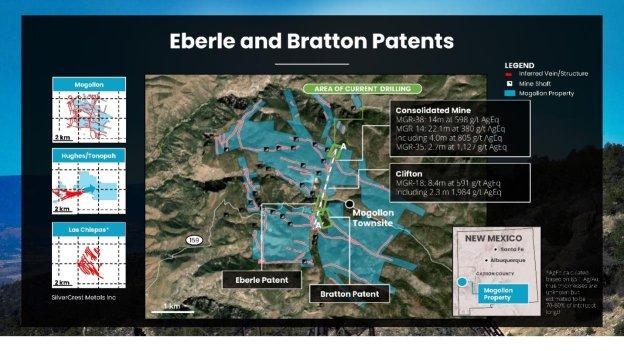

Summa Silver Options Historic Eberle Mine at the High-Grade Silver-Gold Mogollon Property, New Mexico

Eberle Mine Highlights

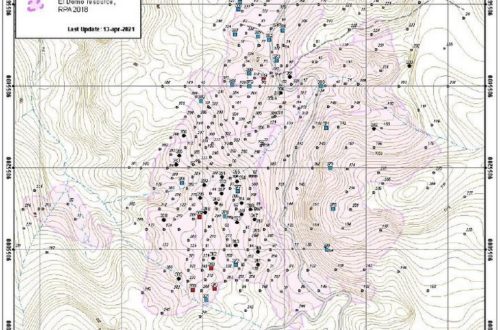

- High Potential Target: The Eberle Mine, located at the intersection between the Queen vein and the Maud S vein, is similar to other significantly mineralized zones in the district (see attached figures).

- Minimal Historic Development: Only partially developed on three levels in the early 1900’s, the Company believes there is strong potential for the discovery of mineralized high-grade zones along strike and below the historic workings.

- Largely Unexplored: Although anecdotal reports of historic work on the Patents exist, the results are unavailable and no modern exploration work has ever been completed around the mine.

- Privately Owned Until Now: Having been owned by a private landowner and their heir since 1972, the Patents have never been part of the current property package.

Acquisition Terms

The Company may earn a 100% interest in the Patents by making payments totalling USD $700,000 over four years (Table 1). After completion of the payments, the Patents will not be subject to any underlying royalties or other encumbrances.

Galen McNamara, CEO, stated: “Signing an option to earn a 100% interest in the Eberle Mine represents a natural progression for us at Mogollon as we develop new targets to drill. The geological features present at Eberle are strikingly similar to our current drilling area around the old Consolidated Mine. As drilling progresses at Consolidated throughout 2022, we will also prepare permit applications for Eberle so we can immediately shift to delineating the next zone once drilling at Consolidated is completed.”

The Patents

The Patents consist of the Eberle and Bratton patented mining claims that were staked in the 1880’s and patented in 1893. The Eberle and Bratton mining claims encompass 18.89 acres and 17.33 acres, respectively.

Located on the Eberle patent, the Eberle Mine is situated at the intersection between the east-west Maud S vein and the north-south-trending Queen vein. The mine has been developed on three levels, the upper two of which are adit levels and the lower level which is developed from an internal winze. Production from the Eberle Mine is estimated to have been approximately 10,000 tons1 prior to 1916, the bulk of which came from the Maud S vein. Based on the production history of the district, and when comparing this area to the footprint of mineralization around the current drilling area at the Consolidated Mine, the Company believes there is strong potential for significant mineralization below and surrounding the Eberle Mine.

Qualified Person

The technical content of this news release has been reviewed and approved by Galen McNamara, P. Geo., the CEO of the Company and a qualified person as defined by National Instrument 43-101.

Marketing

In connection with the Company’s commercial introduction plans, the Company has entered into a 12-month programmatic digital advertising campaign with Native Ads Inc. (“Native Ads”) for a total cost of USD $200,000. This comprehensive advertising program is designed to build awareness through the following services: (a) digital advertising (b) paid distribution, (c) media buying and (d) content creation.

Native Ads is a full-service ad agency that owns and operates a proprietary ad exchange with over 80 integrated SSPs (supply-side platforms) resulting in daily access to three to seven billion North American ad impressions.

Neither Native Ads, nor any of its respective, principals, directors and/or officers own any securities of the Company or any right to acquire securities of the Company. Native Ads is privately owned and is an arm’s length party to the Company. The appointment of Native Ads is subject to approval by the TSX Venture Exchange.

About Summa Silver Corp

Summa Silver Corp is a Canadian junior mineral exploration company. The Company owns a 100% interest in the Hughes property located in central Nevada and has an option to earn 100% interest in the Mogollon property located in southwestern New Mexico. The Hughes property is host to the high-grade past-producing Belmont Mine, one of the most prolific silver producers in the United States between 1903 and 1929. The mine has remained inactive since commercial production ceased in 1929 due to heavily depressed metal prices and little to no modern exploration work has ever been completed.

Follow Summa Silver on Twitter: @summasilver

LinkedIn: https://www.linkedin.com/company/summa-silver-corp/

ON BEHALF OF THE BOARD OF DIRECTORS

“Galen McNamara”

Galen McNamara, Chief Executive Officer

Investor Relations Contact:

Kin Communications

Giordy Belfiore

604-684-6730

In Europe:

Swiss Resource Capital AG

Jochen Staiger

1Summary Report on the Geology of the Mogollon Mining District and Challenge Mining Company, Prepared by Bighorn Exploration Inc. Challenge Mining Company Internal Report, 1986

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary note regarding forward-looking statements

This news release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian and U.S. securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. The forward-looking information contained herein is provided for the purpose of assisting readers in understanding management’s current expectations and plans relating to the future. These forward‐looking statements or information relate to, among other things: acquisition of the Patents, the exploration and development of the Company’s mineral exploration projects; services to be provided by Native Ads; and applicable regulatory approvals.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual actions, events or results to be materially different from those expressed or implied by such forward-looking information, including but not limited to: the requirement for regulatory approvals; enhanced uncertainty in global financial markets as a result of the current COVID-19 pandemic; unquantifiable risks related to government actions and interventions; stock market volatility; regulatory restrictions; and other related risks and uncertainties.

Forward-looking information are based on management of the parties’ reasonable assumptions, estimates, expectations, analyses and opinions, which are based on such management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect.

The Company undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management’s best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()