Karora Announces Major Extension of Beta Hunt Larkin Zone to Over 1,000 Metres of Strike, Including 9.4 g/t Over 11.0 Metres and Provides Beta Hunt Exploration Update

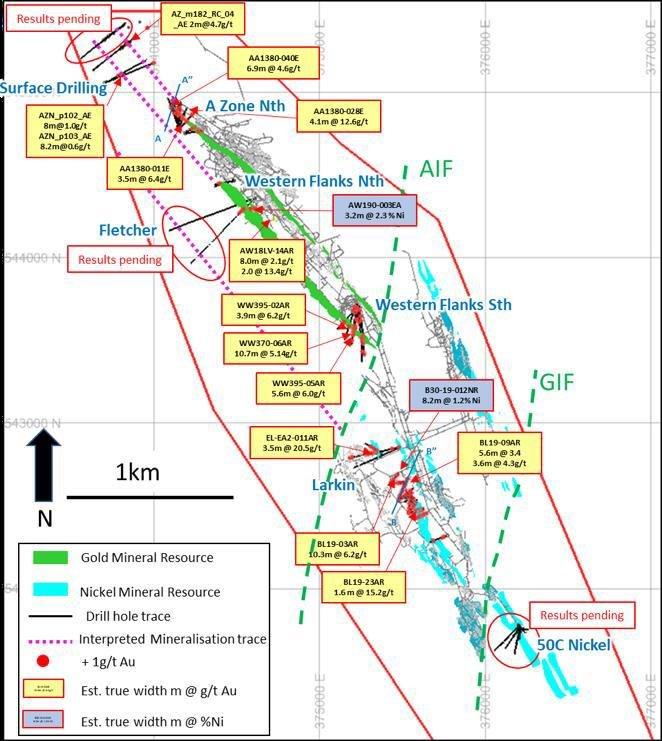

Paul Huet, Chairman and CEO of Karora said, “As expected, continued strong recent drill results from the Larkin gold discovery have significantly extended the interpreted strike length to over 1,000 metres and to a depth of up to 150 metres below the ultramafic / basalt contact zone. This rapid strike and depth expansion follows the drilling success reported earlier this year which previously extended Larkin over a strike of 650 metres and up to 120 metres down dip (see Karora news release dated May 12, 2021). Importantly, the Larkin zone remains open for further extension both along strike and at depth. Newly reported results from Larkin included intercepts of 9.4 g/t over 11.0 metres (hole BL19-09AR), 20.5 g/t over 3.5 metres (hole EL-EA2-011AR) and 15.2 g/t over 1.6 metres (hole BL19-23AR).

At Western Flanks North and South, infill drilling aimed at upgrading and supporting the Western Flanks Mineral Resource model returned solid intercepts, including 5.1 g/t over 10.7 metres (hole WW370-01AE) and 6.0 g/t over 5.6 metres (hole WW395-04AR).

In addition to the encouraging Larkin and Western Flanks North and South infill results, I am particularly pleased with the initial extensional drill results from surface in the A Zone North zone, which has confirmed the presence of gold mineralization 300 metres from the margin of the existing resource with a result of 4.7 g/t over 2.0 metres, including 9.3 g/t over 1.0 metres. Planning for additional drilling to test the continuity of this mineralization is underway. As highlighted in our growth plan, our planned second decline at Beta Hunt will provide the potential to access this gold mineralization very early in the development with the opportunity to provide gold revenue at an early stage of the mine expansion program.

On the nickel front, drilling is underway at the 50C Nickel Trough discovery where we previously reported strong initial results, including 11.6% Ni over 4.6 metres, including 18.4% Ni over 2.2 metres (Karora news release dated April 6, 2021). Assay results are pending on the new drilling, however, contact related nickel sulphides were observed in all 11 of the new holes completed and following up drilling is ongoing.

Overall, drilling results at Beta Hunt continue to deliver robust, continuous extensions to our major mineralized shear zones which positions us well for our 2021 Reserve and Resource update. I am particularly pleased that our team was able to complete the initial phase of our aggressive Larkin drill program, overcoming the well-known challenges with respect to the tight labour market and COVID-19 related restrictions in Western Australia, both of which have significantly increased assay turn around times at third party labs. We look forward to delivering pending results as they become available across several exciting targets and extensions at our flagship underground operation.”

