Tier One Silver Intersects 384.6 g/t Silver Equivalent over 3 Metres on the Tipal Structural Corridor at Curibaya and Appoints Christian Rios as Senior Vice President of Exploration

The Company is also pleased to announce the appointment of Christian Rios to SVP of Exploration from his former role as the SVP of Operations in Peru. Mr. Rios is a professional geologist (P.Geo.) who, prior to working with Tier One Silver, was the Vice President of Exploration at Bear Creek Mining where he was directly involved in the discovery of the world-class Santa Ana and Corani silver-lead-zinc deposits in Peru and was on the team that delivered the feasibility study of the Corani deposit. Mr. Rios has a master’s degree in Economic Geology and over twenty years of experience in exploration, mining development and operations, specializing in Peru. He is replacing Dave Smithson, who resigned for personal reasons.

A Message from Peter Dembicki, President, CEO & Director:

"We are very pleased to confirm a fourth structural corridor target carrying high-grade silver, both on surface and at depth, through our drill program. We believe the grade and scalability of the Curibaya system to-date are impressive and warrant further drilling. In the meantime, we are looking forward to receiving the remaining five drill hole results."

"On behalf of everyone in the Company, I would like to thank Dave for his commitment, dedication, and efforts to help bring Curibaya to this stage as a world-class exploration target. We look forward to working with Christian in a new capacity as he has played an integral role within the Company to-date, and his notable exploration experience with silver discoveries in Peru will provide respected knowledge and leadership."

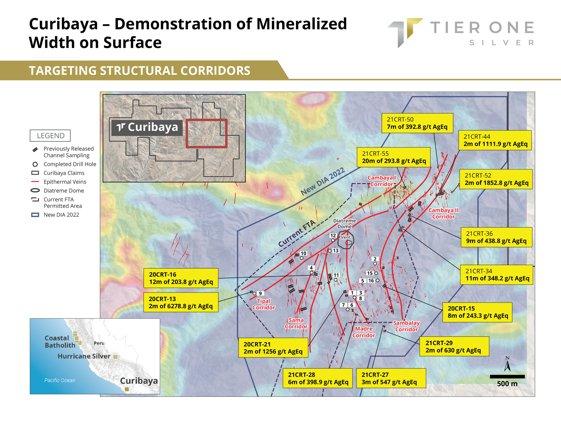

At the Tipal structural corridor, holes 9 and 10 were drilled 830 m apart, focusing around channel samples of 2 m of 6,278.8 g/t AgEq and 4 m of 282.1 g/t AgEq, respectively (Figure 3). Drill hole 9 intercepted vein arrays within kaolinite and sericite alteration, 50 m below the surface, returning 3 m of 384.6 g/t AgEq from 83 m – 86 m in a broader interval of 5.5 m of 221.5 g/t AgEq from 82 m – 87.5 m. The structure was tested again in hole 10, 830 m to the NE, and returned 1 m of 383.6 g/t AgEq from 96 m – 97 m in a broader interval of 2 m of 224.9 g/t AgEq from 96 m – 98 m, also in vein arrays with kaolinite and sericite alteration (Figure 3). A summary of significant results from drill holes 9 and 10 is provided in Table 1.

At the Madre structural corridor, drill holes 7, 8, and 11 targeted a 650 m section of the 1.4-km-long corridor, where channel sampling previously identified high-grade mineralization (Figure 4). Holes 7 and 8 targeted beneath channel samples of 6 m of 398.9 g/t AgEq, 4 m of 189.2 g/t AgEq and 2 m of 1,256 g/t AgEq. Hole 7 returned 1 m of 261.8 g/t AgEq from 115.5 m – 116.5 m in a broader interval of 8 m of 62.2 g/t AgEq from 115.5 m – 123.5 m. The intercept was in vein arrays with quartz-adularia and sericite-kaolinite alteration (Figure 4). Hole 8, located 335 m to the north from hole 7 on the Madre corridor, intercepted multiple parallel banded quartz-adularia vein zones and returned 2.5 m of 195.2 AgEq from 197 m – 199.5 m, 2 m of 104.8 AgEq from 213 m – 215 m in a broader interval of 28 m of 38 g/t AgEq from 209 m – 237 m and 2 m of 160.1 g/t AgEq from 269 m – 271 m (Figure 4). The veins come with adularia, colloform and drusy silica vein textures as well as sericite-kaolinite alteration (Figure 4). Hole 11 was positioned another 300 m to the north from hole 8, targeting the Madre corridor under high-grade rock grab samples, but no significant mineralization was encountered (Figure 4). A summary of significant results from drill holes 7, 8 and 11 is provided in Table 1.

