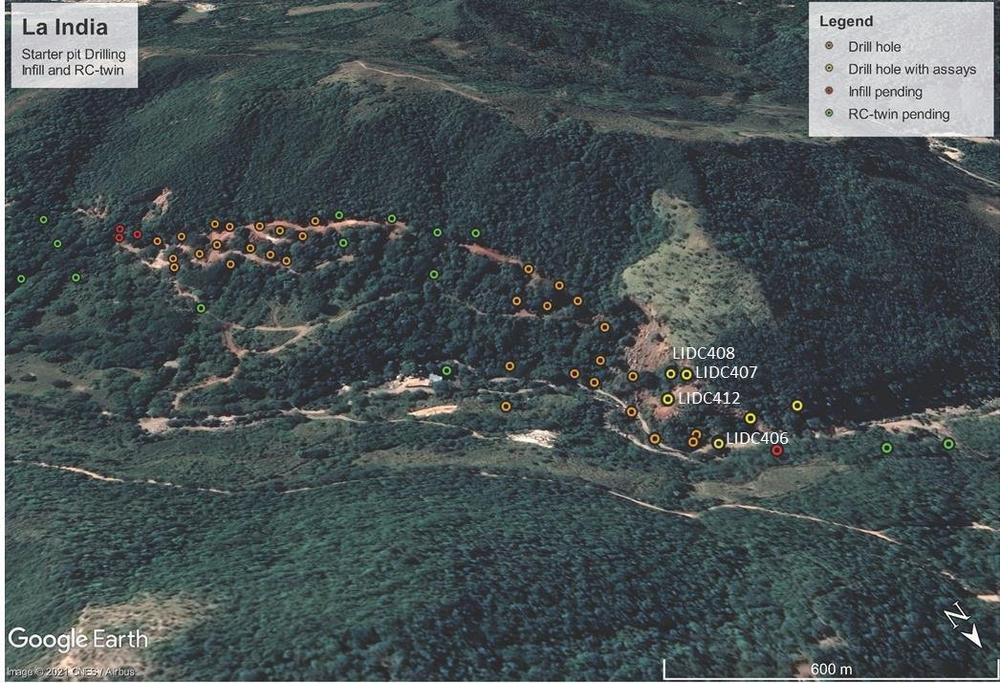

The primary objective of the drilling programme is to provide 25 m spaced drill sampling within the two , high-grade Starter Pits (up to 35 m deep) within the main La India Open Pit Mineral Reserve. As already announced, drilling on the Northern Starter Pit has been completed with 25 drill holes for 1,273 m, four of which have twinned existing RC drill holes. Drilling is nearing completion on the Southern Starter Pit with 15 holes for 897 m completed, also including four RC-twin holes (Figure 1). Drill results have now been received for a total of six drill holes which are all located at the northern end of the Northern Starter Pit, two of which (LIDC404 and LIDC405) have been previously reported. The drilling results received to date support, and add considerable confidence to, the geological model used in the mineral resource and reserve estimation and mine plan, and include two significant intercepts.

Highlights

- LIDC406 intersected 17.90 m (17.4 m true width) at 3.27 g/t gold from 24.55 m drill depth, including 2.1 m @ 15.1 g/t gold from 36.0 m drilled depth.

- LIDC412 intersected 7.65 m (7.5 m true width) @ 3.55 g/t from 19.0 m drill depth.

- 40 drill holes for a combined 2,170 m of infill and RC replacement drilling completed within La India Starter Pits.

