Salient Features – Quarter ended 31 March 2021 (Q1 2021) compared to quarter ended 31 March 2020 (Q1 2020)

– Record quarterly financial performance – 78% increase in adjusted EBITDA3 to R19.8 billion (US$1.3 billion)

– Solid operational results from all segments – pre-COVID (Q1 2020) production levels exceeded

- 9% increase from the US PGM operations to 154,350 2E oz

- 6% increase from the SA PGM operations to 444,609 4E oz

- 5% increase from the SA gold operations to 249,392 oz (7,757kg)

– Precious metals fundamentals remain positive with prices well supported

– Robust Group financial position – well positioned for continued delivery of value

OVERVIEW FOR THE QUARTER ENDED 31 MARCH 2021 COMPARED TO QUARTER ENDED 31 MARCH 2020

The start to the year has been extremely positive, with the operational momentum from Q4 2020 (following normalisation of the operations post COVID-19 disruptions), carrying through into 2021. Despite ongoing adherence to COVID-19 protocols – with the South African (SA) operations in particular having to manage the health and safety challenges associated with the second wave of COVID-19 infections which affected the country in January 2021 – the SA gold, SA PGM and US PGM segments, all reported higher production year-on-year#.

This positive operational performance underpinned a record quarterly financial performance, with Group adjusted EBITDA of R19,826 million (US$1,325 million) for Q1 2021 78% higher than adjusted EBITDA for Q1 2020 of R11,132 million (US$724 million), which was then a record quarter for the Group. The SA PGM operations in particular benefited from a strong operational performance and sharply higher PGM prices, delivering a 90% increase in adjusted EBITDA to R15,280 million (US$1,021 million) from R8,043 million (US$523 million) for Q1 2020.

Notably, adjusted EBITDA generated by the SA PGM operations for this quarter, is higher than the total acquisition costs of these operations, emphasising the significant return on investment already delivered and the future windfalls stakeholders can continue to expect. With the 4E PGM basket having increased further during Q2 2021, the outlook for the year is very promising.

Precious metals prices remained strong during Q1 2021, with palladium and rhodium prices again reaching record levels, supported by ongoing supply disruptions and strong physical demand. For the US PGM operations, the 2E PGM basket price averaged US$2,128/2Eoz for Q1 2021, 4% higher than for Q1 2020, with the 4E PGM basket for the SA PGM operations 59% higher year-on-year at R52,722/4Eoz (US$3,524/4Eoz) and the average rand gold price, 8% higher at R857,126/kg (US$1,782/oz).

PGM prices have risen further in Q2 2021 to date, with the gold price remaining firm. PGM markets remain tight with the fundamental outlook for these metals positive. In the medium term, the roll out of COVID-19 vaccines across the globe continues and stimulus measures drive global economic recovery. Longer term our PGMs and green metals are expected to continue to play a critical role as global sentiment shifts towards a more environmentally conscious future.

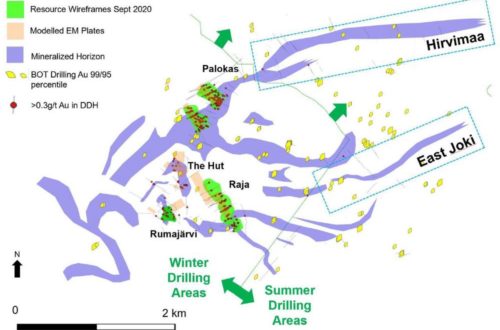

As a consequence of our rapid growth in the PGM industry along with the significant outperformance of PGM prices relative to most commodities in recent years, the PGM operations’ contribution to the Group’s financial performance is predominant. We therefore continue to seek more balance in our portfolio by advancing our green metals strategy, with our first investment into the Keliber lithium project in Finland in March 2021, and through our stated intent to grow our gold portfolio internationally. Re-balancing our investment portfolio should ensure greater earnings consistency through the cycle and create a larger, more stable investment proposition, which will be relevant to a broader and deeper pool of investors.

The Group achieved full financial deleveraging and resumed industry leading dividends during 2020. Given a stable operational outlook and favourable precious metals fundamentals, the outlook for 2021 and beyond is expected to be positive. The enlarged Group is now in a robust financial position and well positioned to continue delivering superior financial returns through the implementation of our capital allocation strategy.

It has been pleasing to see the Group successfully deliver on its vision to create superior value for all stakeholders since its inception in 2013. For shareholders specifically, exceptional value has been created both through the over 500% appreciation in the share price (20 fold increase in market capitalisation from approximately R10 billion (US$1.2 billion) on listing, to approximately R200 billion (US$15 billion) and also through the approximately R15 billion (US$1 billion) in dividends returned to shareholders over the last eight years. The total dividend of just under R11 billion (US$729 million), declared for the 2020 year alone, was greater than the Group’s market capitalisation when it listed in 2013, illustrating the significant transformation the Group has undergone in the last eight years and the tangible value that has been created.

