Gold and silver prices put up a brave fight

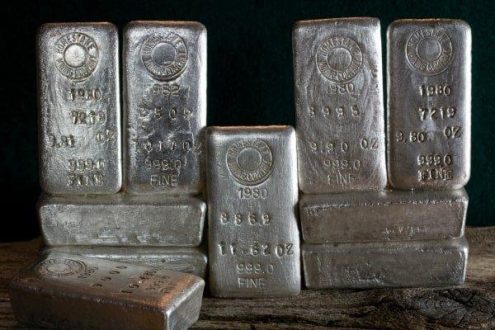

The mark at 1,833 U.S. dollars per ounce represented a massive resistance, but now after weeks the mark has been exceeded and thus a buy signal has been generated. From a chart perspective, gold could now rise slightly to 1,848 U.S. dollars per ounce. If the gold price breaks out over this value, also 1,920 US dollar per ounce would not be surprising. Also, with the silver price it looks at the moment well, over 24 US dollar per ounce silver, one did not see for weeks anymore. The current gold-silver ratio is thus around 76, which means that silver is undervalued compared to gold.

Many experts in the silver sector see great potential for the precious metal to catch up. This is because demand from industry is high. Whether it’s switch contacts or the photovoltaic sector, silver is an indispensable raw material in industry. And especially from the photovoltaic sector an immense demand is expected in the coming years. For investors, silver should be more than just gold’s little brother. Precious metals offer value preservation, as it is not easy to find in today’s world. Here a view of the inflation figures shows the misery. In December, the inflation rate in Germany was 5.3 percent, and according to statements by the German Bundesbank, an inflation rate of 3.6 percent is forecast for the current year. Investors can hedge against this with tangible assets such as shares, because high inflation will not disappear overnight. Analysts at BCA Research, for example, see little hope of improvement in the medium term. The reasons are the increasing labor shortage, rising wages, supply chain problems and the consequences of the economic stimulus programs.

Promising companies include OceanaGold and Maple Gold.

OceanaGold – https://www.youtube.com/watch?v=PtFuwcmAl9E&t=92s – is successfully producing gold, with projects in New Zealand, the Philippines, and the United States.

Maple Gold Mines – https://www.youtube.com/watch?v=28PbZGxE7r8 – is working with joint venture partner Agnico Eagle in Quebec’s Abitibi greenstone Gold Belt on the Douay and Joutel gold projects.

Current corporate information and press releases from Maple Gold Mines (- https://www.resource-capital.ch/en/companies/maple-gold-mines-ltd/ -) and OceanaGold (- https://www.resource-capital.ch/en/companies/oceanagold-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()