Osisko Metals outlines signficant reduction in dewatering requirements at Pine Point

Highlights:

- New data confirms that underground water flow at Pine Point is preferentially controlled by subvertical structural discontinuities such as fracture zones or low-displacement faults, with little evidence for significant ground water flow from formational aquifers in either the Sulfur Point or Pine Point Formations.

- Potential for significant reductions in Operating and Sustaining Capital Expenditures associated to dewatering over the Life of Mine (“LOM”) in the 2020 PEA economic model for the Pine Point project.

- Q1 2022 PEA Update will incorporate the new 3D hydrogeological model, dewatering volume estimates and all associated cost reductions.

The cost reductions are achieved by the aggregate effect of dewatering across all six production areas in the C1 Cluster; since dewatering in the deepest area will reduce the amount of ground water to be extracted from adjacent production areas. The ultimate objective is to focus on a given cluster to maximize mining efficiency and thereby reduce the volumes of water to manage. The integrated mining and hydrogeological modelling will be an iterative process as the 2021 field data is being integrated into the model, the same analysis will then be applied to all ten pit clusters on the project. The results will be included in the PEA Update scheduled for release in Q1 2022.

Robert Wares, Chairman & CEO, commented: “The 2021 hydrogeological modelling confirms that discrete faults, and not continuous formational aquifers, control water inflow in the mineralized horizon at Pine Point. This is very different from aquifer models used in the 2020 PEA, which resulted in very expensive life-of-mine dewatering estimates. Stated simply, managing water influx along discrete zones is much simpler and cheaper than managing an entire aquifer, and the C1 Cluster cost analysis demonstrates this. These results hopefully eliminate, once and for all, investor concerns that water management at Pine Point would be unwieldy. I wish to congratulate the technical team alongside our consultants for this significant de-risking milestone.”

Jeff Hussey, President & COO, commented: “The hydrogeological analysis required the use of the Company’s project scale 3D geological modeling developed after three years of data recovery, analysis and re-interpretation. This 3D hydrogeological modelling process is being applied for the first time at Pine Point and we are rapidly seeing highly encouraging results. We will now refine both the hydrogeological model and, more importantly, the mining plan. We believe we will be able to achieve lower dewatering rates than historically experienced through better mine sequencing using the cluster strategy within the Life-of-Mine plan that is being integrated with the new hydrogeological modelling results.”

Details of 2021 Hydrogeological Work

A total of 25 of 31 water wells were surveyed with Profile Tracer Testing (“PTT”), consisting of mixing a tracer in the borehole without inducing any stress, followed by monitoring the tracer dilution within the same hole. This allows for accurate identification of water-bearing sources, including structural discontinuities, and their flow characterization.

PTT results continue to indicate that the groundwater flow is preferentially controlled by discrete discontinuities (i.e., faults and or fracture zones) with insignificant inflow from formational aquifers, including the dolomitized Sulfur Point Formation that hosts most of the zinc and lead Mineral Resources at Pine Point. Locally, high-grade mineralization within porous dolomitized rocks is associated to inflow since Prismatic high-grade deposits are also associated to the same structural discontinuities discussed above.

This represents a significant shift from previous interpretations of underground water flow modelling at Pine Point, which was almost exclusively based on formational aquifer flow within the Sulfur Point Formation and/or the underlying stratigraphy. The water is mainly associated to fault structures, therefore localized water well emplacement around these structures will be more effective and are a far less costly water management strategy.

The next step is to complete the same analysis for the other Clusters across the Pine Point project and confirm the overall reduction in operating costs and sustaining CAPEX. The C1 Cluster results remain representative of the potential cost savings but the final reduction for the entire project has yet to be determined from ongoing work.

Hydro-Ressources Inc. (“HRI”) started working on the model in Q1 2021, defining the hydrogeology at Pine Point, using the Company’s 3D geological model, LIDAR topographical data, and GIS database to target hydrogeological testing and investigations to better characterize water flow at Pine Point. Historical holes are also being used for testing where possible. The testing methodologies include state-of-the-art measurement systems, such as Profile Tracer Tests, slug tests, injection tests, velocity flow profiles, water samples and chemistry profiles, and pump test analyses, among others.

