Osisko Metals Intersects 6.00 Metres Grading 20.78% Zinc + Lead At Pine Point

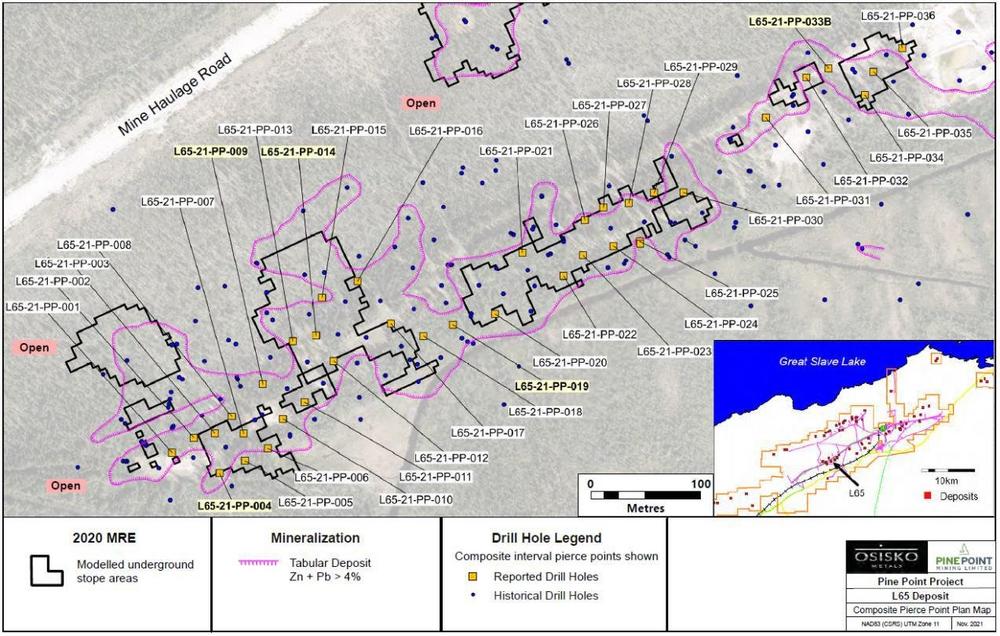

The results reported herein are from the L65 Tabular deposit in the Central Zone (see Map 1 and Tables 1 & 2) and form a part of the C1 Cluster area that has recently demonstrated improved hydrogeological modelling and substantially reduced dewatering requirements (see news release dated October 27, 2021).

Highlights:

- Drill hole L65-21-PP-009 intersected 00 metres grading 7.11% Zn and 1.73% Pb (8.84% Zn+Pb) in well-developed tabular mineralization.

- Drill hole L65-21-PP-033B intersected 00 metres grading 20.06% Zn and 0.72% Pb (20.78% Zn+Pb) in well-developed tabular mineralization.

- A number of well-mineralized intercepts occur outside underground stope areas that were modelled in the 2020 PEA.

- The L65 deposit is part of the C1 cluster (1.17MT @ 6.00% Zn and 1.8% Pb underground Inferred Mineral Resource) and is open to the west where it may connect with the nearby M67 deposit (0.67MT @ 4.41% Zn, 1.45% Pb open pit Inferred Mineral Resource), located 300 metres away.

Following recent positive hydrogeological results and significant spot zinc price increases, the Company will remodel this area with revised cost estimates and price forecasts. The objective is to convert the underground Mineral Resources in the Central Zone to open pit mining methods similar to the other four neighboring proposed open pits in the C1 Cluster. The potential opportunity is to simplify the operational aspects and reduce mining costs for this Cluster of deposits.

Robert Wares, CEO and Chairman, commented: “The excellent infill drilling results announced today add to the significant impact of our updated dewatering assumptions. The cluster mining strategy will potentially result in a simplified mine plan in the C1 Cluster. We will be able to leverage these improvements to other clusters and possibly expand the total tonnage mined and mine life at Pine Point. Shareholders are reminded that only 39.6Mt of the larger 52.4Mt resource was utilized in the 2020 PEA. We are excited to see the final impact of the updated dewatering model in our updated PEA expected in Q1 2022.”

The L65 mineralization is shallow and flat-lying, intersected between 60 and 87 metres vertical depth. Results were consistent with respect to the current resource block model and provided partial infill spacing required for the L65 deposit to meet the Indicated Mineral Resource threshold as defined in the 2020 PEA. The holes also further confirmed historical data.

Drilling to date has been conducted where summer access was available, and the Company is now in preparation for the 20,000 metres winter drilling program.

