Copper Mountain Mining Announces Updated Economics and Development Plan for Eva Copper Project

“Eva’s project economics are strong and have improved compared to the May 2020 Feasibility Study,” commented Gil Clausen, Copper Mountain’s President and CEO. “The current inflationary environment prevalent globally, particularly for some material and labour supply in Queensland Australia, has resulted in some Project capital cost escalation. We believe this impact will ease as the local economy opens fully after COVID-19 restrictions lift, materials flow regularly, and labour pressures relax over the next six to 12 months.”

“The Company will continue to adhere to a disciplined project execution plan to closely manage capital expenditures and the project schedule. With that approach, our Board has now formally approved the plan to construct the Project subject to advancing detailed engineering to 80% completed; obtaining committed project financing; and the lifting of COVID-19 restrictions in Queensland, Australia. Upon satisfaction of these items, the Company will be able to fix a construction start date. We expect this detailed engineering work to require approximately six months to complete during which time the Company will secure commitments on certain critical long lead-time equipment. This project execution plan approach reduces development risk but will have a four to six-month extension to the original project schedule. The Company now anticipates Eva Mine commissioning in late 2024, provided the above conditions are met,” added Mr. Clausen.

Mr. Clausen continued, “We will fund the expenditures for moving the Project through detailed engineering and to secure long lead items with current cash on hand. We expect to fund the full development of Eva through conventional bank project debt financing and internal cash flow. The project financing process is well advanced, with closing expected for mid- 2022. We are excited to formally advance Eva, which is expected to add over 100 million pounds of copper production per year, given the ever increasing and important role copper will play in a green economy and the limited number of other copper projects currently in development globally.”

Summary of Metrics

The December 2021 Update compared to the May 2020 Feasibility Study is provided below.

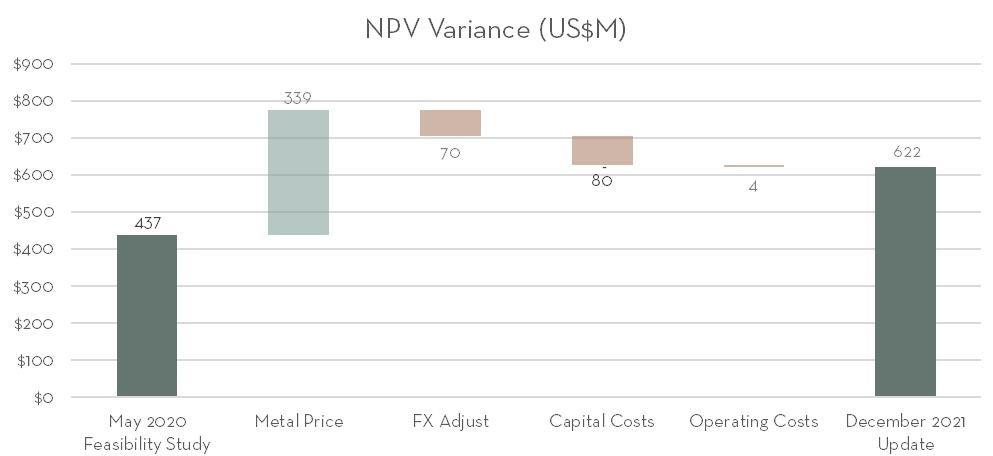

Eva’s after-tax net present value (NPV), based on an 8% discount rate is now $622 million, a 42% increase compared to the May 2020 Feasibility Study. The main factor for the value growth is higher metal prices, offset by a stronger Australian dollar and higher capital. A variance analysis comparing the after-tax NPVs in the December 2021 Update and the May 2020 Feasibility Study is provided below.

Total initial development capital for the Project is estimated to be approximately A$836 million, including a contingency of A$76 million. A summary of the total initial development capital by area in Australian Dollars is provided below.

Initial development capital in the December 2021 increased by approximately 18.7% compared to the May 2020 Feasibility Study. A summary of the variances by main area is provided below.

Cost increases in steel, mechanical, concrete, and construction labour were the most significant drivers in the higher capital costs, particularly in the processing area. Raw material and finished equipment costs have been impacted by shortages as COVID restrictions remain tight, especially in Queensland. Higher estimated infrastructure costs were mainly driven by an expanded camp facility, power infrastructure, and water development, with lower mining equipment costs marginally offsetting the overall higher capital costs in other areas. The total life of mine sustaining capital in the December 2021 Update is estimated to be US$46.6 million, compared to US$33.8 million in the May 2020 Feasibility Study. This increase in sustaining capital is mainly due to higher sustaining mining equipment costs as well as appreciation in the A$ to US$ exchange rate. Sustaining capital is comprised of rehabilitation costs and mining equipment.

The average life of mine C1 cash cost per pound of copper in the December 2021 Update is estimated to be US$1.53, net of by-product credits. This cost compares to US$1.44 per pound of copper in the May 2020 Feasibility Study. The increase in C1 cash cost is due to A$ to US$ exchange rate appreciating from 1.55 to 1.40.