At the same time, we have been able to invest significantly in the sustainability of our operations – in SA, recently announcing investment of approximately R6.3 billion in projects at both our PGM and gold segments and in the US continuing to invest in growth at Blitz (Stillwater East). These investments will secure employment and deliver significant economic value to all stakeholders over the long term.

# The operational performance from the SA gold and PGM operations is seasonal due to the December holiday period, which affects production in the first quarter of each calendar year, hence year-on-year comparisons are made

Note: Certain information presented in this quarterly update constitutes pro forma financial information as per the JSE Listing Requirements. The responsibility for preparing and presenting the pro forma financial information, its completeness and accuracy is that of the directors of Sibanye Stillwater. The information is presented for illustrative purposes only. Because of its nature, the pro forma financial information may not fairly present the Company’s financial position, changes in equity, and results of operations or cash flows. The information has not been audited or reviewed or reported on by external auditors of the Company

SAFE PRODUCTION

The health and safety of our employees remains our key priority and we remain committed to continuous improvement in health and safety at our operations.

The safe production performance from the US PGM operations for Q1 2021 improved significantly year-on-year, with a total reportable injury frequency rate (TRIFR) per million hours worked, 34% better in Q1 2021 compared to Q1 2020. The US PGM operations reported another successive, fatality free quarter.

The SA PGM operations achieved 2 million fatality free shifts on 2 March 2021 and had no fatal incidents during Q1 2021, although regressions in other safety metrics are of concern and are being prioritised.

Regrettably, we lost three of our colleagues at the SA gold operations during the quarter.

On 8 January 2021, Mr Mhlangabezi Tulumani, a Team Leader at Kloof Thuthukani shaft, was fatally injured when he fell down a development ore pass, whilst in the process of constructing a platform. Mr Tulumani was 45 years old, single and is survived by 2 children. On 11 February 2021 Mr Thamsanqa Papinyana, a Team Leader at Thuthukani shaft, was involved in a gravity related fall of ground, whilst conducting barring activities. Mr Papinyana was 51 years old and is survived by his wife and four children. On 29 March 2021, Mr Albert Mkhabela a Rock Drill Operator, at Kloof Hlalanathi shaft was involved in a seismic related fall of ground. Mr Mkhabela was 43 years old and is survived by his wife and three children. Our heartfelt condolences are extended to the families, friends and colleagues of our three deceased colleagues. All incidents have been investigated together with the relevant stakeholders and appropriate support has been provided to the families and children who will benefit from the Matshediso trust.

The roll out of COVID-19 vaccines in Montana is proceeding, with a number of employees having already been inoculated. Progress in South Africa has been slow, but is gaining momentum, and the classification of mining employees as essential workers and their inclusion in the upcoming second phase (due to commence in May 2021) of the vaccine roll out programme, is positive. We continue to offer our services and assistance with the vaccine roll out to the SA government, but to date have not received approval to do so.

OPERATING REVIEW

US PGM operations

Mined 2E PGM production for Q1 2021 of 154,350 2Eoz was 9% higher than for Q1 2020. Mined production from the Stillwater Mine (including Stillwater East (SWE)) was 92,271 2Eoz, 11% higher than for Q1 2020, with mined production from East Boulder (EB) of 62,079 2Eoz, 7% higher than for Q1 2020. Tonnes milled for Q1 2021 totaled 389,068 tonnes, 12% higher than for Q1 2020. Plant head grade of 13.5 g/t for Q1 2021 was 3% lower than for Q1 2020. Head grade challenges were largely attributed to lower than expected heading availability.

All-in sustaining cost (AISC) of US$920/2Eoz for Q1 2021 was 3% higher than for the comparable period in 2020, primarily due to higher sustaining capital expenditure of US$37 million for Q1 2021. This compares with US$23 million in sustaining capital expediture for Q1 2020. Higher royalties, insurance and taxes also contributed US$47 per ounce to the year-on-year increase, driven by higher US$ PGM prices (3E) and the previously noted increase in mine production.

Consistent with the revised SWE (Blitz) plan and to improve mining flexibility at the US PGM operations, total development increased by 37% year-on-year to 8,037 metres. Total development for SWE of 2,153 metres was 79% higher than Q1 2020.