Hydrogeological Program Update

Modelling is ongoing for the other Clusters of deposits as part of the Life of Mine Planning that will be included in the Q1 2022 PEA Update.

Two additional holes within the L65 zone have been cased with internal perforated PVC for hydrogeological purposes. Further testing is planned for December.

Qualified Person

Mr. Robin Adair is the Qualified Person and the Vice President Exploration for Osisko Metals Incorporated. He is responsible for the technical data reported in this news release and he is a Professional Geologist registered in the Northwest Territories.

Quality Assurance / Quality Control

Osisko Metals adheres to a strict QA/QC program with regard to core handling, sampling, transportation of samples and lab analyses. Drill core samples from the Pine Point project area were securely transported to its core facility at the Pine Point project site, Northwest Territories where they were logged and sampled. Samples selected for assay were shipped via secure transportation to the ALS Canada Ltd.’s preparation facility in Yellowknife. Pulps were analyzed at the ALS Canada Ltd. facility in North Vancouver, British Columbia. All samples are analyzed by four acid digestion followed by both ICP-AES and ICP-MS for ultra-trace level detection for a multi-element suite with a 1% upper detection limit for base metals. Samples reporting over 1% for Zn and 1% for Pb are analyzed by assay grade, four acid digestion and ICPAES analysis with an upper detection limit of 30% and 20% respectively. Samples reporting Zn >30% and or Pb >20% are analyzed by traditional titration. Current drill program is following strict COVID19 protocols, has been underway since January 15th 2021 and is in progress. Further assay results are pending.

About Osisko Metals

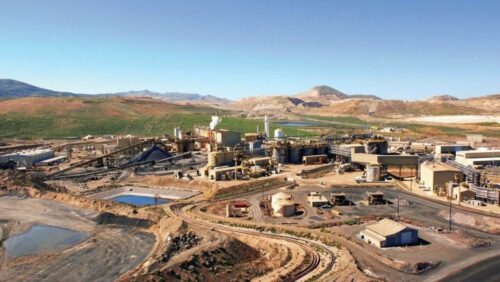

Osisko Metals Incorporated is a Canadian exploration and development company creating value in the base metal space. The Company controls one of Canada’s premier past-producing zinc mining camps, the Pine Point Project, located in the Northwest Territories for which the 2020 PEA has indicated an after-tax NPV of $500M and an IRR of 29.6%. The Pine Point Project PEA is based on current Mineral Resource Estimates that are amenable to open pit and shallow underground mining and consist of 12.9Mt grading 6.29% ZnEq of Indicated Mineral Resources and 37.6Mt grading 6.80% ZnEq of Inferred Mineral Resources. Please refer to the technical report entitled “Preliminary Economic Assessment, Pine Point Project, Hay River, North West Territories, Canada” dated July 30, which has been filed on SEDAR. The Pine Point Project is located on the south shore of Great Slave Lake in the Northwest Territories, near infrastructure, paved highway access, and has an electrical substation as well as 100 kilometres of viable haulage roads already in place.

The current Mineral Resources mentioned in this press release conform to NI43-101 standards and were prepared by independent qualified persons, as defined by NI43-101 guidelines. The abovementioned Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of the reported Inferred Mineral Resources are conceptual in nature and are estimated based on limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological grade and/or quality of continuity. Zinc equivalency percentages are calculated using metal prices, forecasted metal recoveries, concentrate grades, transport costs, smelter payable metals and charges (see respective technical reports for details).

Cautionary Statement on Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation based on expectations, estimates and projections as at the date of this news release. Any statement that involves predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance are not statements of historical fact and constitute forward-looking information. This news release may contain forward-looking information pertaining to the Pine Point Project, including, among other things, the results of the PEA and the IRR, NPV and estimated costs, production, production rate and mine life; the expectation that the Pine Point Project will be an robust operation and profitable at a variety of prices and assumptions; the expected high quality of the Pine Point concentrates; the potential impact of the Pine Point Project in the Northwest Territories, including but not limited to the potential generation of tax revenue and contribution of jobs; and the Pine Point Project having the potential for mineral resource expansion and new discoveries. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management, in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, including, without limitation, assumptions about: favourable equity and debt capital markets; the ability to raise additional capital on reasonable terms to advance the development of its projects and pursue planned exploration; future prices of zinc and lead; the timing and results of exploration and drilling programs; the accuracy of mineral resource estimates; production costs; operating conditions being favourable; political and regulatory stability; the receipt of governmental and third party approvals; licences and permits being received on favourable terms; sustained labour stability; stability in financial and capital markets; availability of equipment; and positive relations with local groups. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information are set out in the Company’s public documents filed at www.sedar.com. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()