Market mechanisms for gold suspended

“Looking at all three major economic blocs, we can see that they are all growing at more or less the same level in 2022”, Gerlinger pointed out. “Europe is catching up to the US and China.” Overall, the global economy is proceeding at a very high level, even if the peak has probably been passed. All the while, only a few reorientation steps are likely expected, such as the start of tapering in the US. “In Europe, no turnaround in monetary policy is in sight yet, and fiscal policy also remains expansionary on both sides of the Atlantic”, according to Gerlinger.

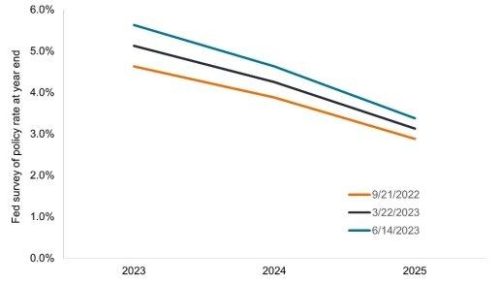

This is accompanied by a very significant rise in inflation rates recently. “We are currently experiencing a transition from asset price inflation to real economy inflation”, Gerlinger said. “So far, the almost unlimited availability of capital had mainly driven up asset prices.” Now, however, this effect is increasingly arriving at the levels of producer and consumer prices. Once again, Europe is lagging somewhat: “In the course of the year, we forecast inflation rates in Europe to rise to over four per cent; in the US, on the other hand, we do not expect any further increases, but rather a slight decline from the peak”, Gerlinger added.

Normally, expectations of higher inflation should drive demand for gold. “That has pretty much failed to materialise this time, however, at least in terms of prices”, Gerlinger explained. “In fact, more gold has been bought, but that hasn’t moved the price.” The precious metal has also recovered from the recent flash crash. “The regularly observed market mechanism of higher inflation expectations and falling yields leading to a rise in the price of gold did not happen this time”, Gerlinger remarked. Actually, the price of an ounce of gold should be at $2,000 rather than $1,800. “Apparently, market participants are joining the opinion of central banks that price increases will soon be significantly lower again”, Gerlinger said. “All of this even though central bankers have been considerably off the mark with their expectations recently.”

“Some investors consider the new gold to be cryptocurrencies and prefer to resort to them as a hedge against inflation”, Gerlinger highlighted. In any event, the fear remains that, after all, the market will react as the market always does: Rising yields and decreasing inflation might push the price of gold down. For investors, this means a significant increase in uncertainty. “Relying on individual stocks or just a few products is becoming increasingly risky under these circumstances”, Gerlinger cautioned. “In this situation, asset-managed solutions are the way to go.”

Additional information is available at www.moventum.lu

Moventum Asset Management S.A. (Moventum AM) is a wholly owned subsidiary of Moventum S.C.A. Since 2019 Moventum AM manages Moventum’s own funds of funds and individual mandates as part of its asset management portfolios.

As an independent financial service partner, Moventum S.C.A. has been providing a home for financial service providers such as advisors and asset managers as well as institutional clients from all over the world for more than 20 years. The digital "MoventumOffice" platform offers access to more than 10,000 funds, ETFs and other securities. In addition, it allows financial advisors to open securities accounts for their clients, to place trading orders and to use analysis, reporting and support tools. Institutional clients are able to outsource their entire fund trading with complementary services to Moventum as part of collective or individual custody account management. A variety of fund services are assumed for asset managers, ranging from registrar and transfer agent services to fund accounting, company administration and domiciliation services.

Moventum S.C.A

12, rue Eugène Ruppert

L2453 Luxembourg

Telefon: +352 (26154) 200

http://www.moventum.lu

Telefon: +352 (26154) 200

E-Mail: contact@moventum.lu

news & numbers GmbH

Telefon: +49 (178) 4980733

E-Mail: bodo.scheffels@news-and-numbers.de

newskontor GmbH

Telefon: +49 (170) 28172-87

E-Mail: isabel.melahn@newskontor.de

![]()