The average 2E PGM basket price of US$2,128/2Eoz for Q1 2021, was 4% higher than for the comparable period in 2020, which, together with increased mine production from the US PGM operations resulted in adjusted EBITDA increasing by 65% to US$220 million. The recycling operation contributed US$24 million of the total. The combined EBITDA margin of 23% for Q1 2021 was lower than for Q1 2020 as a result of the larger proportionate contribution of the recycling business to adjusted EBITDA.

Given the ongoing planned rebuild of electric furnace 1 (EF1), which is ahead of schedule, recycle feed rates were reduced resulting in an inventory build-up of 553 tonnes during the quarter. Once EF1 and EF2 are running at capacity, following the rebuild during May 2021, an accelerated feed of the recycled inventory is expected, yielding a concomitant reduction in this readily available and liquid inventory. This is anticipated from June 2021 onwards and should see recycle inventory being drawn down to a more normalised level of 200 – 300 tonnes. Recycle advances amounted to US$731 million at the end of the quarter, generating a positive net-interest carry well above current balance sheet interest rates.

SA PGM operations

The SA PGM operations delivered another very solid operating performance, which together with a higher 4E PGM basket price, resulted in another record financial result from the segment.

4E PGM production of 444,609oz for Q1 2021 was 6% higher than for the comparable period in 2020. AISC of R19,771/4Eoz (US$1,322/4Eoz) was 18% higher than for Q1 2020, primarily due to significantly higher cost of purchasing concentrate (PoC) from third parties. The processing of PoC contributed R350 million (US$23 million) at a margin of 22% to the Marikana adjusted EBITDA. Adjusting for these higher PoC costs, AISC of the underlying operations are R17,738/4Eoz (US$1,186/4Eoz). Higher royalty taxes added R1,151/4Eoz (US$77/4Eoz) to AISC compared with Q1 2020, due to the higher PGM prices.

The average 4E PGM basket price of R52,722/4Eoz (US$3,524/4Eoz) for Q1 2021 was 59% higher than for Q1 2020, primarily due to due to a significant increase in the rhodium price (up 127% year-on-year) and the platinum price (up 28% year-on-year).

As a result of higher production and the significant increase in the 4E PGM basket price, adjusted EBITDA increased by 90% to R15,280 million (US$1,021 million) from R8,043 million (US$523 million) for Q1 2020, which was a record at the time. The adjusted EBITDA margin for Q1 2021 increased to 66% from 51% for the comparable period in 2020.

4E PGM production from the Rustenburg operation was 2% higher than for Q1 2020 at 156,956 4Eoz, with an increase in production from surface sources, offsetting marginally lower underground production. AISC from the Rustenburg operations increased by 4% to R19,002/4Eoz (US$1,270/4Eoz), year-on-year, despite the impact of higher royalties and taxes (due to the significantly improved margins) and above inflation electricity price increases, with an improvement in plant recoveries an offsetting factor.

The Kroondal operation continued to perform steadily, with 4E PGM production of 53,046 4Eoz for Q1 2021, 1% lower than comparable period in 2020. Despite marginally lower production and inflation increases, AISC of R12,137/4Eoz (US$811/4Eoz), was 4% lower than for the comparable period in 2020.

4E PGM production from the Marikana operation of 193,995 4Eoz for Q1 2021, was 13% higher than for the comparable period in 2020. Production from underground was 7% higher and production from surface sources and third party processing 66% higher. The increase in surface production is primarily due to an increase in processing of third party concentrate, with 4E PGM production from PoC increasing by 140% year-on-year to 19,125 4Eoz for Q1 2021. AISC of R23,000/4Eoz (US$1,537/4Eoz) reflect the additional cost of purchasing this concentrate from third parties at higher prevailing PGM prices. AISC from Marikana excluding third party PoC costs were R18,755/4Eoz (US$1,254/4Eoz) for Q1 2021.

The Mimosa operation continued to perform steadily, with attributable 4E PGM production of 29,878 4Eoz, 4% higher than for Q1 2020, and AISC of R13,401/4Eoz (US$896/4Eoz) 6% higher than the comparable period in 2020.

Chrome sales for Q1 2021 of approximately 370,000 tonnes were significantly lower than for Q1 2020 (approximately 507,0000 tonnes) due to a slow start up of operations and logistical issues in March which resulted in no chrome sales from the Rustenburg operation. Chrome revenue was R347 million (US$23 million) for Q1 2021, 7% higher than the Q1 2020 chrome revenue of R324 million (US$21 million), due to an increase in the chrome price from $128/tonne for Q1 2020 to $162/tonne for Q1 2021.

