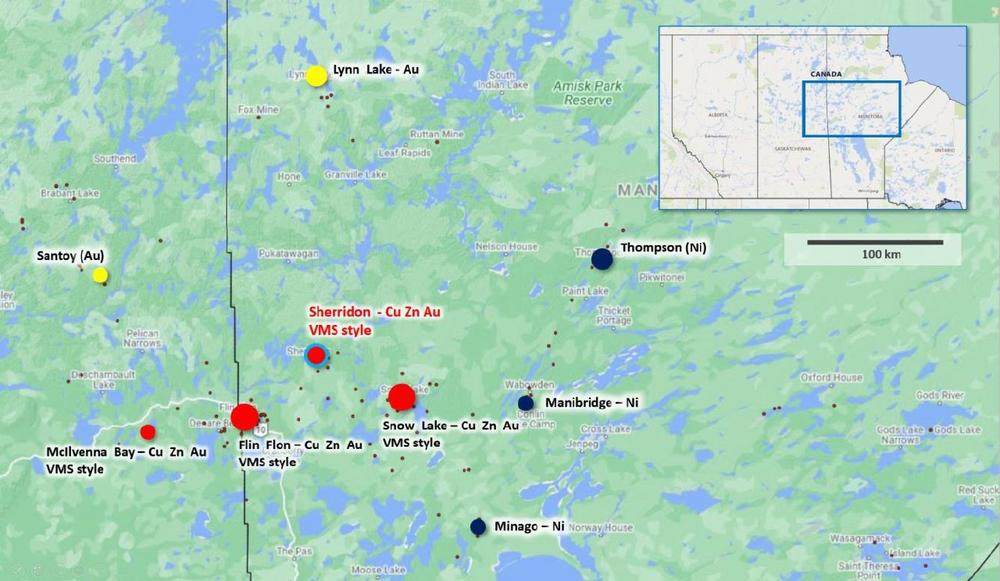

Aguila Copper acquires multiple copper-zinc-gold resources in the Sherridon district, Manitoba

Sherridon is one of Canada’s notable Volcanic Hosted Massive Sulphide (VHMS) mining camps, that lies 65km northeast of the mining/metallurgical complex in Flin Flon, linked by an all-weather 78 km road. The site is serviced by a railroad, power line and the small community of Sherridon/Cold Lake.

Mining of the Sherritt Gordon deposit at Sherridon took place between 1931 and 1951, over which time 7.74 million tonnes were mined at an average grade of 2.46% Cu, 2.84% Zn, 0.6 g/t Au and 33 g/t Ag (Froese & Goetz, 1981). Subsequent exploration was completed in the region by a range of companies, which identified numerous massive sulphide occurrences, typically associated with a similar host-horizon as Sherritt Gordon (Ostry et al, 1998).

Exploration activity peaked with the investment of the Vendor between November 2006 and July 2010, including the drilling of 159 holes and estimation of near surface indicated and inferred mineral resources. Additional in-fill and along strike drilling was completed at the project subsequent to resource calculation. No exploration activity is documented after November 2012. Today, the Vendor is the registered 100% owner of 28 Mining Claims and 1 Mineral Lease covering the Sherridon mining district (see Figure 1) for a total of 4968 Ha. Some Mining Claims are the subject of royalty agreements relating to prior contracts and agreements.

Full technical data pertaining to the acquisition will be shared at the satisfactory completion of a 40-day due diligence period. The executed Option Agreement is binding upon the Vendor. The obligations of the Company under the Option Agreement are subject to the approval of the TSX Venture Exchange (the “Exchange”). The closing date of the Option Agreement will be two business days following the receipt of Exchange approval, or such other date as agreed to by the parties (the “Closing Date”).