Beta Hunt Drilling

The summary below covers new assay results received for 124 infill and extensional drill holes totalling 23,039 metres. Turn-around times on assay results continue to be extremely slow due to industry-wide third-party laboratory capacity issues resulting from significantly increased demand for their services exacerbated by pervasive labour supply hurdles related to COVID-19 restrictions. As restrictions ease, this situation is expected to improve going forward.

Drilling to date has focused on extending and upgrading (infill drilling) the Western Flanks, A Zone and Larkin Zone. Nickel drilling was directed at following up the 50C Gamma Zone discovery intersection of 11.6% Ni over 4.6 m (KRR news release, April 6, 2021) and infilling the 30C Mineral Resource.

Larkin Zone

The Larkin Zone is interpreted as the faulted southern offset of the Western Flanks zone (see Figure 1). The 30C nickel resource lies directly above the gold mineralization associated with the Larkin Zone (See Karora Technical Report dated February 1, 2021, available on www.sedar.com).

The current phase of drilling in the Larkin Zone was completed in July 2021, totalling 123 holes for 16,207 metres with new assay results recently returned. The drill program continued to test the southern extension of Larkin which has now been drilled over 1,000 metres of strike and up to 150 metres below the nickel contact. The zone remains open both along strike and at depth.

The BL series of holes were designed to infill previously reported drill results between the 40 Access drill cuddy and the 2460 access to the south. Recent results continue to support the preliminary interpretation of the Larkin Zone comprising two to three, steep dipping, mineralized zones (Figure 2) of varying widths (3 metres to 12 metres) with mineralization associated with biotite-albite-pyrite altered steep-dipping shear zones and narrow, extensional quartz veins, similar in style to the A Zone and Western Flanks deposits.

A Zone North (U/G)

A Zone North drilling totalled 27 holes for 4,473 metres targeted to upgrade and extend the Inferred Mineral Resource along the northern margin of the existing A Zone Mineral Resource. Results show gold mineralization extends over 150 metres down-dip of the existing mineral resource. Drilling is also supportive of a continuation of the A Zone resource along strike to the north resulting in potential for both up-dip and down dip extensions (Figure 3). The most northern drill hole drilled in this campaign, drill hole AA1380-040E, intersected 6.9 metres @ 4.6g/t.

Surface Drilling – Western Flanks North / A Zone North

Initial surface exploration drilling was undertaken to test the near surface potential for both the Western Flanks and A Zone to continue north along strike from the current underground resources. The surface target area was the focus of nickel exploration by WMC in the 1970s and 1980s who undertook limited shallow drilling targeting the basalt/ultramafic nickel contact. The previous work presented Karora the opportunity to test for gold mineralization with surface drilling up to a 700 metre strike distance from existing resources. Drilling included both RC and diamond drilling and totalled 9 holes for 2,765 metres.

Drilling targeted the interpreted extensions of both the Western Flanks and A Zone at variable depths to a maximum of 500 metres below surface. Geological observations from logging the RC chips and diamond core show very strong shearing up to 40 metres wide. The strong shearing is along strike of Western Flanks and is dominated by biotite-sericite-pyrite alteration with minor quartz veining. The interpreted A Zone extensional position is associated with a number of weak to moderate shear zones with minimal quartz veining.

First pass assay results support Karora’s geological theory, intersecting gold mineralization associated with the interpreted Western Flanks shear zone 700 metres north along strike from the margin of the existing resource. The interpreted A Zone position, located 300 metres north along strike of the existing resource also provides encouragement for further work with a best intersection of 4.7 g/t over 2 metres, including 9.3 g/t over 1.0 metres in drill hole AZ_m182RC_04AE.

Western Flanks Nickel: Selected holes targeting the up-dip position of the Western Flanks gold mineralization were extended to test for contact-related nickel mineralization. AW190-003EA returned a significant result of 2.3% Ni over 3.2 metres (estimated true width). The Western Flanks nickel mineralization is typically more complex, related to multiple thrusting, compared to the Beta nickel troughs to the south, however, the recent results continue to provide encouragement to further assess nickel mineralization in this area.

