HANNAN Channel samples 1.6m @ 5.3% copper and 83 g/t silver and confirms reduced shale host at Tabalosos East, Peru

Highlights:

– Surface channel sampling from outcrops at Tabalosos East, taken over a 500-metre strike, returned significant results from three new outcrops. The zone is located 1.9 kilometres north of previously reported mineralization and is interpreted to be hosted in the same mineralized horizon. Better assays included (Figures 1 and 2):

o 2.8 metres (“m”) @ 3.0% copper (“Cu”) and 48 g/t silver (“Ag”) (partially sampled) Including 1.6m @ 5.3% Cu and 83 g/t Ag

o 2.0m @ 1.1 % Cu and 11 g/t Ag

o 0.2m @ 2.2 % Cu and 27 g/t Ag (partially sampled)

– Separately, 1.2 kilometres east of the new outcrops, mapping over significant distances of mineralized outcrops in trenches, exposed beneath soil anomalies, clearly demonstrates that copper is hosted by a fine grained, organic-rich reduced shale within a bleached package of shaly siltstones:

o A 10m wide altered and bleached zone with anomalous copper has been mapped and inferred over 650m of strike with geochemical assays from 380m of strike including 1.2m @ 0.52% Cu and 6 g/t Ag and 3.5m @ 0.73% Cu and 9 g/t Ag including 0.2 m @ 1.1% Cu and 13 g/t Ag;

o This is considered critical new geological information, as it is the first time that detailed mapping, over the larger scale, has defined a mappable, consistent, and well-defined fine-grained, reduced organic shale, previously only mapped between sporadic boulders and poorly exposed outcrops;

o This provides further evidence that the mineralization at San Martin and is of the reduced facies sediment hosted copper-silver “Kupferschiefer” style;

– All mineralization described above is located at Tabalosos East where the company is currently preparing an Environmental Impact Statement (Declaración de Impacto Ambiental, or "DIA") study. The DIA, previously reported here, will allow low impact mineral exploration that includes diamond drilling of up to 40 platforms in a 9 x 3 kilometre area. Subject to permitting, drilling is anticipated to take place in Q2 2022.

Michael Hudson, CEO, states, "Further high-grade surface channel samples with a highlight result of 1.6m @ 5.3% Cu and 83 g/t Ag from outcrop mineralization attest to the thickness of high-grade copper and silver mineralization that we continue to uncover at San Martin over such large scales (Figure 2). However, equally important is the first detailed work to emerge from the project that demonstrates a consistent and mappable organic and reduced shale that hosts mineralization, that further geologically supports the reduced facies sediment-hosted style. This geological style globally forms the largest and most consistent sediment-hosted copper systems, and includes the vast Kupferschiefer deposit in Eastern Europe and deposits of the African Copper Belt in sub-Saharan Africa, two of the largest copper districts on earth. We have multiple geological teams unravelling the opportunity while permitting and social teams continue to work together with all stakeholders on the DIA, to permit diamond drilling.”

Detailed mapping of outcrops with correlating stratigraphic columns demonstrates that copper mineralization in the new zone mentioned above is hosted by an organic rich shale facies within an approximately 10m thick bleached/altered and copper anomalous package of shaly siltstones. This sequence represents a different depositional environment of lower energy that has facilitated the deposition of a consistent organic-rich, reduced shale facies. The impact on the exploration model is fundamental, as it supports the assumption of a widespread reduced facies across the Huallaga basin.

Five geologists and associated field assistants, two social consultants plus two local social support, two archaeologists and other external environmental consultants related to the DIA program have been engaged at Tabalosos East. In other work, a total of 2,329 soil samples have now been collected within the DIA area, and 22 pits and trenches have been dug below the soil samples. Additionally, a total of 90% of the 64,500 hectares or 2,782-line kms of LiDAR have been acquired at the San Martin JOGMEC JV sediment-hosted copper-silver project with the survey to be completed in the coming weeks when weather conditions allow.

Technical Background

All samples were collected by Hannan geologists. Rock and sediment samples were transported to ALS in Lima via third party services using traceable parcels. At the laboratory rock samples were prepared and analyzed by standard methods. The sample preparation involved crushing 70% to less than 2mm, riffle split off 250g, pulverize split to better than 85% passing 75 microns. The crushers and pulverizes were cleaned with barren material after every sample. Samples were analyzed by method ME-MS61, a four acid digest preformed on 0.25g of the sample to quantitatively dissolve most geological materials. Analysis is via ICP-MS.

Channel samples are considered representative of the in-situ mineralization samples and sample widths quoted approximate the true width of mineralization, while grab samples are selective by nature and are unlikely to represent average grades on the property.