The Sherridon Option Agreement requires Aguila pay CA$15,000 cash. To keep the Option Agreement in good standing, Aguila must issue to the Vendor 100,000 fully paid shares in the Company within six months of the Closing Date, and incur exploration expenditures of CA$100,000 before the first anniversary of closing. Aguila will earn an 80% interest in the Property by incurring an additional CA$900,000 exploration expenditures by the 4th anniversary, and earn an additional 10% (for a total of 90%) by incurring an additional CA$1,000,000 of exploration expenditures by the seventh anniversary. Upon exercise of the option, the Vendor and Aguila will form a joint venture to advance the Property. The Vendor may then fund project expenditure in proportion to its interest in the Property, or its interest will be converted into a 1.5% net smelter royalty that is purchasable by the Company for CA$2,000,000 at any time. All shares issued pursuant to the terms of the Option Agreement are subject to a hold period under applicable securities laws for a period of four months from the date of issuance.

The 40-day due diligence period shall allow Aguila to collate past exploration data and gain a full understanding of past royalty agreements.

“The Sherridon mining district is a strategic acquisition for Aguila alongside our US portfolio” said Mark Saxon, CEO of Aguila Copper Corp. “Our focus during 2021 has been to identify copper-rich projects, of attractive geological styles, within mining supportive jurisdictions. This Sherridon acquisition has exceeded our expectations, and, subject to final due diligence, provides an excellent flagship asset alongside our recent US acquisitions. VHMS style deposits are one of the largest producers of copper, zinc and gold globally, including such world class deposits as Neves Corvo, Kidd Creek, and the Bathurst camp.”

We are excited to have this opportunity to play a role in the energy transition, with a high quality copper asset close to existing mining and processing infrastructure.”

Goetz, P., & Froese, E., 1981, The Sherritt Gordon Massive Sulphide Deposit. Precambrian Sulphide Deposits, H.S. Robinson Memorial Volume, edited by R.W. Hutchinson, C.D. Spence and J.M. Franklin, Geological Association of Canada Special Paper 25, 1982

Ostry, G., Athayde, P., & Trembath, G., 1998, Mineral Deposits and Occurrences in the Sherridon Area, NTS 63N/3. Mineral Deposit Series Report No. 17, Manitoba Energy and Mines Geological Survey

Technical Background

The Company has obtained historic exploration data for this press release from Manitoba Agriculture and Resource Development, and other public archives. Although historic exploration data was generated by reputable companies applying practice of the day, Aguila cannot verify the data or determine the quality assurance and quality control measures applied in generating the data. Furthermore, there is no guarantee that the exploration history is fully captured. Accordingly, the Company cautions that the exploration data reported in this news release may not be reliable. Readers are cautioned that a "qualified person" as defined by National Instrument 43-101 has not completed sufficient work to be able to verify the historical information, and therefore the information should not be relied upon.

The qualified person for the Company’s projects, Mr. Mark Saxon, the Company’s Chief Executive Officer, a Fellow of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists, has reviewed and verified the contents of this release.

About Aguila Copper Corp (TSX.v: AGL) (OTC: AGLAF) (WKN: A2DR6E)

Aguila Copper Corp is an emerging copper and precious metal company enhancing shareholder value through exploration and discovery.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Certain information set out in this news release constitutes forward-looking information. Forward looking statements are often, but not always, identified by the use of words such as "seek", "anticipate”, "plan", "continue”, "estimate”, "expect", "may”, "will", "intend", "could", "might", "should", "believe" and similar expressions. Forward-looking statements are based upon the opinions and expectations of management of the Company as at the effective date of such statements and, in certain cases, information provided or disseminated by third parties. Forward-looking statements in this news release include statements regarding the closing of the transactions contemplated in the Option Agreement, the exercise of the option and the Exchange approval of the Option Agreement. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, and that information obtained from third party sources is reliable, they can give no assurance that those expectations will prove to have been correct. Readers are cautioned not to place undue reliance on forward-looking statements.

These forward-looking statements are subject to a number of risks and uncertainties. Actual results may differ materially from results contemplated by the forward-looking statements. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. Such risks include the ability of the Company to complete all payments, share issuances and expenditures required under the Option Agreement, the Exchange approval to the Option Agreement and uncertainties relating to exploration activities. When relying on forward-looking statements to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements, except as may be required by applicable securities laws.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()