International Consolidated Uranium Provides Update on the Moran Lake Uranium and Vanadium Project in Labrador

Key Points:

- Summer Program Planned – A permit application has been submitted to the relevant authorities with respect to a planned summer field program on the Project. The program is expected to commence on or about July 1, 2021 and will include UAV topo survey (LiDAR and/or photogrammetry) and geological mapping/structural analysis.

- 43-101 Technical Report Underway – Terrane Geoscience Inc., based in Maritime Canada, has been retained to complete a technical report on the Project in compliance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Completion of the report will require a site visit to the Project, which is currently scheduled for later this month but may be delayed due to COVID 19 travel restrictions. The technical report will be filed on SEDAR when completed.

- Historical Data Being Compiled and Analyzed – The Project was the subject of significant past exploration programs. The Company is now in possession of a large amount of the data from the past work which includes drilling data, mapping, sampling, metallurgy and numerous geophysical surveys. Specifically, the geophysical data includes Gravity, EM, IP, Magnetics and Radiometric surveys. A thorough review of this data is underway which will be used to further refine the geological model and enhance our understanding of the controls on mineralization. This work, when taken together with results from the planned summer program, will be used to help determine the next steps for the Project.

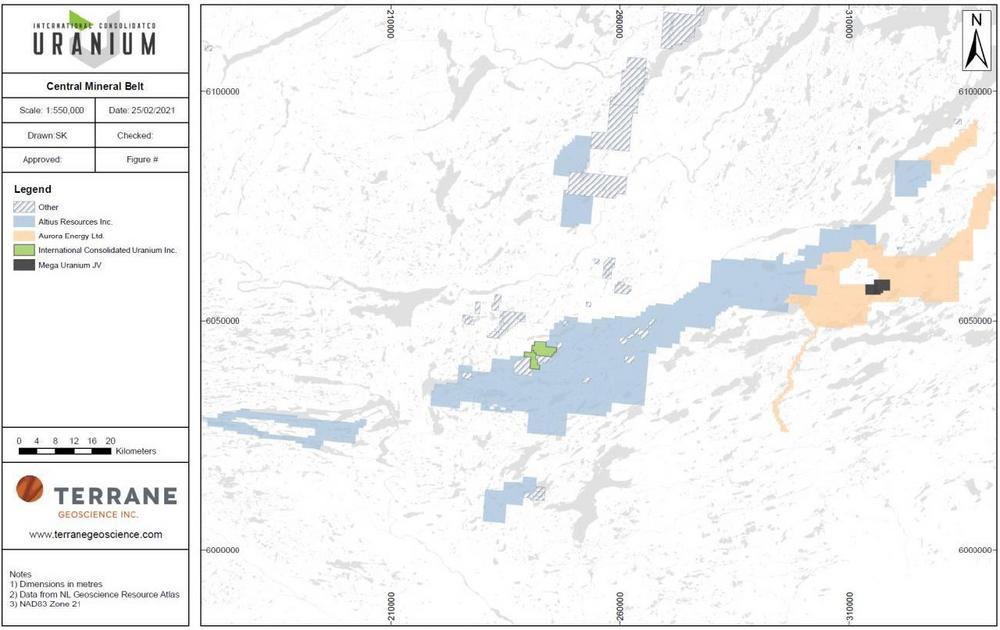

- Aggressive Staking in the Central Mineral Belt – Recent staking activity in the Central Mineral Belt has seen large amounts of ground taken up, by other parties, including to the east, west and south of the Moran Lake Project (Figure1). In particular, Altius Minerals Corporation (TSX:ALS) has taken up a substantial ground position in the Belt.

- Canada Remains Focus Area – Moran Lake is one of three projects that the Company has optioned or acquired in Canada, such that the Company now has a presence in Nunavut and Quebec as well as Labrador. As one of the top global mining jurisdictions and having significant past expenditures on uranium exploration and development, the Company intends to continue to build out its project portfolio in Canada.

Philip Williams, CEO commented “Moran Lake is a perfect case study of our strategy for advancing projects in our portfolio. In most cases, the projects we are acquiring have significant past expenditure so step one is consolidating and analyzing all the historical data we can find. At Moran Lake our planned summer work program, while small in budget, will serve to maintain the project in good standing while at the same time provide useful information for determining the next steps for the project. We are encouraged, although not surprised, to see other players take up positions in the Central Mineral Belt alongside Moran Lake. The area is prospective for both Uranium and iron oxide copper-gold (IOCG) mineralization and, in our view, any new discoveries will only serve to elevate the value of our project which already hosts historic uranium and vanadium resource estimates.”

The Moran Lake Uranium Project

The Project is located within the Central Mineral Belt of Labrador, approximately 140 kilometres north of the town of Happy Valley-Goose Bay and 85 kilometres southwest of the coastal community of Postville on Kaipokok Bay. Access to the Project is by helicopter and float plane out of Goose Bay.