Mark Child, Chairman and CEO commented:

“A drill intersect in LIDC406 of 17.90 m (17.4 m true width) at 3.27 g/t gold from 24.55 m drill depth, including 2.1 m @ 15.1 g/t gold is highly encouraging and adds considerable confidence to the geological model, the mineral resource and reserve calculation and mine plan. The drill intercept is within the northern La India Starter pit, which is within the fully permitted main La India open pit mineral reserve. The geology team has done an excellent job and completed 40 drill holes for a combined 2,170 m of infill and RC replacement drilling within the two La India starter pits. Assay results for only 6 drill holes have been received to date. Approximately 1,400 m drilling remains to be completed of the current drill programme”

Latest Assay Results

Results have now been received for the first six drill holes which were all located at the northern end of the Northern Starter Pit. The results of the first two holes, which were reported in an RNS dated the 9th March, only tested the footwall part of the main mineralised structure. The latest results include two drill holes that sampled the entire main mineralised structure. Both of these drill holes returned significant gold intercepts, confirming continuity of gold mineralisation in the La India structure and supporting the geological model used in the mineral resource and reserve estimation:

1. Drill hole LIDC406,(Figure 2). tested a zone where the main mineralized structure bifurcates into two close spaced vein stacks, both of which are strongly brecciated along the structure. Shallow level artisanal mining activity was intersected, but it has only stoped a 0.8 m width of the upper structure. Both mineralized structures have returned significant intercepts of

17.90 m (17.4 m true width) at 3.27 g/t gold from 24.55 m drill depth, including both

i. 4.45 m (4.3 m true width) at 4.20 g/t gold from 24.55 m drill depth, and

ii. 9.35 m (9.1 m true width) at 4.20 g/t gold from 33.90 m drill depth, including 2.1 m @ 15.13 g/t

2. Drill hole LIDC412 which was drilled approximately 50 m along strike to the southwest of LIDC406 where the mineralization merges to form one single main mineralized structure. This hole also returned a significant drill intercept of 7.65 m (7.5 m true width) at 3.55 g/t gold from 19.00 m drill depth which is consistant with the geological model (Figure 3).

The remaining two drill holes (LIDC407 and LIDC408) were both collared (started) within the surface expression of the main mineralised zone drilling. The Main Zone mineralisation has been interpreted as being eroded where LIDC407 was started, but an intercept of 4.40 m (4.3 m true width) at 3.20 g/t gold shows that there is gold mineralization in the footwall at grades that warrant further investigation (Figure 3).

Drilling Programme – Looking Ahead

The drilling programme is constantly being assessed and adapted based on geological observations from core logging. Quartz veins and breccias have been identified within the footwall host rock, in some cases, 10 to 20 m below the Main Vein in both the Northern and Southern Starter Pits. Consequently, selected neighbouring infill drill holes are being extended beyond the originally planned depth to target the footwall quartz vein and brecias. The goal is to rapidly upgrade and potentially extend, (on the footwall targets) existing inferred mineral resources to the indicated mineral resource category, and their potential inclusion in the mine schedule.

To-date approximately 2,120 m of diamond core drilling has been completed. It is anticipated that another 265 m of drilling will be required to complete the 25 m-spaced infill and RC-drill replacement drilling within and immediately adjacent to the two Starter Pits.

Following completion of the drilling in the Southern Starter Pit, the next stage in the infill drilling programme is to twin drill an additional 14 RC drill holes (1142 m of drilling) that are located within the La india mineral resource pit shell.

About the Drilling Techniques

Drilling is being undertaken using heavy duty track-mounted drilling rigs. All of the drilling is being undertaken using diamond core drilling techniques employing large diameter PQ core barrels and triple tube in the mineralised zones to ensure good sample recovery. Drilling close to surface and in proximity to historical and artisanal mine workings can present challenges to the driller, however, the drilling programme is benefitting from employment of local geologists, field support staff and experienced drill contractors, all with a decade of experience of drilling at la India. Consequently, all target depths have been met and good sample recovery is being achieved.

About the Assaying

Drill core is cut, and half core samples collected and bagged by Condor staff on-site. Samples are transported to Bureau Veritas accredited sample preparation laboratory in Managua every week in batches of two or three drill holes, generally being submitted to the lab within 5-10 days of completing the drill hole. Sub-samples of the pulverised rock samples are forwarded for assay to Bureau Veritas accredited analytical laboratory in Vancouver, Canada. As with many other operators delays in the return of assay results are being experienced due to industry demand and COVID-19 pandemic restrictions.

