InTiCa Systems AG publishes interim report for H1 2021 – High growth in sales and earnings also in the second quarter

- Group sales increased to EUR 53.7 million (H1 2020: EUR 29.5 million)

- EBIT margin of 4.4% at the upper end of expectations

- New production facility in Eastern Europe planned for long-term growth

- Uncertainty remains high, full-year forecast confirmed

InTiCa Systems AG (Prime Standard, ISIN DE0005874846, ticker IS7) today published the interim report for the first half of 2021. Although operating conditions were anything but easy, orders on hand, order call-offs and capacity utilization remained high in the second quarter. While both the automotive industry and the electrical and electronics sector as a whole are still battling to regain the pre-crisis level, InTiCa achieved record sales in the first half of the year and the earnings situation was also at the upper end of expectations despite challenging supply chains and the related rise in material costs.

"Pent-up demand naturally accounted for some of the growth, but more important was our focus on future-oriented e-solutions, where both segments make an equal contribution. Our stators for hybrid vehicles, performance electronics for onboard chargers and power components for stationary energy storage are in tune with the times, so we are increasingly benefiting from future-oriented trends such as end-to-end electrification, digitalization and automation of the automotive sector, industry and infrastructure. For example, in recent months we have acquired several new orders for energy storage systems, which will make a contribution to our overall performance both in the current year and in the coming years", comments Dr. Gregor Wasle, CEO of InTiCa Systems AG the business development.

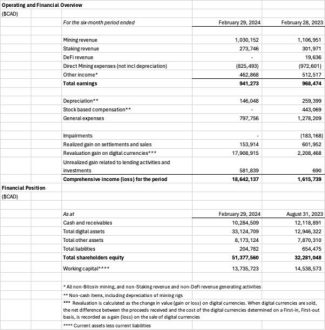

Earnings, asset and financial position

Group sales in the first half of 2021 were significantly above the level of the prior-year period, which was particularly affected by the coronavirus pandemic. Sales totalled EUR 53.7 million, an increase of 82.2% (H1 2020: EUR 29.5 million). Both segments contributed to the strong growth: While sales in the Automotive segment increased by 88.1% to EUR 40.2 million compared to the first half of 2020 (H1 2020: EUR 21.4 million), the Industry & Infrastructure segment recorded a 66.8% increase to EUR 13.5 million (H1 2020: EUR 8.1 million).

At 64.6%, the ratio of material costs to total output in the reporting period was well above the prior-year level (H1 2020: 59.5%) due to a more material-intensive product mix and strained supply chains. By contrast, the personnel expense ratio (including agency staff) decreased from 23.3% to 20.7%. At the same time, other expenses increased from EUR 5.0 million in the prior-year period to EUR 7.8 million. This was primarily due to the expenses for agency staff, which increased from EUR 1.6 million in the first six months of 2020 to EUR 3.6 million in the reporting period.

EBITDA (earnings before interest, taxes, depreciation and amortization) increased to EUR 5.2 million (H1 2020: EUR 2.3 million), with the EBITDA margin also well above the previous year’s level at 9.8% (H1 2020: 7.8%). EBIT (earnings before interest and taxes) was also clearly positive at EUR 2.3 million, compared with negative EBIT of minus EUR 0.5 million in the first half of 2020. At segment level, Automotive reported EBIT of EUR 1.6 million in the first six months of 2021 (H1 2020: minus EUR 0.4 million) and the Industry & Infrastructure segment reported EBIT of EUR 0.7 million (H1 2020: minus EUR 0.03 million).

The financial result was minus EUR 0.2 million in the reporting period (H1 2020: minus EUR 0.3 million). While tax income of EUR 33 thousand was recorded in the first half of 2020, the Group recorded tax expenses of EUR 0.5 million in the reporting period. Group net income therefore amounted to EUR 1.6 million in the first six months of 2021 (H1 2020: minus EUR 0.7 million). Earnings per share were EUR 0.36 (H1 2020: minus EUR 0.17).