Gamma Zone/50C: Drilling commenced testing the potential of the interpreted 50C nickel trough as a follow-up to the discovery hole, G50-22-005E which intersected 11.6% Ni over 4.6 metres, including 18.4% Ni over 2.2 metres (see Karora news release, April 6, 2021). Drilling is aimed at defining the width and strike of the newly discovered trough. To date 11 holes have been completed for 1,613 metres. Contact-related nickel sulphides was observed in all 11 holes drilled to date with preliminary interpretation indicating the trough to be 50 metres wide. Assay results are pending at third-party labs. This first stage of follow-up drilling is scheduled to be completed by the end of 2021.

Compliance Statement (JORC 2012 and NI 43-101)

The disclosure of scientific and technical information contained in this news release has been reviewed and approved by Stephen Devlin, FAusIMM, Group Geologist, Karora Resources Inc., a Qualified Person for the purposes of NI 43-101.

At Beta Hunt all drill core sampling is conducted by Karora personnel. Drill core samples for gold analysis in this instance were shipped to ALS Laboratories, Perth for preparation and assaying by 50gram fire assay analytical method. All gold diamond drilling samples submitted for assay include at least one blank and one Certified Reference Material ("CRM") per batch, plus one CRM or blank every 20 samples. In samples with observed visible gold mineralization, a coarse blank is inserted after the visible gold mineralization to serve as both a coarse flush to prevent contamination of subsequent samples and a test for gold smearing from one sample to the next which may have resulted from inadequate cleaning of the crusher and pulveriser. The lab is also required to undertake a minimum of 1 in 20 wet screens on pulverised samples to ensure a minimum 90% passing at -75µm. Samples for nickel analysis are shipped to SGS Australia Mineral Services of Kalgoorlie for preparation. Pulps are then shipped to Perth for assaying. The analytical technique is ICP41Q, a four acid digest ICP-AES package. Assays recorded above the upper detection limit (25,000ppm Ni) are re-analyzed using the same technique with a greater dilution (ICP43B). All samples submitted for nickel assay include at least one Certified Reference Material (CRM) per batch, with a minimum of one CRM per 20 samples. Where problems have been identified in QAQC checks, Karora personnel and the SGS laboratory staff have actively pursued and corrected the issues as standard procedure. Where problems have been identified in QAQC checks, Karora personnel and the SGS and ALS laboratory staff have actively pursued and corrected the issues as standard procedure.

About Karora Resources

Karora is focused on doubling gold production to 200,000 ounces by 2024 compared to 2020 and reducing costs at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations ("HGO") in Western Australia. The Higginsville treatment facility is a low-cost 1.6 Mtpa processing plant, expanding to a planned 2.5 Mtpa by 2024, which is fed at capacity from Karora’s underground Beta Hunt mine and Higginsville mines. At Beta Hunt, a robust gold Mineral Resource and Reserve is hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial Mineral gold Resource and Reserve and prospective land package totaling approximately 1,800 square kilometers. The Company also owns the high grade Spargos Reward project which is anticipated to begin mining in 2021. Karora has a strong Board and management team focused on delivering shareholder value and responsible mining, as demonstrated by Karora’s commitment to reducing emissions across its operations. Karora’s common shares trade on the TSX under the symbol KRR and also trade on the OTCQX market under the symbol KRRGF.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to the timing for the completion of technical studies the results of exploration and development work, liquidity and capital resources of Karora, production guidance and the potential of the Beta Hunt Mine, Higginsville Gold Operation, the Aquarius Project and the Spargos Gold Project.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora ’s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Cautionary Statement Regarding the Higginsville Mining Operations

A production decision at the Higginsville gold operations was made by previous operators of the mine, prior to the completion of the acquisition of the Higginsville gold operations by Karora and Karora made a decision to continue production subsequent to the acquisition. This decision by Karora to continue production and, to the knowledge of Karora, the prior production decision were not based on a feasibility study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, which include increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that anticipated production costs will be achieved. Failure to achieve the anticipated production costs would have a material adverse impact on the Corporation’s cash flow and future profitability. Readers are cautioned that there is increased uncertainty and higher risk of economic and technical failure associated with such production decisions.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()