Initially, the Company and HRI compiled existing hydrogeological reports, reference papers, and used the 3D Geological model interpreted from historical and recent drill logs to define the stratigraphic boundaries, including the Sulfur Point Formation, the main host of Tabular mineralization at Pine Point. A structural analysis using drone surveys of Cominco Ltd. era open pits was also used to interpret lineaments from different data sources (Magnetic survey, LIDAR, aerial photographs, etc.) and these suggest where the structural discontinuities may be located.

C1 Cluster Dewatering Overview

Within the 6X6 kilometre area used for the C1 Cluster model domain, there are 4 historical open pits with measured historical water inflow rates based on Stevenson (1984). The first step was to calibrate the new hydrogeological model to simulate the inflow rates into the historical open pits listed below.

The model was calibrated using retro-engineering techniques to estimate historical inflow measurements to enable more precise forecasting. These simulated K values are quite similar to the observed K values in surrounding test holes that were recently measured (K Values ranged from 2.3e-5 to 5.9e-5).

Once the calibration was completed, inflow rates were simulated in steady state conditions for all open pits individually within Cluster C1, with no interference from the other pits. The following table illustrates the results compared to the previous individual inflow rate analysis done in 2020.

The total inflow into individual mining areas was estimated in 2020 at 735,304 m3/d, while the current study estimates 403,079 m3/d. This represents a reduction of 46% of the estimated inflow rates for open pits and underground mines included in Cluster C1.

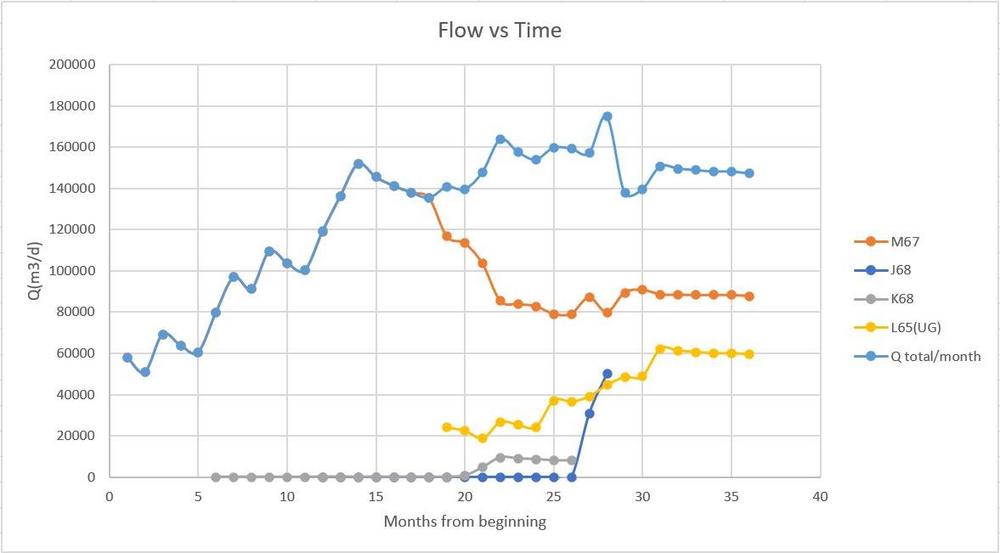

A three year mine plan was prepared by Osisko Development and used by HRI for the hydrogeological modelling of Cluster C1. Monthly production rates were provided to simulate inflow rates while maintaining water levels at 15m below the operational bench elevations. The evolution of the inflow per mine is illustrated in the graph below.

The peak of inflow occurs in Month 28 with an inflow of 174,000 m3/d. The average inflow is estimated at 150,000 m3/d during operations for the period modelled versus 400,000 m3/d using the 2020 PEA mine schedule. M67 and LG65(UG) are the main contributors of water, affecting the piezometric surfaces in the surrounding environment, reducing inflow in the other proposed open pit mines in the Cluster C1 domain model.

This new C1 Cluster mining strategy combined with the updated hydrogeological model reduced the estimated inflow rates by an aggregate 63% when compared to mining them individually. This illustrates the importance of the Cluster strategy for mining open pits together as a group to reduce dewatering volumes during mining operations by using appropriate field data acquisition and simulation methods.

