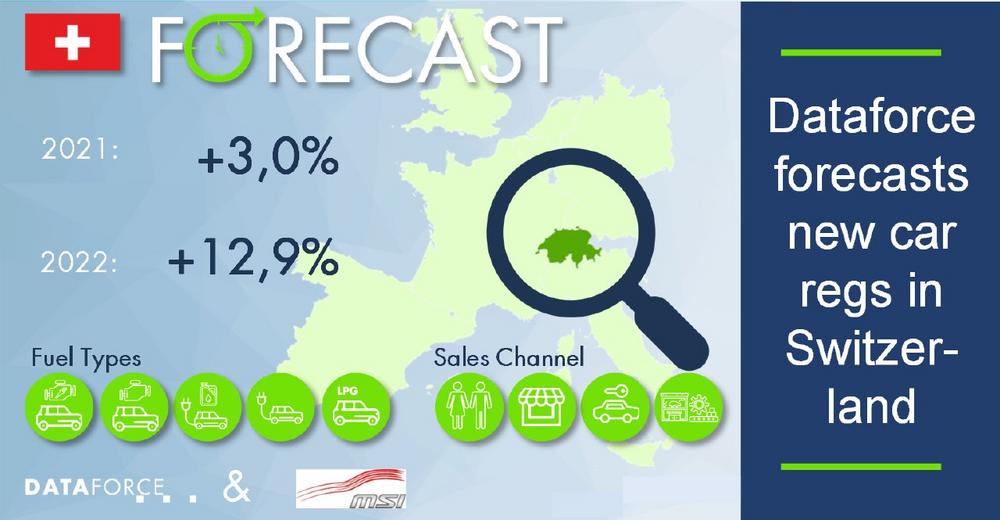

Dataforce forecasts new car registrations in Switzerland

Forecast scope

In 2017, Dataforce developed its channel split into the buyer groups Private, True Fleet, Car Rental Companies and Self-Registrations of Vehicle Dealers and Importers for Switzerland. With this approach, it is easier to identify and quantify market trends.

Based on this market segmentation, Dataforce now provides a sales forecast for Switzerland. The monthly development of new registrations for the next five years is broken down by sales channel and fuel type. Particularly electrification and the pressure on importers reduce the CO2 emissions are leading to disruptive changes.

The forecast is available as a 30-page English study with detailed explanations. In addition, the data can be accessed online via the Dataforce IRIS® system and as an interactive dashboard. Both of them are updated once per quarter.

2021 the market will stagnate, 2022 13% more registrations

In 2021, the Swiss passenger car market will remain far below its sales potential. Between a lockdown at the beginning of the year and the worsening semiconductor shortage from the middle of the year, there was hardly any room for recovery. Overall, this means that only around 244,000 new registrations can be expected, 3 percent more than in 2020.

Next year we predict a stronger increase of just under 13%. Among the sales channels, car rental companies, followed by the True Fleet Market, will see the largest percentage increases. Rental companies are still coming from a low base and need to rebuild their parc to be able to meet the increasing demand from tourism and business travel. Demand from fleet customers is increasing not only due to the improving economy, but also because many postponed purchases are being made up.

Within the fuel types, plug-in hybrids (+39%) are growing the most, closely followed by battery electric vehicles and full hybrids. But there are also signs of a recovery in petrol engines in 2022 after the production bottlenecks have been overcome. Only diesel will not be able to benefit, as the competition from other fuel types is too fierce.

Channel-specific forecasts reflect influences more accurately

Sales forecasts have been an integral part of the Dataforce product portfolio for more than ten years. In cooperation with the Spanish forecasting specialists from MSI and the renowned industry expert Detlef Borscheid, Dataforce also offers forecasts by fuel type.

In the forecast model, long-term trends are determined by factors such as changes in mobility behaviour and technical developments. In addition, there are structural breaks in the traffic and environmental policy framework. For Switzerland, CO2 regulation plays an even more important role than in the EU. The different effects on the sales channels are reflected here, for example, in the increase in tactical registrations.

In the medium term, in addition to economic development, taxes changes often lead to postponed or bought-forward demand. In addition, there are special effects such as Corona last year or the current semiconductor shortage. For the forecast of the individual months, the seasonal distribution must also be taken into account. Here in particular, the individual sales channels differ considerably.

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Telefon: +49 (69) 95930-265

Fax: +49 (69) 95930-333

E-Mail: christian.spahn@dataforce.de

![]()