The cash flow from operating activities was EUR 1.3 million in the first six months of 2021 (H1 2020: EUR 0.7 million). The year-on-year rise was mainly due to the increase in the interim result, the fact that there was no longer a non-cash net exchange loss and the increase in trade accounts payable. In view of the ongoing coronavirus pandemic, capital expenditures remain cautious. After investments and scheduled repayments, the total cash flow in the reporting period was negative at minus EUR 2.6 million (H1 2020: minus EUR 2.4 million). The equity ratio remained solid at 31.4% (December 31, 2020: 31.7%).

Outlook

Orders on hand, which reflect customers‘ requirements for a period of 18 months, make InTiCa Systems confident that it can maintain the high sales momentum in the second half of the year. Orders on hand totalled EUR 117 million as of June 30, 2021, which was well above the prior-year figure of EUR 98 million and also an improvement of around EUR 4 million compared with the end of the first quarter.

"Well over half of Group sales now come from hybrid technology and e-mobility. The development and manufacture of series-ready alternative drives will continue to fuel a considerable rise in demand for InTiCa Systems‘ performance electronics and stator systems in the medium term. In the long term, the growth of the Group should be secured through focused investment in development, technology and the expansion of local and global manufacturing capacity. Our focus is currently on setting up a production facility for wage-intensive products in Eastern Europe. Various options are currently under consideration. The aim is for this facility to come into service in 2022", comments Günther Kneidinger, Member of the Management Board.

The biggest risk factor for the development of business in the remainder of this year is currently the uncertainty surrounding the availability of materials and price trends. Increasing shortages of important starting products such as semiconductors and other electronic components, as well as aluminium and copper products, electroplated components and plastics granulates are already resulting in shutdowns and short-time working at some companies. In addition, the rise in the price of industrial raw materials as a result of the shortages is putting pressure on margins. In some cases, even price escalation clauses and renegotiation of product prices are/were not able to keep pace with the speed and frequency of price rises.

That said, until the Covid-19 pandemic is completely over, business development will be subject to considerable uncertainty about economic policy and behavioural changes by consumers and companies in response to further waves of infection and new virus variants. In view of this, the Board of Directors still expects that in 2021 as a whole, consolidated sales will rise to between EUR 85.0 million and EUR 100.0 million and the EBIT margin will be between 3.5% and 4.5%. Depending on the product portfolio, the material cost ratio should be optimized further in both segments and the equity ratio should remain stable.

The complete interim report for H1 2021 is available for download from the Investor Relations section of InTiCa Systems‘ website at www.intica-systems.com.

Forward-looking statements and predictions

This press release contains statements and forecasts referring to the future development of InTiCa Systems AG which are based on current assumptions and estimates by the management that are made using information currently available to them. If the underlying assumptions do not materialize, the actual figures may differ substantially from such estimates. Future developments and results are in fact dependent on a large number of factors; they contain different risks and imponderables and are based on assumptions that may not be accurate. We neither intend nor assume any obligation to update forward-looking statements on an ongoing basis as these are based exclusively on the circumstances prevailing on the date of publication.

InTiCa Systems is a European leader in the development, manufacture and commercialization of inductive components, passive analogue switching technology and mechatronic assemblies. It operates in the Automotive Technology and Industrial Technology segments and has about 900 employees at its sites in Passau (Germany), Prachatice (Czech Republic) and Silao (Mexico).

The Automotive Technology segment focuses on innovative products that raise the comfort and safety of cars, improve the performance of electric and hybrid vehicles and reduce carbon emissions. InTiCa Systems‘ Industrial Electronics segment develops and manufactures mechatronic assemblies for the solar industry and other industrial applications.

InTiCa Systems AG

Spitalhofstraße 94

94032 Passau

Telefon: +49 (851) 96692-0

Telefax: +49 (851) 96692-15

http://www.intica-systems.de

Vorsitzender des Vorstands

Telefon: +49 (851) 96692-0

Fax: +49 (851) 96692-15

E-Mail: investor.relations@intica-systems.com

![]()