Uranium was first discovered near Moran Lake by British Newfoundland Exploration Ltd. (Brinex), which conducted prospecting, geological mapping and radiometric surveying in the area from 1956 to 1958. The uranium mineralization is structurally controlled, typically hosted within fracture systems and to a lesser extent within shear zones. In outcrop, it is clear that local faulting, brecciation and alteration, all of uncertain age, are associated with the uranium-copper mineralization at the Moran Lake C zone. The mineralization is epigenetic and occurs in mafic volcanics of the Joe Pond formation, Moran Lake Group, as well as in overlying sedimentary rocks of the Heggart Lake formation, Bruce River Group.

Uranium mineralization at the C zone mainly occurs in two distinct zones, referred to as the Upper C (“UC”) and Lower C (LC). Mineralization in the UC is hosted within brecciated, hematite altered and/or bleached mafic volcanics, and hematitic cherts of the Joe Pond formation, while mineralization in the structurally underlying LC is hosted predominantly within chloritized (reduced) sandstones of the Heggart Lake formation. The UC also contains vanadium mineralization hosted mainly by hematized and brecciated mafic volcanic rocks of the Joe Pond formation and brecciated gabbro or diabasic intrusives. In many areas, the vanadium concentration is directly proportional to the intensity of hematization and brecciation. The occurrence of vanadium mineralization may coincide with, but is not restricted to, zones of uranium mineralization.

In 2004, Crosshair Exploration and Mining entered an option agreement with prospectors to earn an interest in claims in the area including those being optioned by CUR. Crosshair conducted exploration between 2005 and 2012 ultimately abandoning the claims on Nov. 1, 2013.

Global Historic Mineral Resource Table

The table below sets out the historical mineral resource estimates for each project CUR currently owns outright or on which it has announced an option agreement. The mineral resource estimate for each project is considered to be a “historical estimate” under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and is not considered by the Company to be current.

Technical Disclosure and Qualified Person

The scientific and technical information contained in this news release was prepared by Peter Mullens (FAusIMM), CUR’s VP Business Development, who is a “Qualified Person” (as defined in NI 43-101).

Each of the above mineral resource estimates are considered to be “historical estimates” as defined under NI 43-101, and have been sourced as follows:

- Ben Lomond: dated as of 1982, and reported by Mega Uranium Ltd. in a company report entitled “Technical Report on the Mining Leases Covering the Ben Lomond Uranium-Molybdenum Deposit Queensland, Australia” dated July 16, 2005;

- Georgetown/Maureen: dated as of June 25, 2008, and reported by Mega Uranium Ltd. in a company report entitled “A Review and Resource Estimate of the Maureen Uranium-Molybdenum Deposit, North Queensland, Australia Held by Mega Uranium Ltd.” dated June 25, 2008;

- Mountain Lake: dated as of February 15, 2005 and reported by Triex Mineral Corporation in a company report entitled “Mountain Lake Property Nunavut” dated February 15, 2005;

- Moran Lake: dated as of January 20, 2011 as revised March 10, 2011 and reported by Crosshair Exploration & Mining Corp. in a company report entitled “Technical Report on the Central Mineral Belt (CMB) Uranium – Vanadium Project, Labrador, Canada” dated January 20, 2011 as revised March 10, 2011;

- Laguna Salada: dated as of May 20, 2011 and reported by U3O8 Corporation in a company report entitled “NI 43-101 Technical Report Laguna Salada Initial Resource Estimate” dated May 20, 2011; and

- Dieter Lake: dated 2006 and reported by Fission Energy Corp. in a company report entitled “Technical Report on the Dieter Lake Property, Quebec, Canada” dated October 7, 2011.

In each instance, the historical estimate is reported using the categories of Mineral Resources and Mineral Reserves as defined by NI 43-101, but is not considered by the Company to be current. In each instance, the reliability of the historical estimate is considered reasonable, but a Qualified Person has not done sufficient work to classify the historical estimate as a current Mineral Resource and the Company is not treating the historical estimate as a current Mineral Resource. The historical information provides an indication of the exploration potential of the properties but may not be representative of expected results.

For Ben Lomond, as disclosed in the above noted technical report, the historical estimate was prepared by The Australian Atomic Energy Commission (AAEC) using a sectional method. The parameters used in the selection of the ore intervals were a minimum true thickness of 0.5 metres and maximum included waste (true thickness) of 5 metres. Resource zones were outlined on 25 metre sections using groups of intersections, isolated intersections were not included. The grades from the composites were area weighted to give the average grade above a threshold of 500 ppm uranium. The area was measured on each 25 metres section to give the tonnage at a bulk density of 2.603. The Company would need to conduct an exploration program, including twinning of historical drill holes in order to verify the Ben Lomond historical estimate as a current Mineral Resource.

