Karora Intersects 40.5 g/t Gold over 4.0 metres in New Discovery and Widest Intercept To Date at Beta Hunt Totalling 1.5 g/t Gold over 90.5 metres

Highlights:

- New mineralized setting intersected beneath the 50C nickel trough has returned an initial diamond drill intersection of 40.5 g/t over 4.0 metres in hole G50-22-007NE1,3. The intersection is associated with a basalt breccia, different to what has previously been observed in the A Zone and Western Flanks Mineral Resources. Interpretation of this new host mineralization is underway.

- A second new gold discovery hole intersected the widest ever mineralized interval drilled by Karora at Beta Hunt. The intersection of 1.5 g/t over 90 metres1,3 includes 50.9 g/t over 0.4 metres and occurs approximately 250 metres west of the Larkin Zone. Results of the two holes drilled to date west of the Larkin Zone include1,3:

- EL-EA2-004AE: 1.5 g/t over 90.5 metres including 3.2 g/t over 13.1 metres (includes 50.9 g/t over 0.4 metres) and 2.7 g/t over 6.0 metres

- EL-EA2-005AR: 1.2 g/t over 30.3 metres, including 2.2g/t over 4.3 metres

- Recent infill drilling of the Larkin Zone continues to support continuity of the gold mineralization defined to date. Highlights include2,3:

- EL-EA2-004AE: 7 g/t over 5.0 metres

- BL-19-17AR: 6 g/t over 2.1 metres

- BL-19-20AR: 0 g/t over 1.0 metre

- Interval lengths are downhole widths. True estimated widths cannot be determined with available information.

- Interval lengths are estimated true widths

- Tables showing complete results and drill holes can be found at the end of this news release.

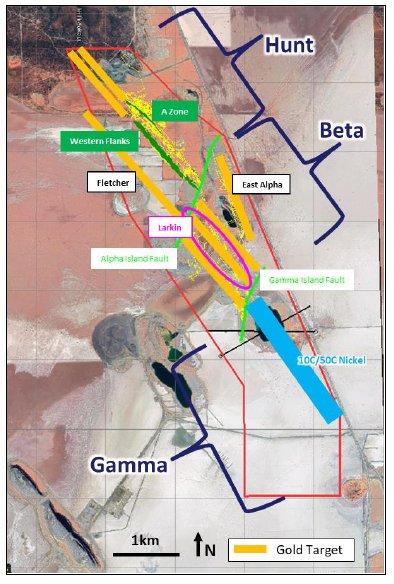

TORONTO, November 15, 2021 – Karora Resources Inc. (TSX: KRR; OTCQX: KRRGF) ("Karora" or the “Corporation" – https://www.commodity-tv.com/ondemand/companies/profil/karora-resources-inc/) is pleased to announce new exploration drilling results from the Beta Hunt Mine. The new drilling results include the discovery of high grade gold mineralization approximately 50 metres below the interpreted extension of the 50C nickel trough in the Gamma Block (see Karora news releases dated April 6, 2021 and October 8, 2021 and Figure 1 below for an outline of block areas at Beta Hunt).

Underground exploration drilling has returned an initial intersection of 40.5 g/t over 4.0 metres in diamond drill hole G50-22-007NE. The new discovery is associated with a basalt breccia. This association of gold mineralization with brecciation is not generally observed in current gold Mineral Resources at Beta Hunt.

Exploration drilling to the west of the Larkin Zone has also intersected what appears to be a parallel zone of gold mineralization. The discovery hole of 90 metres grading 1.5 g/t is approximately 250 metres west of the Larkin Zone and returned individual grades as high as 50.9 g/t over 0.4 metres.

Paul Huet, Chairman and CEO of Karora said, "I am excited by the new exploration drill results which continue to demonstrate the tremendous growth potential at the Beta Hunt Mine.

Our first drill hole south of the 50C nickel discovery in the Gamma Block area intersected 40.5 g/t gold over 4.0 metres (hole G50-22-007NE) as part of the drill program targeting the southern extent of the nickel trough and highlights the further potential of this area to host significant gold mineralization.