Project Plan

The Company has formally approved the development of Eva, contingent on completing detailed engineering to at least 80%, which is expected to take approximately six months, project financing committed, and the lifting of COVID-19 restrictions in Queensland, Australia. The advancement of detailed engineering will minimize project execution risk and allow the Company to establish a more significant component of fixed-price contracts for major scope elements. The Company also intends to place deposits on long lead capital equipment during this period. Total project expenditures for the first half of 2022 are estimated to be approximately A$40 million. Detailed engineering is planned for completion, to at least an 80% level, in Q3 of 2022.

The Company’s current cash will fund the near-term project expenditures. The Company also plans to finance the development expense of Eva through conventional project bank debt and internal cash flow. Copper Mountain continues to advance the project financing process and expects it to close mid-2022.

About Copper Mountain Mining Corporation

Copper Mountain’s flagship asset is the 75% owned Copper Mountain Mine located in southern British Columbia near the Town of Princeton. The Copper Mountain Mine currently produces approximately 100 million pounds of copper equivalent per year, with average annual production expected to increase to about 140 million pounds of copper equivalent. Copper Mountain also has the 100% owned development-stage Eva Copper Project in Queensland, Australia and an extensive 2,100 km2 highly prospective land package in the Mount Isa area. Copper Mountain trades on the Toronto Stock Exchange under the symbol “CMMC” and Australian Stock Exchange under the symbol “C6C”.

Additional information is available on the Company’s web page at www.CuMtn.com.

On behalf of the Board of

COPPER MOUNTAIN MINING CORPORATION

“Gil Clausen”

Gil Clausen, P.Eng.

President and Chief Executive Officer

For further information, please contact:

Website: www.CuMtn.com

Cautionary Note Regarding Forward-Looking Statements

This document may contain "forward looking information" within the meaning of Canadian securities legislation and "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, "forward-looking statements"). These forward-looking statements are made as of the date of this document, and Copper Mountain does not intend, and does not assume any obligation, to update these forward-looking statements, whether as a result of new information, future events or otherwise, except as required under applicable securities legislation.

All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements relate to future events or future performance and reflect our expectations or beliefs regarding future events.

In certain circumstances, forward-looking statements can be identified, but are not limited to, statements which use terminology such as “plans”, “expects”, “estimates”, “intends”, “anticipates”, “believes”, “forecasts”, “guidance”, scheduled”, “target” or variations of such words, or statements that certain actions, events or results “may”, “could”, “would”, “might”, “occur” or “be achieved” or the negative of these terms or comparable terminology. In this document, certain forward-looking statements are identified, including production and cost guidance, economics, including capital and operating costs, for the Project, anticipated timing for the completion of detailed engineering for the Project, Eva Mine commissioning and the closing of project financing, expectations regarding the funding of the development of the Project, anticipated production at the Copper Mountain Mine and Eva, expectations regarding the impact of the COVID-19 pandemic on operations, financial condition and prospects, anticipated metals prices and the anticipated sensitivity of the Company’s financial performance to metals prices, events that may affect its operations and development projects, anticipated cash flows from operations and related liquidity requirements, the anticipated effect of external factors on revenue, such as commodity prices, estimation of mineral reserves and resources, mine life projections, reclamation costs, economic outlook, government regulation of mining operations, and business and acquisition strategies. Forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual results, performance, achievements, and opportunities to differ materially from those implied by such forward-looking statements. Factors that could cause actual results to differ materially from these forward-looking statements include, among others, the successful exploration of the Company’s properties in Canada and Australia, market price, continued availability of capital and financing and general economic, market or business conditions, the reliability of the historical data referenced in this document and risks set out in Copper Mountain’s public documents, including in each management discussion and analysis, filed on SEDAR at www.sedar.com. The potential effects of the COVID-19 pandemic on Copper Mountain’s business and operations are unknown at this time, including Copper Mountain’s ability to manage challenges and restrictions arising from COVID-19 in the communities in which Copper Mountain operates and its ability to continue to safely operate and to safely return the business to normal operations. The impact of COVID-19 is dependent on a number of factors outside of the Company’s control and knowledge, including the effectiveness of the measures taken by public health and governmental authorities to combat the spread of the disease, global economic uncertainties and outlook due to the disease, and the evolving restrictions relating to mining activities and to travel in certain jurisdictions in which Copper Mountain operates. Although Copper Mountain has attempted to identify important factors that could cause our actual results, performance, achievements and opportunities to differ materially from those described in our forward-looking statements, there may be other factors that cause our results, performance, achievements and opportunities not to be as anticipated, estimated or intended, believes that the information and assumptions used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Accordingly, readers should not place undue reliance on the Company’s forward-looking statements.

Cautionary Note Regarding Non-GAAP Performance Measures

This document includes certain non-GAAP performance measures that do not have a standardized meaning prescribed by IFRS. These measures may differ from those used and may not be comparable to such measures as reported by other issuers. The Company believes that these measures are commonly used by certain investors, in conjunction with conventional IFRS measures, to enhance their understanding of the Company’s performance. These performance measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These measures have been derived from the Company’s financial statements and applied on a consistent basis. The calculation and an explanation of these measures is provided in the Company’s latest MD&A and such measures should be read in conjunction with the Company’s financial statements.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()