Considering that the inflow rate is estimated to be 10,800m3/d per well, it is possible to define the number of wells to be installed for each open pit within Cluster C1. The following graph shows the number of required wells over time for the C1 Cluster.

Based on this analysis, dewatering efforts will be initially focused around the M67 pit with a total of 16 strategically located operating wells being required during the 3-year Cluster 1 production period. This compares to 66 wells used in the 2020 PEA for dewatering demand for production from the same sources.

The M67 pit is located at an elevation of 215m amsl, and the bottom of the open pit is at 130m amsl where an additional 15m margin was applied. The maximum required head is 100m (140psi) for free discharge to surface. At 70% pumping efficiency, 250HP pumps would be used in each 400m diameter well.

Hydrogeological modelling enhancements will be an iterative process going forward using the Feflow Version 7 software. This ongoing modelling will help to optimize the Company’s strategy to pump less water and use less energy.

These results will then be included in a Site Wide Water model that will include surface water models and will be used for Environmental Assessment purposes as well as the Q1 2022 PEA Update and the upcoming Feasibility Study.

Osisko Development Corporation is also supporting the project as the Company’s internal design engineers that will integrate the hydrogeological results into the new LOM plan that will be qualified for the Q1 2022 PEA Update.

Qualified Person

Mr. Michael Verreault P.Eng. MSc, will be acting as the Qualified Person for Osisko Metals regarding hydrogeological work. He is a Professional Geological Engineer with a Master’s degree in Hydrogeology, and he is responsible for the technical data reported in this news release.

About Osisko Metals

Osisko Metals Incorporated is a Canadian exploration and development company creating value in the base metal space. The Company controls one of Canada’s premier past-producing zinc mining camps, the Pine Point Project, located in the Northwest Territories for which the 2020 PEA has indicated an after-tax NPV of $500M and an IRR of 29.6%. The Pine Point Project PEA is based on current Mineral Resource Estimates that are amenable to open pit and shallow underground mining and consist of 12.9Mt grading 6.29% ZnEq of Indicated Mineral Resources and 37.6Mt grading 6.80% ZnEq of Inferred Mineral Resources. Please refer to the technical report entitled “Preliminary Economic Assessment, Pine Point Project, Hay River, North West Territories, Canada” dated July 30, which has been filed on SEDAR. The Pine Point Project is located on the south shore of Great Slave Lake in the Northwest Territories, near infrastructure, paved highway access, and has an electrical substation as well as 100 kilometres of viable haulage roads already in place.

The current Mineral Resources mentioned in this press release conform to NI43-101 standards and were prepared by independent qualified persons, as defined by NI43-101 guidelines. The abovementioned Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of the reported Inferred Mineral Resources are conceptual in nature and are estimated based on limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological grade and/or quality of continuity. Zinc equivalency percentages are calculated using metal prices, forecasted metal recoveries, concentrate grades, transport costs, smelter payable metals and charges (see respective technical reports for details).

For further information on this press release, visit www.osiskometals.com or contact:

Robert Wares, CEO

Osisko Metals Incorporated

Email: info@osiskometals.com

www.osiskometals.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Cautionary Statement on Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation based on expectations, estimates and projections as at the date of this news release. Any statement that involves predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance are not statements of historical fact and constitute forward-looking information. This news release may contain forward-looking information pertaining to the Pine Point Project, including, among other things, the results of the PEA and the IRR, NPV and estimated costs, production, production rate and mine life; the expectation that the Pine Point Project will be an robust operation and profitable at a variety of prices and assumptions; the expected high quality of the Pine Point concentrates; the potential impact of the Pine Point Project in the Northwest Territories, including but not limited to the potential generation of tax revenue and contribution of jobs; and the Pine Point Project having the potential for mineral resource expansion and new discoveries. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management, in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, including, without limitation, assumptions about: favourable equity and debt capital markets; the ability to raise additional capital on reasonable terms to advance the development of its projects and pursue planned exploration; future prices of zinc and lead; the timing and results of exploration and drilling programs; the accuracy of mineral resource estimates; production costs; operating conditions being favourable; political and regulatory stability; the receipt of governmental and third party approvals; licences and permits being received on favourable terms; sustained labour stability; stability in financial and capital markets; availability of equipment; and positive relations with local groups. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information are set out in the Company’s public documents filed at www.sedar.com. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()