We also drilled Karora’s widest ever +1 g/t intersection at Beta Hunt. In the Beta Block, a campaign is underway to upgrade the 30C nickel trough and underlying Larkin Gold Zone. As part of this campaign an exploration drillhole was extended 250 metres past the Larkin Zone and returned a very wide gold mineralized intercept of 1.5 g/t over 90.5 metres, including 3.2 g/t over 13.1 metres and 2.7 g/t over 6.0 metres (hole EL-EA2-004AE). Infill drilling below the 30C nickel trough intersected gold mineralization supporting our Larkin Zone interpretation of three steep dipping zones ranging between 3 to 12 metres in width. The new drilling results from this area include 4.7 g/t over 5.0 metres (hole EL-EA2-004AE), 7.6 g/t over 2.1 metres (hole BL19-17AR) and 74.0 g/t over 1.0 metre (hole BL19-20AR).

It is important to understand that Beta Hunt’s current gold Mineral Resources are entirely contained within the northern Hunt Block, with both the Beta and Gamma Blocks remaining at very early stages of gold exploration. As Karora continues to develop the mine toward the south, opportunities to add to the current resource from these southern blocks is very encouraging as highlighted by the recent drill intersections from our exploration program.”

Recent Drilling Update

The description below covers new gold results for the drill period between August 1 to October 31, 2021 for drillholes in the Beta and Gamma Blocks. Drilling within these areas totalled 27 holes for 3,333 metres over the period. The Beta Block is defined as the area between the Alpha Island Fault and the Gamma Island Fault. The Gamma Block is defined by that area south of the Gamma Island Fault. The area north of the Alpha Island fault is defined as the Hunt Block (see Figure 1).

Turn-around times on assay results continue to be slow, up to 6 to 8 weeks for exploration samples, for reasons previously reported (see Karora news release dated September 8, 2021). As restrictions ease, this situation is expected to improve going forward.

Gamma Block Drilling

The first hole (G50-22-007NE) drilled south of the 50C nickel trough discovery intersected high grade gold mineralization comprising a downhole intersection of 40.5 g/t over 4.0 metres. The intersection is hosted by quartz veined and brecciated basalt within the Lunnon footwall basalt. This hole was part of a program targeting the southern strike extension of the 50C nickel trough. The mineralized breccia host rock is an unusual occurrence not observed in current gold Mineral Resources at Beta Hunt. Work is underway to determine the significance of the breccia, including reviewing the geological logs of adjacent drill holes with the aim of developing an interpretation for this new mineralized host.

The recent focus of drilling within the Gamma Block is to extend the 50C and 10C nickel mineralization within these troughs. This new high grade gold intersection highlights the potential for the Gamma Block to also host significant gold mineralization. Further drilling is planned to delineate the extent and continuity of the mineralization outlined to date, including this most recent gold intersection.

Beta Block Drilling

Drilling focused on upgrading the 30C nickel trough and underlying Larkin Gold Zone supplemented by a single exploratory drill hole designed to test for mineralization below the Beta West historical nickel mine area – the most western margin of known nickel mineralization at Beta Hunt.

Exploratory hole, EL-EA2-004AE, successfully confirmed the position of the known Larkin Zone, and intersected a further three wide zones of shear and quartz veined mineralization not previously reported west of the Larkin Zone. The widest mineralized zone, 1.5 g/t over 90.5 metres contains a quartz-feldspar porphyry associated with stockwork quartz veining with silica and pyrite alteration replacing the host basalt (see Figure 4).

Porphyry intrusives at Beta Hunt have been observed to replace sections of the mineralized shear zone up to 5 to 6 metres in width, however, in this instance, the main porphyry is 46 metres wide. The full mineralized interval, including the adjacent basalt is the widest (+1g/t) intersection reported in drilling completed by Karora at Beta Hunt. This new zone has not been tested at depth or along strike by drilling and potentially represents the faulted southern offset of the Fletcher Zone (see Karora news release, September 16, 2019) located on the north side of the Alpha Island Fault and a new, significant opportunity to expand the gold Mineral Resource at Beta Hunt.

The potential for steep, shear-related down-dip continuity associated with the new zones west of Larkin is supported by mineralization intersected in drill hole EL-EA2-005AR drilled below EL-EA2-004AE. This

resource development hole was designed to target the Larkin Zone and the mineralization below the 40C nickel trough.

Significant results1.from testing west of Larkin are highlighted below:

- EL-EA2-004AE: 1.5 g/t over 90.5 metres including 3.2 g/t over 13.1 metres (includes 50.9 g/t over 0.4 metres) and 2.7 g/t over 6.0m; 1.2 g/t over 15 metres

- EL-EA2-005AR: 2 g/t over 30.3 metres, including 2.2 g/t over 4.3 metres

1.Interval lengths are downhole widths. True estimated widths cannot be determined with available information.

