Chinese are buying more cars again – good for raw materials

In 2021 as a whole, around 6.5 percent more cars were sold in the Middle Kingdom than in the previous year. The pre-pandemic level was thus almost reached again. Incidentally, around 15 percent of these were electric vehicles. With the increased sales of electric cars, demand for raw materials such as copper and zinc is also rising. Copper is used in electric cars to a much greater extent than in conventional vehicles, and zinc is always involved in car construction as a corrosion inhibitor.

Copper, also known as the economic metal, is also benefiting from rising economic growth and infrastructure measures. These are planned on a large scale in China and also in the USA. The infrastructure package of the current US President Biden is worth 550 billion US dollars. On the one hand, investments in climate protection and, on the other, modernization of roads, ports and the like. China’s "New Silk Road" project will need raw materials, as will the EU’s "Global Gateway" initiative. The EU plans to invest 300 billion euros in the infrastructure of emerging and developing countries. Rail lines and roads are to be built. This is also to include, for example, an underwater cable link for data transport between the EU and Latin America.

Companies that have such sought-after raw materials as copper or zinc in their projects should therefore find enough customers for their future production in the next few years.

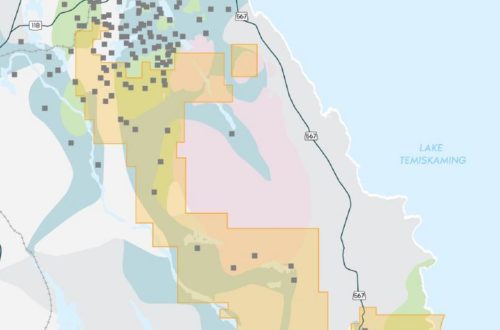

Zinc is the business of Osisko Metals – https://www.youtube.com/watch?v=l1J1C-3t2iA -. The Canadians own the important Pine Point zinc mining camp in the Northwest Territories. Once production starts there, Pine Point will be the fourth largest zinc camp in America.

Promising projects with copper and gold are part of GoldMining’s – https://www.youtube.com/watch?v=gofefXhUHKY – portfolio. The projects are located in Canada, USA, Colombia, Brazil and Peru.

Current corporate information and press releases from Osisko Metals (- https://www.resource-capital.ch/en/companies/osisko-metals-inc/ -) and GoldMining (- https://www.resource-capital.ch/en/companies/goldmining-inc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()