Gold and copper with best chances

To boost the economy, China is planning a large-scale expansion of high-speed rail on its rail network. By 2025, this line is to be extended by 12,000 kilometers to 50,000 kilometers. One kilometer will consume just over eight tons of copper. By 2035, the high-speed line is to be extended to 200,000 kilometers. In the areas of clean energy such as wind and solar energy, as well as electronics and electromobility, the economic metal copper is in increasing demand.

The value preservation vehicle gold is also increasingly in the focus of investors, especially since there is a lot going on geopolitically at the moment. An allegedly imminent military conflict, Russia could invade Ukraine, affects the risk appetite of investors. In addition, North Korea has now fired missiles once again in a fourth missile test this year. News that the United Arab Emirates has been attacked with drones also raises eyebrows. The price of gold usually benefits from such uncertainties, while they can often be only a rather short-term reaction. But in the longer term, the specter of inflation should provide good fundamentals for the gold price. And this specter is not only going around in this country, but also in Great Britain (inflation rose by 5.4 percent in December) or Canada (an increase of 4.8 percent). With the oil price extremely high at the same time, it should be worthwhile to bet on gold and copper or companies that own these commodities. For example, Aztec Minerals or Osisko Gold Royalties could be considered.

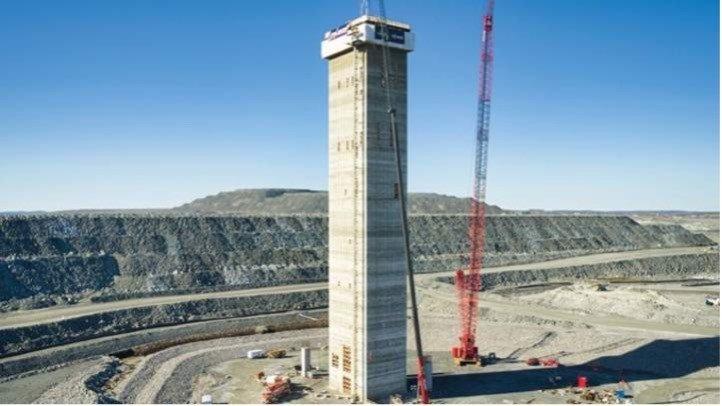

Aztec Minerals – https://www.youtube.com/watch?v=t6PFpRjvfTo&t=14s – owns, among other things, a 75% interest in the historic Tombstone Silver District in Arizona and a 65% interest in the prospective Cervantes porphyry gold-copper project in Mexico.

Osisko Gold Royalties – https://www.youtube.com/watch?v=IJM_VsIaxmw – could generate nearly 80,000 ounces of gold from its royalty and precious metal sales in 2021.

Latest corporate information and press releases from Osisko Gold Royalties (- https://www.resource-capital.ch/en/companies/osisko-gold-royalties-ltd/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()