In the central area of the Larkin Zone, infill drilling below the 30C nickel trough intersected additional Larkin Zone mineralization which continued to support the current interpretation of two to three, steep dipping, mineralized zones of varying widths (3 metres to 12 metres) with intersections associated with biotite-albite-pyrite altered steep-dipping shear zones and narrow, extensional quartz veins. Significant results1. from the most recent drilling are shown below:

- EL-EA2-004AE: 7 g/t over 5.0 metres

- BL19-17AR: 6 g/t over 2.1 metres

- BL19-20AR: 0 g/t over 1.0 metres

1.Interval lengths are estimated true widths

Compliance Statement (JORC 2012 and NI 43-101)

The disclosure of scientific and technical information contained in this news release has been reviewed and approved by Stephen Devlin, FAusIMM, Group Geologist, Karora Resources Inc., a Qualified Person for the purposes of NI 43-101.

At Beta Hunt all drill core sampling is conducted by Karora personnel. Drill core samples for gold analysis in this instance were shipped to ALS Laboratories, Perth for preparation and assaying by 50gram fire assay analytical method. All gold diamond drilling samples submitted for assay include at least one blank and one Certified Reference Material ("CRM") per batch, plus one CRM or blank every 20 samples. In samples with observed visible gold mineralization, a coarse blank is inserted after the

visible gold mineralization to serve as both a coarse flush to prevent contamination of subsequent samples and a test for gold smearing from one sample to the next which may have resulted from inadequate cleaning of the crusher and pulveriser. The lab is also required to undertake a minimum of 1 in 20 wet screens on pulverised samples to ensure a minimum 90% passing at -75µm. Samples for nickel analysis are shipped to SGS Australia Mineral Services of Kalgoorlie for preparation. Pulps are then shipped to Perth for assaying. The analytical technique is ICP41Q, a four acid digest ICP-AES package. Assays recorded above the upper detection limit (25,000ppm Ni) are re-analyzed using the same technique with a greater dilution (ICP43B). All samples submitted for nickel assay include at least one Certified Reference Material (CRM) per batch, with a minimum of one CRM per 20 samples. Where problems have been identified in QAQC checks, Karora personnel and the SGS and ALS laboratory staff have actively pursued and corrected the issues as standard procedure.

About Karora Resources

Karora is focused on doubling gold production to 200,000 ounces by 2024 compared to 2020 and reducing costs at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations ("HGO") in Western Australia. The Higginsville treatment facility is a low-cost 1.6 Mtpa processing plant, expanding to a planned 2.5 Mtpa by 2024, which is fed at capacity from Karora’s underground Beta Hunt mine and Higginsville mines. At Beta Hunt, a robust gold Mineral Resource and Reserve is hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial Mineral gold Resource and Reserve and prospective land package totaling approximately 1,800 square kilometers. The Company also owns the high grade Spargos Reward project which is anticipated to begin mining in 2021. Karora has a strong Board and management team focused on delivering shareholder value and responsible mining, as demonstrated by Karora’s commitment to reducing emissions across its operations. Karora’s common shares trade on the TSX under the symbol KRR and also trade on the OTCQX market under the symbol KRRGF.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to the growth potential of the Beta Hunt Mine, the results of exploration and development work, liquidity and capital resources of Karora, production guidance and the potential of the Beta Hunt Mine, Higginsville Gold Operation, the Aquarius Project and the Spargos Gold Project.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora ’s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Cautionary Statement Regarding the Higginsville Mining Operations

A production decision at the Higginsville gold operations was made by previous operators of the mine, prior to the completion of the acquisition of the Higginsville gold operations by Karora and Karora made a decision to continue production subsequent to the acquisition. This decision by Karora to continue production and, to the knowledge of Karora, the prior production decision were not based on a feasibility study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, which include increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that anticipated production costs will be achieved. Failure to achieve the anticipated production costs would have a material adverse impact on the Corporation’s cash flow and future profitability. Readers are cautioned that there is increased uncertainty and higher risk of economic and technical failure associated with such production decisions.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Director, Investor Relations

Telefon: +1 (416) 363-0649

Swiss Resource Capital AG

E-Mail: info@resource-capital.ch

![]()