SA gold operations

Production from the SA gold operations for Q1 2021 of 7,757kg (249,392oz) was 5% higher than for Q1 2020 and reflected the return to normalised production levels in November 2020, following the COVID-19 disruptions that year. AISC of R772,572/kg (US$1,606/oz) was 4% higher than for the comparable period in 2020.

Underpinned by this stable operational performance and combined with a 8% increase in the average gold price year on year to R857,126/kg (US$1,782/oz), adjusted EBITDA from the SA Gold operations of R1,376 million (US$92 million) for Q1 2021, was 22% higher than for the comparable period in 2020.

Underground production from the Driefontein operation increased by 18% to 2,220kg (71,375oz) year-on-year. The average yield from underground production was 14% higher than the previous period due to higher face grades and an improvement in mining quality, with the mine call factor improving by 7% on the previous comparable period in 2020. AISC of R731,851/kg (US$1,522/oz) was 7% lower than for Q1 2020 primarily as a result of the increase in gold sold.

Production of 2,010kg (64,623oz) from the Kloof underground operations was similar to Q1 2020, with improved underground throughput offsetting a lower underground yield. The underground operations were affected by safety stoppages and seismicity during the period, which temporarily restricted access to some higher grade areas. Production from surface sources of 487kg (15,657oz), was 25% higher year-on-year. Some surface sources from Kloof were toll treated at the Driefontein and Ezulwini metallurgical plants. AISC of R844,744/kg (US$1,756/oz) was 4% higher than for Q1 2020, primarily due to increased throughput of lower grade material.

Underground production from the Beatrix operation of 1,317kg (42,342oz), was 11% lower than for Q1 2020, primarily due to a slower than anticipated start-up post the December break, safety stoppages and temporary damage to infrastructure at Beatrix 4 shaft relating to a mud rush, which has since been repaired. Beatrix employs a higher proportion of foreign nationals (primarily from Lesotho) than the other operations, with COVID-19 related restrictions at border posts, affecting the return to work after the December break. Gold production from surface sources increased to 61kg (1,961oz) due to the higher gold price, which reduced the pay limits for surface sources, making it viable to utilise existing milling capacity to process lower grade surface material. AISC of R882,082/kg (US$1,834/oz) was 18% higher than for Q1 2020, primarily due to lower production.

Surface gold production from Cooke operations decreased by 6% to 280kg (9,002oz) mainly due to an expected decrease in grades. Care and maintenance costs at Cooke operations was in line with Q1 2020 at R136 million (US$9 million).

DRDGOLD delivered another consistent operating performance, with production of 1,382kg (44,432oz) for Q1 2021, 3% higher than for Q1 2020. AISC costs of R648,129/kg (US$1,348/oz) were 12% higher than for Q1 2020.

OPERATING GUIDANCE FOR 2021

The 2021 annual guidance provided to the market in February 2021 remains unchanged except for the SA PGM project capital for the year. Four-year production and AISC guidance for the three segments were shared in the 2020 year-end presentation slides on 18 February 2021, please refer to https://www.sibanyestillwater.com/….

Mined 2E PGM production from the US PGM operations for 2021 is forecast to be between 660,000 2Eoz and 680,000 2Eoz, with AISC of between US$840/2Eoz to US$860/2Eoz. Capital expenditure is forecast to be between US$300 million and US$320 million, approximately 60% of which is growth capital in nature.

4E PGM production from the SA PGM operations for 2021 is forecast to be between 1,750,000 4Eoz and 1,850,000 4Eoz with AISC between R18,500/4Eoz and R19,500/4Eoz (US$1,230/4Eoz and US$1,295/4Eoz). Capital expenditure is forecast at R 3,800 million (US$253 million) with levels for 2021 elevated due to carry-over of approximately R800 million (US$53 million) of capital from 2020 which was unspent due to the COVID-19 disruptions. In addition, R408 million (US$27 million) of project capital expenditure is expected to be spend in terms of the K4 and Klipfontein projects for the year.

Gold production from the SA gold operations for 2021 (excluding DRDGOLD) is forecast at between 27,500kg (884,000oz) and 29,500kg (948,000oz) with AISC between R760,000/kg and R815,000/kg (US$1,576/oz and US$1,690/oz). Capital expenditure is forecast at R4,025 million (US$268 million), including carry-over of approximately R400 million (US$27 million) from 2020 which was unspent due to the COVID-19 disruptions. R425 million (US$28 million) of project capital expenditure has been provided for.

The dollar costs are based on an average exchange rate of R15.00/US$.