About the Starter Pits

On 25 January 2019, SRK Consulting (UK) Limited completed an updated Mineral Resource Estimate (the “MRE”; see RNS dated 28 January 2019) on Condor’s 100% owned La India Project in Nicaragua comprising 9.85 million tonnes (“M tonnes” or “Mt”) at 3.6 g/t gold for 1,140,000 oz gold in the Indicated category and 8.48M tonnes at 4.3g/t gold for 1,179,000 oz gold in the Inferred category.

The La India Vein Set hosts an open pit Mineral Resource of 8,377kt at 3.1g/t gold for 837Koz gold in the Indicated category and 887kt at 2.4 g/t gold for 69,000oz gold in the Inferred category. Beneath the La India open pit is an underground Mineral Resource estimate of 678kt at 4.9g/t gold for 107Koz gold in the Indicated category and 1,718kt at 5.6 g/t gold for 309,000 oz gold in the Inferred category.

The 25 January 2019 MRE update did not materially change the La India open pit Mineral Resource estimate and consequently the 2014 Pre-Feasibility Study (“PFS”) remained unchanged. La India open pit has an existing Probable Mineral Reserve of 6.9 million tonnes (“Mt”) at 3.01 g/t gold for 675,000 oz gold.

As announced on 4 March 2020 (see RNS), Condor completed internal studies on readily accessible high-grade material within the permitted La India open pit. The starter pits within La India open pit contain a diluted tonnage of 387Kt at 4.29g/t gold for 53,000 oz gold. Condor has subsequently further advanced these studies. Within a designed pit shell, the starter pits have two scenarios. At 0.75g/t gold cut-off grade, 635Kt at 3.32g/t gold for 67,800 oz gold with a 4.5 to 1 strip ratio. Using a 2.0g/t cut-off grade, 445Kt at 4.17g/t gold for 59,700 oz gold with a 6.8 to 1 strip ratio. See table 1 below:

For further information please visit www.condorgold.com

About Condor Gold plc:

Condor Gold plc was admitted to AIM in May 2006 and dual listed on the TSX in January 2018. The Company is a gold exploration and development company with a focus on Nicaragua.

In August 2018, the Company announced that the Ministry of the Environment in Nicaragua had granted the Environmental Permit (“EP”) for the development, construction and operation of a processing plant with capacity to process up to 2,800 tonnes per day at its wholly-owned La India gold project (“La India Project”). The EP is considered the master permit for mining operations in Nicaragua. Condor Gold published a Pre-Feasibility Study (“PFS”) on the project in December 2014, summarised in the Technical Report, as defined below. The PFS details an open pit gold Mineral Reserve in the Probable category of 6.9 Mt at 3.0 g/t gold for 675,000 oz gold, producing 80,000 oz gold per annum for 7 years. La India Project contains a Mineral Resource of 9,850 Kt at 3.6 g/t gold for 1.14 Moz gold in the Indicated category and 8,479 Kt at 4.3 g/t gold for 1.18 Moz gold in the Inferred category. The Indicated Mineral Resource is inclusive of the Mineral Reserve. A gold price of $1,500/oz and a cut-off grade of 0.5 g/t and 2.0 g/t gold were assumed for open pit and underground resources, respectively. A cut-off grade of 1.5 g/t gold was furthermore applied within a part of the Inferred Resource. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that any part of the Mineral Resources will be converted to Mineral Reserves.

Environmental Permits were granted in April and May 2020 for the Mestiza and America open pits respectively, both located close to La India. The Mestiza open pit hosts 92 Kt at a grade of 12.1 g/t gold (36,000 oz contained gold) in the Indicated Mineral Resource category and 341 Kt at a grade of 7.7 g/t gold (85,000 oz contained gold) in the Inferred Mineral Resource category. The America open pit hosts 114 Kt at a grade of 8.1 g/t gold (30,000 oz) in the Indicated Mineral Resource category and 677 Kt at a grade of 3.1 g/t gold (67,000 oz) in the Inferred Mineral Resource category. Following the permitting of the Mestiza and America open pits, together with the La India open pit Condor has 1.12 Moz gold open pit Mineral Resources permitted for extraction, inclusive of a Mineral Reserve of 6.9 Mt at 3.0 g/t gold for 675,000 oz gold.

