Fleet market with a strong performance in the first four months of 2021

More environmentally friendly powertrains and less combustion engines in True Fleets

The development of both True Fleets and the Private Market is interesting. Due to the weakness of registrations on private households, the fleet market was even the strongest channel in January and February 2021 for the first time ever in Germany! That has changed in March and April but still the share of True Fleets April year-to-date is very close to the one for the Private Market (31.2% vs. 32.4%).

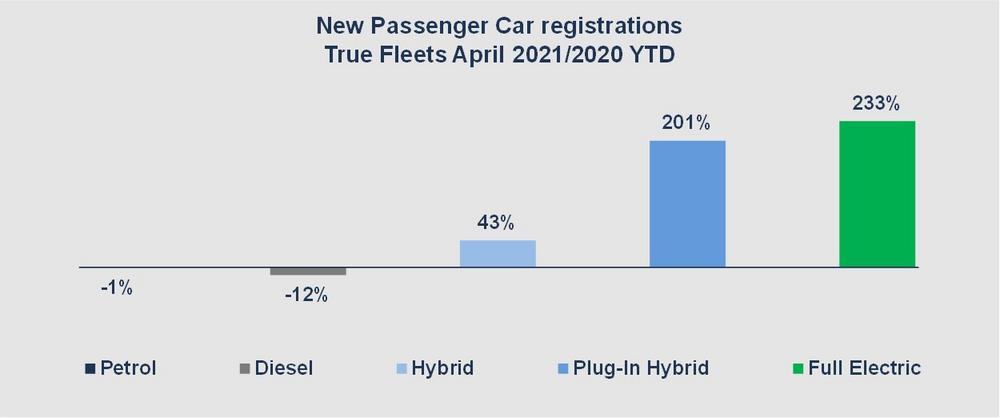

The evolution of fuel types in the fleet segment is remarkable as well. After the first four months of 2021, new registrations of classic internal combustion engines are in the red (especially diesel) while alternative powertrains are rising significantly.

While the growth of hybrids is “only” 42%, registrations for full electric models and plug-in hybrids are going through the roof. With growth rates beyond 200%, these two fuel types account for 27% of all new passenger cars registered fleet customers.

PHEVs and premium brands team up very well

Volkswagen is the clear number one in terms of new passenger car registrations on German fleet customers overall, but currently ranks "only" third for Plug-in Hybrids behind Mercedes and BMW, followed closely by another premium brand: Audi. These four manufacturers account for 2/3 of all new PHEV registrations while their share for the total fleet market is “only” 52%. Volvo in fifth place adds another 7.5 percentage points for the group of premium brands. Behind Skoda, Ford and Opel, and rounding up the top-10 we see two manufacturers that had no PHEV sales at all at the beginning of 2020: SEAT (Leon, Tarraco) and Renault (Captur, Megane). Obviously, the times are over when impressive percentage growth rates had to be put into perspective when looking at very low absolute sales figures. PHEVs have become mainstream in the meantime.

Plug-in hybrids gain importance within the brands

In addition to the ranking by volume, it is also interesting to analyze the share PHEVs have reached within some brands. At Volvo, for example, 62% of their cars registered by corporate customers in the first four months of this year are Plug-In Hybrids! Jeep follows in second place with a share of 45% – thanks to their models Compass and Renegade. Mercedes, Mitsubishi and CUPRA also have PHEV shares of more than 30%.

Across the top 30 brands, the overall share is 17.3%, compared to just 6.5% in the first four months of 2020. Of course, there are also manufacturers and importers with rather low PHEV shares. But that doesn’t mean that alternative powertrains are insignificant to them; there are just different. For example, pure electric brands such as Polestar, smart and Tesla, brands with a high EV share (Hyundai, MINI, Renault) or a very high full hybrid share (Lexus, Toyota).

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Telefon: +49 (69) 95930-231

Fax: +49 (69) 95930-333

E-Mail: michael.gergen@dataforce.de

![]()