For Georgetown/Maureen, as disclosed in the above noted technical report, the historical estimate was prepared by Mining Associates using a block model estimation methodology. Resource modelling was carried out on a database comprising 94,810 metres of combined drilling. Using a variety of estimation techniques, a 5x5x5 metre block model was constructed. This defined the shallow westward-dipping mineralisation mantos which contain the higher-grade zones. The Company would need to conduct an exploration program, including twinning of historical drill holes in order to verify the Georgetown/Maureen historical estimate as a current Mineral Resource.

For Mountain Lake, as disclosed in the above noted technical report, the historical estimate was prepared by F.R. Hassard, B.A.Sc., P. Eng. (Qualified Person) using the polygon method. The resource estimate was based on a minimum grade of 0.1% U3O8, a minimum vertical thickness of 1.0 metre. and specific gravity of 2.5. The Company would need to conduct an exploration program, including twinning of historical drill holes in order to verify the Mountain Lake historical estimate as a current Mineral Resource.

For Moran Lake, as disclosed in the above noted technical report, the historical estimate was prepared by C. Stewart Wallis P. Geo, Barry A. Sparkes, P. Geo., Gary H. Giroux, P. Eng. (Qualified Person) using three-dimensional block models utilizing ordinary kriging to interpolate grades into each 10m x 10m x 4m high block. For the purpose of the vanadium resource estimate, a vanadium specific model was created in the Upper C rock package above the C Zone thrust fault. The vanadium model is based on a wireframe solid defining the vanadium mineralized envelope using an external cut-off of approximately 0.1% V2O5. For the purposes of the estimates, a specific gravity of 2.83 was used. The Company would need to conduct an exploration program, including twinning of historical drill holes in order to verify the Moran Lake historical estimate as a current Mineral Resource.

For Laguna Salada, as disclosed in the above noted technical report, the historical estimate was prepared by Coffey Mining Pty. Ltd. using block models utilizing ordinary kriging to interpolate grades into each 1000m x 1000m x 10m parent cell. For the purposes of the estimate, bulk density of 1.7t/m³ was used for Lago Seco and 1.95t/m³ for Guanaco. The Company would need to conduct an exploration program, including trenching in order to verify the Laguna Salada historical estimate as a current Mineral Resource.

For Dieter Lake, as disclosed in the above noted technical report, the historical estimate was prepared by Davis & Guo using the Thiessen (Voronoi) polygon method. Data constraints used were 200 ppm, 500 ppm, and 1000ppm U3O8 over a minimum of 1 metre thickness. Polygons created had radii of 200 metres. A rock density of 2.67g/cm3 was used. The Company would need to conduct an exploration program, including twinning of historical drill holes in order to verify the Dieter Lake historical estimate as a current Mineral Resource.

About International Consolidated Uranium

International Consolidated Uranium Inc. (formerly, NxGold Ltd.) is a Vancouver-based exploration and development company. The Company has entered option agreements to acquire five uranium projects in Australia, Canada and Argentina each with significant past expenditures and attractive characteristics for development. With Mega Uranium Ltd. (TSX: MGA), the Company has the right to acquire a 100% interest in the Ben Lomond and Georgetown uranium projects in Australia; with IsoEnergy Ltd. (TSXV: ISO), the right to acquire a 100% interest in the Mountain Lake uranium project in Nunavut, Canada; with a private individual, the Company has the right to acquire a 100% interest in the Moran Lake uranium and vanadium project in Labrador, Canada, with U3O8 Corp. (TSXV: UWE.H), the Company has the right to acquire a 100% interest in the Laguna Salada uranium and vanadium project in Argentina; and the company has acquired the Dieter Lake project in Quebec, Canada. The Company entered into the Mountain lake option agreement with IsoEnergy Ltd. on July 16, 2020, and the transaction remains subject to regulatory approval, as does the transaction with U3O8 Corp. on the Laguna Salada Project.

In addition, the Company owns 80% of the Mt. Roe gold project located in the Pilbara region of Western Australia and an equity interest in Meliadine Gold Ltd., the owner of the Kuulu Gold Project (formerly

known as the Peter Lake Gold Project) in Nunavut.

Neither TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information.

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to activities, events or developments that the Company expects or anticipates will or may occur in the future including the anticipated timing, scope and outcome of the summer filed program to be completed at the Project and the Company’s plans to complete a NI 43-101 compliance technical report with respect to the Project. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof.

Such forward-looking information and statements are based on numerous assumptions, including that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company’s planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves or resources, reliance on key management and other personnel, potential downturns in economic conditions, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, and risks generally associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

Reader should also be cautioned that where reference is made to mineralization of adjacent or near-by properties it is not necessarily indicative of mineralization hosted on the Company’s Property.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

President and CEO – International Consolidated Uranium Inc.

Telefon: +1 (778) 383-3057

E-Mail: pwilliams@consolidateduranium.com

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()