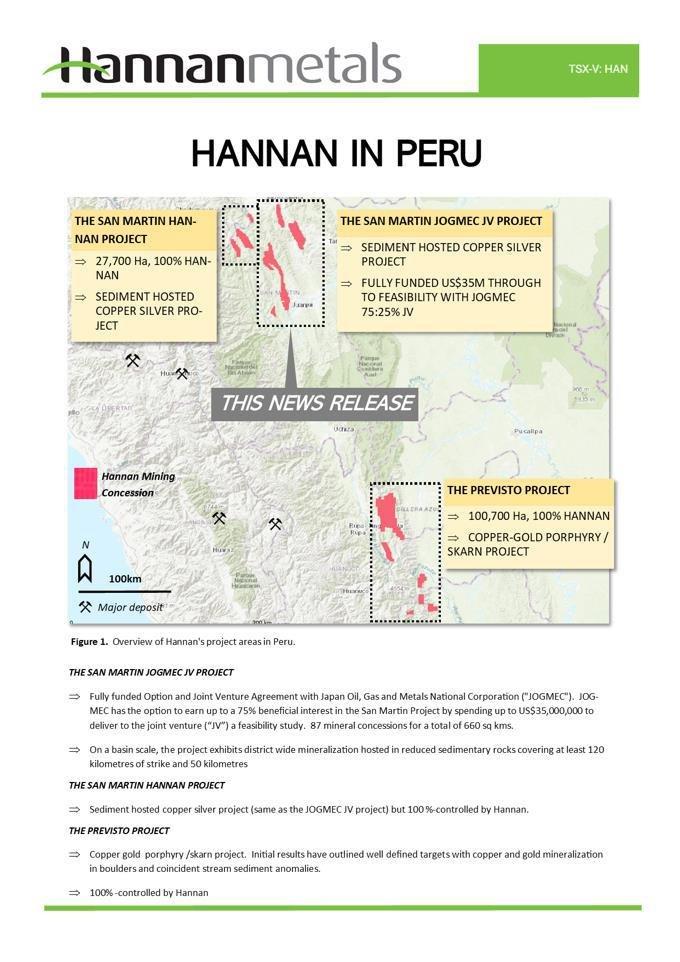

About the San Martin JOGMEC JV Project (Copper-Silver, Peru, 88 mining concessions for 660 sq km)

On November 30, 2020 Hannan announced that it had signed a binding letter agreement for a significant Option and Joint Venture Agreement (the “Agreement”) with JOGMEC. Under the Agreement, JOGMEC has the option to earn up to a 75% beneficial interest in the San Martin Project by spending up to US$35,000,000 to deliver to the joint venture (“JV”) a feasibility study.

The Agreement grants JOGMEC the option to earn an initial 51% ownership interest by funding US$8,000,000 in project expenditures at San Martin over a four-year period, subject to acceleration at JOGMEC’s discretion.

JOGMEC, at its election, can then earn:

- an additional 16% interest for a total 67% ownership interest by achieving either a prefeasibility study or funding a further US$12,000,000 in project expenditures in amounts of at least US$1,000,000 per annum (for a US$20,000,000 total expenditure); and,

- subject to owning a 67% interest, a further 8% interest for a total 75% ownership interest by achieving either a feasibility study or funding a further US$15,000,000 in project expenditures in amounts of at least US$1,000,000 per annum (for a US$35,000,000 total expenditure).

Should JOGMEC not proceed to a prefeasibility study or spend US$20,000,000 in total, Hannan shall have the right to purchase from JOGMEC for the sum of US$1, a two percent (2%) Participating Interest, whereby Hannan’s Participating Interest will be increased to fifty-one percent (51%) and JOGMEC’s Participating Interest will be reduced to forty-nine percent (49%).

At the completion of a feasibility study, JOGMEC has the right to either:

- purchase up to an additional ten percent (10%) Participating Interest from Hannan Metals (for a total 85% maximum capped Participating Interest) at fair value as determined in accordance with internationally recognized professional standards by an agreed upon independent third-party valuator; or

- receive up to an additional ten percent (10%) Participating Interest from Hannan (for a total 85% maximum capped Participating Interest) in consideration of JOGMEC’s agreement to fund development of the project, by loan carrying Hannan until the San Martin Project generates positive cash flow.

After US$35,000,000 has been spent by JOGMEC and before a feasibility study has been achieved, both parties will fund expenditures pro rata or dilute via a standard industry dilution formula. If the Participating Interest in the Joint Venture of any party is diluted to less than 5% then that party’s Participating Interest will be automatically converted to a 2.0% net smelter royalty (“NSR”), and the other party may at any time purchase 1.0% of the 2.0% NSR for a cash payment of US$1,000,000. Hannan will manage exploration at least until JOGMEC earns a 51% interest, after which the majority participant interest holder will be entitled to act as the operator of the joint venture. Initial exploration activities will focus on the collection of the geological, geophysical, and geochemical datasets in the JV project areas.

Sediment-hosted stratiform copper-silver deposits are among the two most important copper sources in the world, the other being copper porphyries. They are also a major producer of silver. According to the World Silver Survey 2020 KGHM Polska Miedz’s (“KGHM”) three copper-silver sediment-hosted mines in Poland are the leading silver producer in the world with 40.2Moz produced in 2019. This is almost twice the production of the second largest producing mine. The Polish mines are also the sixth largest global copper miner and in 2018, KGHM produced 30.3 Mt of ore at a grade of 1.49% copper and 48.6 g/t silver from a mineralized zone that averages 0.4m to 5.5m thickness.

About Hannan Metals Limited (TSXV:HAN) (OTCPK: HANNF)

Hannan Metals Limited is a natural resources and exploration company developing sustainable resources of metal needed to meet the transition to a low carbon economy. Over the last decade, the team behind Hannan has forged a long and successful record of discovering, financing, and advancing mineral projects in Europe and Peru. Hannan is a top ten in-country explorer by area in Peru.

Mr. Michael Hudson FAusIMM, Hannan’s Chairman and CEO, a Qualified Person as defined in National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release.

Further Information

www.hannanmetals.com

Forward Looking Statements.

Certain disclosure contained in this news release may constitute forward-looking information or forward-looking statements, within the meaning of Canadian securities laws. These statements may relate to this news release and other matters identified in the Company’s public filings. In making the forward-looking statements the Company has applied certain factors and assumptions that are based on the Company’s current beliefs as well as assumptions made by and information currently available to the Company. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. These risks and uncertainties include but are not limited to: the political environment in which the Company operates continuing to support the development and operation of mining projects; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; risks related to negative publicity with respect to the Company or the mining industry in general; planned work programs; permitting; and community relations. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()