Neal Froneman

Chief Executive Officer

In Europe: Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

FORWARD-LOOKING STATEMENTS

The information in this report may contain forward-looking statements within the meaning of the “safe harbour” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements, including, among others, those relating to Sibanye Stillwater Limited’s (“Sibanye-Stillwater” or the “Group”) financial positions, business strategies, plans and objectives of management for future operations, are necessarily estimates reflecting the best judgment of the senior management and directors of Sibanye-Stillwater and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. As a consequence, these forward-looking statements should be considered in light of various important factors, including those set forth in this report.

All statements other than statements of historical facts included in this report may be forward-looking statements. Forward-looking statements also often use words such as “will”, “forecast”, “potential”, “estimate”, “expect”, “plan”, “anticipate” and words of similar meaning. By their nature, forward-looking statements involve risk and uncertainty because they relate to future events and circumstances and should be considered in light of various important factors, including those set forth in this disclaimer. Readers are cautioned not to place undue reliance on such statements.

The important factors that could cause Sibanye-Stillwater’s actual results, performance or achievements to differ materially from estimates or projections contained in the forward-looking statements include, without limitation, Sibanye-Stillwater’s future financial position, plans, strategies, objectives, capital expenditures, projected costs and anticipated cost savings, financing plans, debt position and ability to reduce debt leverage; economic, business, political and social conditions in South Africa, Zimbabwe, the United States and elsewhere; plans and objectives of management for future operations; Sibanye-Stillwater’s ability to obtain the benefits of any streaming arrangements or pipeline financing; the ability of Sibanye-Stillwater to comply with loan and other covenants and restrictions and difficulties in obtaining additional financing or refinancing; Sibanye-Stillwater’s ability to service its bond instruments; changes in assumptions underlying Sibanye-Stillwater’s estimation of its current mineral reserves; any failure of a tailings storage facility; the ability to achieve anticipated efficiencies and other cost savings in connection with, and the ability to successfully integrate, past, ongoing and future acquisitions, as well as at existing operations; the ability of Sibanye-Stillwater to complete any ongoing or future acquisitions; the success of Sibanye-Stillwater’s business strategy and exploration and development activities; the ability of Sibanye-Stillwater to comply with requirements that it operate in ways that provide progressive benefits to affected communities; changes in the market price of gold and PGMs; the occurrence of hazards associated with underground and surface mining; any further downgrade of South Africa’s credit rating; a challenge regarding the title to any of Sibanye-Stillwater’s properties by claimants to land under restitution and other legislation; Sibanye-Stillwater’s ability to implement its strategy and any changes thereto; the occurrence of labour disruptions and industrial actions; the availability, terms and deployment of capital or credit; changes in the imposition of regulatory costs and relevant government regulations, particularly environmental, tax, health and safety regulations and new legislation affecting water, mining, mineral rights and business ownership, including any interpretation thereof which may be subject to dispute; the outcome and consequence of any potential or pending litigation or regulatory proceedings or environmental, health or safety issues; the concentration of all final refining activity and a large portion of Sibanye-Stillwater’s PGM sales from mine production in the United States with one entity; the identification of a material weakness in disclosure and internal controls over financial reporting; the effect of US tax reform legislation on Sibanye-Stillwater and its subsidiaries; the effect of South African Exchange Control Regulations on Sibanye-Stillwater’s financial flexibility; operating in new geographies and regulatory environments where Sibanye-Stillwater has no previous experience; power disruptions, constraints and cost increases; supply chain shortages and increases in the price of production inputs; the regional concentration of Sibanye-Stillwater’s operations; fluctuations in exchange rates, currency devaluations, inflation and other macro-economic monetary policies; the occurrence of temporary stoppages of mines for safety incidents and unplanned maintenance; Sibanye-Stillwater’s ability to hire and retain senior management or sufficient technically skilled employees, as well as its ability to achieve sufficient representation of historically disadvantaged South Africans in its management positions; failure of Sibanye-Stillwater’s information technology and communications systems; the adequacy of Sibanye-Stillwater’s insurance coverage; social unrest, sickness or natural or man-made disaster at informal settlements in the vicinity of some of Sibanye-Stillwater’s South African-based operations; and the impact of HIV, tuberculosis and the spread of other contagious diseases, such as the coronavirus disease (COVID-19). Further details of potential risks and uncertainties affecting Sibanye-Stillwater are described in Sibanye-Stillwater’s filings with the Johannesburg Stock Exchange and the United States Securities and Exchange Commission, including the Integrated Annual Report 2020 and the Annual Report on Form 20-F for the fiscal year ended 31 December 2020.

These forward-looking statements speak only as of the date of the content. Sibanye-Stillwater expressly disclaims any obligation or undertaking to update or revise any forward-looking statement (except to the extent legally required). These forward-looking statements have not been reviewed or reported on by the Group’s external auditors.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()