A Message from Christian Rios, SVP of Exploration:

"The technical team is pleased to continue to receive positive drill results in the early stages of our drill program at Curibaya. We are gaining a crucial understanding of the distribution of mineralization along the structural corridors that will help us refine our drill plans as we target the wider surface mineralization at the Cambaya prospect."

"Having been involved with Tier One’s projects since before the Company’s inception, I am excited and eager to begin work as the SVP of Exploration. The quality and potential of our projects provides an incredible opportunity and I look forward to pushing them to the next level."

Significance of Results and Program Update:

To date, two holes totaling 300 m have been drilled into the Tipal structural corridor over a strike length of 830 m and to a vertical depth of 50 m below surface (Figure 3). The 3 m of 384.6 g/t AgEq encountered at depth makes Tipal the fourth confirmed structural corridor to host mineralization in the third dimension at Curibaya. With the addition of channel samples demonstrating high-grade (2 m of 6.2 kg AgEq) on the same structure, the Tier One technical team believes Tipal has the potential to host additional vein zones with high-grade mineralization.

At the Madre structural corridor, four holes totaling 1,547 m have been successfully drilled, covering a strike-length of 550 m and to a vertical depth of 200 m from surface (Figure 4). In the most recent drilling, hole 7 intercepted veinlet-arrays over 2.5 m, averaging 195.2 AgEq. The hole was collared off hole 6 (previously reported), which also intersected a veinlet array, but with bonanza grade veinlets averaging 1.48 kg AgEq over 1 m. Three hundred metres to the north, hole 8 encountered two parallel-trending quartz-adularia veins with 2.5 m width of 104.8 g/t AgEq and 195.2g/t AgEq, respectively. The drilling completed in holes 6 – 8 demonstrates the development of multiple vein horizons with silver grades of 89.3 g/t – 1,480.5 g/t AgEq over 1 m – 2.5 m, indicating that further drilling is warranted on the Madre structure with the goal of intersecting greater widths of high-grade vein development.

To date, the Company has drilled a total of 16 holes for 5,267 m in four of the five precious metal structural corridors, with results pending for holes 12-16 (Figures 2 & 5). The Company expects to resume drilling at Curibaya in Q2 of 2022, which will include a new DIA drill permit to test the extensions of the Madre and Sambalay structures, NE of the diatreme-dome complex, and into the Cambaya zone where recent channel samples have returned up to 20 m of 293.8 g/t AgEq and 2 m of 1.8 kg AgEq (Figure 5). The Company is currently carrying out additional surface sampling and mapping of the principal structural corridors in preparation for phase two of drilling.

About Tier One

Tier One Silver is an exploration company focused on creating value for shareholders and stakeholders through the discovery of world-class silver, gold and base metal deposits in Peru. The Company’s management and technical teams have a strong track record in raising capital, discovery and monetization of exploration success. The Company’s exploration assets in Peru include: Hurricane Silver, Coastal Batholith, Corisur and the flagship project, Curibaya. For more information, visit www.tieronesilver.com.

Curibaya Drilling

Analytical samples were taken by sawing HQ or NQ diameter core into equal halves on site and sent one of the halves to ALS Lab in Arequipa, Peru for preparation and then to Lima, Peru for analysis. All samples are assayed using 30 g nominal weight fire assay with atomic absorption finish (Au-AA25) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where MS61 results were greater or near 10,000 ppm Cu, 10,000 ppm Pb or 100 ppm Ag the assay were repeated with ore grade four acid digest method (Cu, Pb, Ag-OG62). Where OG62 results were greater or near 1,500 ppm Ag the assay were repeated with 30 g nominal weight fire assay with gravimetric finish (Ag-GRA21).

QA/QC programs for 2021 core samples using company and lab duplicates, standards and blanks indicate good accuracy and precision in a large majority of standards assayed.

Silver equivalent grades (AgEq) were calculated using silver price of US$18/oz, gold price of US$1,300/oz, zinc price of US$1.25/lb, and lead price of US$1.00/lb. Metallurgical recoveries were not applied to the silver equivalent calculation.

Intercepts were calculated with no less than 5 m of >= 25 g/t AgEq with maximum allowed consecutive dilution of 6 m. True widths of mineralization are unknown based on current geometric understanding of the mineralized intervals.

Forward Looking Information and General Cautionary Language

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, "forward-looking statements") that relate to the Company’s current expectations and views of future events, in particular, its plans to further explore certain project areas.. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as "will likely result", "are expected to", "expects", "will continue", "is anticipated", "anticipates", "believes", "estimated", "intends", "plans", "forecast", "projection", "strategy", "objective" and "outlook") are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. These statements speak only as of the date of this news release. Mining is a high-risk business, with several risk factors including, but not limited to, fluctuating mineral prices, project economics, political uncertainty and availability of exploration funding. See the Company’s filings at ww.sedar.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()