Golden Christmas

Gold gifts in the form of coins, bars or jewellery are sure to please the recipient. This can be seen from the fact that these gifts have been increasing in popularity for many years. This year this should be especially true, as monetary gifts are probably not the best thing to give in the current inflationary phase, as they are losing value. Gold trading houses such as Pro Aurum, for example, are seeing an increase in buyers in the run up to Christmas. There are also companies and private customers who buy coins and bars as Christmas gifts. In the wake of the pandemic, many people bought bars and coins last year because there was fear of the consequences of the pandemic.

So, in the past years, a lot of gold went over the counter in the pre-Christmas period. At Pro Aurum, demand was sometimes so high that quantities had to be rationed at times. The gold trading house cannot complain about low demand in the current year either. If we thought in 2020 that everything would be over in 2021, we are now being taught otherwise. On top of that, inflation is shrinking savings. Especially in Germany, the demand for gold coins and bars is always strong. It would not be surprising if even at this time of year people are buying more and more from gold dealers.

If you don’t necessarily want to hold the gold in your hands and thus avoid costly storage but want to bet on gold in the longer term, you can invest in gold companies with shares.

For example, in Caledonia Mining – https://www.youtube.com/watch?v=t6PFpRjvfTo . The company managed another record quarterly production with almost 19,000 ounces of gold. The Blanket gold mine in Zimbabwe is responsible for this.

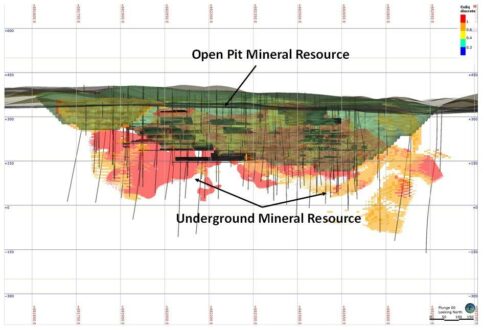

In Nicaragua Condor Gold – https://www.youtube.com/watch?v=mFuZJgdUMh0 – owns three projects, whereby the La India gold project appears particularly promising. In total, estimates amount to 1.5 million ounces of gold lying dormant in the mine.

Latest company information and press releases Caledonia Mining (- https://www.resource-capital.ch/en/companies/caledonia-mining-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()