Disclaimer

Neither the contents of the Company’s website nor the contents of any website accessible from hyperlinks on the Company’s website (or any other website) is incorporated into, or forms part of, this announcement.

Qualified Persons

The Mineral Resource Estimate has been completed by Ben Parsons, a Principal Consultant (Resource Geology) with SRK Consulting (U.S.), Inc, who is a Member of the Australian Institute of Mining and Metallurgy, MAusIMM(CP). He has some nineteen years’ experience in the exploration, definition and mining of precious and base metals. Ben Parsons is a full-time employee of SRK Consulting (U.S.), Inc, an independent consultancy, and has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration, and to the type of activity which he is undertaking to qualify as a “qualified person” as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) of the Canadian Securities Administrators and as required by the June 2009 Edition of the AIM Note for Mining and Oil & Gas Companies. Ben Parsons consents to the inclusion in the announcement of the matters based on their information in the form and context in which it appears and confirms that this information is accurate and not false or misleading.

The technical and scientific information in this press release has been reviewed, verified and approved by Gerald D. Crawford, P.E., who is a “qualified person” as defined by NI 43-101 and is the Chief Technical Officer of Condor Gold plc.

The technical and scientific information in this press release has been reviewed, verified and approved by Andrew Cheatle, P.Geo., who is a “qualified person” as defined by NI 43-101.

Technical Information

Certain disclosure contained in this news release of a scientific or technical nature has been summarised or extracted from the technical report entitled “Technical Report on the La India Gold Project, Nicaragua, December 2014”, dated November 13, 2017 with an effective date of December 21, 2014 (the “Technical Report”), prepared in accordance with NI 43-101. The Technical Report was prepared by or under the supervision of Tim Lucks, Principal Consultant (Geology & Project Management), Gabor Bacsfalusi, Principal Consultant (Mining), Benjamin Parsons, Principal Consultant (Resource Geology), each of SRK Consulting (UK) Limited, and Neil Lincoln of Lycopodium Minerals Canada Ltd., each of whom is an independent “qualified person” as defined by NI 43-101.

Forward Looking Statements

All statements in this press release, other than statements of historical fact, are ‘forward-looking information’ with respect to the Company within the meaning of applicable securities laws, including statements with respect to: the ongoing mining dilution and pit optimisation studies, and the incorporation of same into any mining production schedule, future development and production plans at La India Project. Forward-looking information is often, but not always, identified by the use of words such as: "seek", "anticipate", "plan", "continue", “strategies”, “estimate”, "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", “could”, “might”, “will” and similar expressions. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions regarding: future commodity prices and royalty regimes; availability of skilled labour; timing and amount of capital expenditures; future currency exchange and interest rates; the impact of increasing competition; general conditions in economic and financial markets; availability of drilling and related equipment; effects of regulation by governmental agencies; the receipt of required permits; royalty rates; future tax rates; future operating costs; availability of future sources of funding; ability to obtain financing and assumptions underlying estimates related to adjusted funds from operations. Many assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct.

Such forward-looking information involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to: mineral exploration, development and operating risks; estimation of mineralisation, resources and reserves; environmental, health and safety regulations of the resource industry; competitive conditions; operational risks; liquidity and financing risks; funding risk; exploration costs; uninsurable risks; conflicts of interest; risks of operating in Nicaragua; government policy changes; ownership risks; permitting and licencing risks; artisanal miners and community relations; difficulty in enforcement of judgments; market conditions; stress in the global economy; current global financial condition; exchange rate and currency risks; commodity prices; reliance on key personnel; dilution risk; payment of dividends; as well as those factors discussed under the heading “Risk Factors” in the Company’s annual information form for the fiscal year ended December 31, 2019 dated March 31, 2020 and available under the Company’s SEDAR profile at www.sedar.com.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Technical Glossary

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()