Vizsla provides 2021 year-end summary and 2022 outlook

2021 Year in Review:

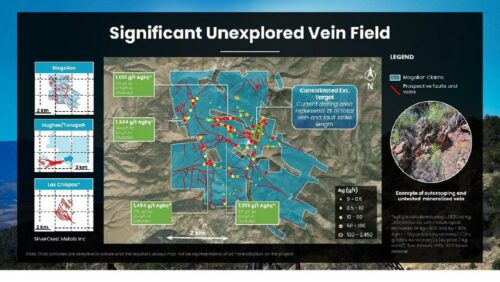

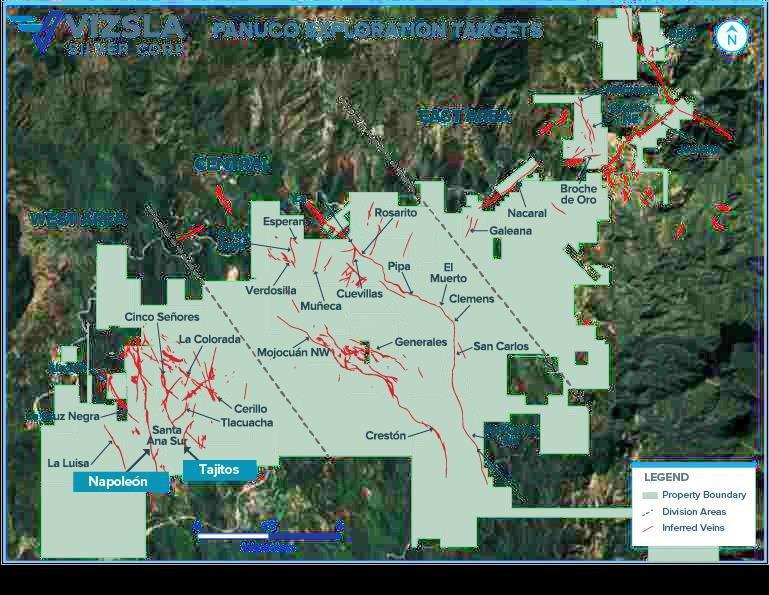

Vizsla President and CEO, Michael Konnert, commented: “2021 was a transformative year for Vizsla both at the project level and on the corporate side. At Panuco, approximately 100,000 meters of new diamond drilling led to the discovery of several new high-grade veins, ultimately advancing the newly consolidated project to the resource drilling stage. On the corporate side, Vizsla successfully raised over C$70M in equity financings to fund ongoing exploration and development at Panuco and exercised its property earn-in agreements to take 100% controlling ownership of the district. To date, we have only drill tested a small portion of the known precious metal rich veins on the Property, with Napoleon and Tajitos representing less than 5% of the total inferred vein strike. Following the announcement of the maiden resource later this quarter, we plan to continue our aggressive exploration of the district with the goal of increasing the project resource base through category conversion and expansion drilling, culminating in a resource update in H2 of this year. We are extremely excited for 2022. We have the targets, the capital and most importantly the team to solidify Panuco as a world class silver primary deposit.”

2021 Highlights & Discoveries:

The bulk of 2021 drilling was centred on the western portion of the district, where incremental step-out drilling at both Napoleon and Tajitos significantly expanded the Project’s mineralized footprint. At Napoleon, mineralization has now been traced over 1,920 meters along strike and to an average depth of 300 meters. This represents an impressive 860% increase in strike length for the year. Similarly, at Tajitos, Vizsla completed ~30,000 meters of targeted expansion drilling resulting in a 470% increase in mineralized strike length. In both areas, systematic drilling improved the overall understanding of vein geometry, structure and controls to mineralization which will feed into the Company’s maiden resource estimate in Q1 2022.

- In 2021, Vizsla drilled 99,783 meters in 319 holes at Panuco. In total, Vizsla has now drilled 127,776 meters in 449 holes on the Property.

- The 2021 exploration program started with five drill rigs (increasing to 10 by year-end) focused primarily on the western portion of the district.

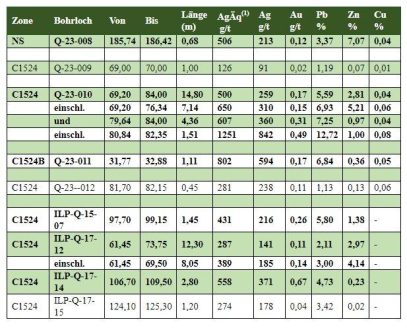

- Napoleon: The current Napoleon resource target area measures approximately 1,920 metres long by 300 metres deep, defined by 148 holes completed to date. Drilling suggests an estimated weighted average true width of 3.36 meters at an average grade of 421 g/t AgEq. High-grade mineralization remains open along strike and down plunge to the south.

- Tajitos: A total of 71 holes have been completed at Tajitos, defining an initial resource target area of 1,000 metres long by 400 metres deep. Results from recent drilling suggest higher grade mineralization remains open at depth, this demonstrated by hole CS-21-105, which intercepted 602 g/t AgEq over 2.68 mTW in the deepest hole drilled to date at Tajitos.

- Copala: The Copala Vein represents a near flat-lying structure located within the Tajitos hanging wall along the northern extents of the Tajitos resource area. Copala is marked by high precious metals grades (up to 2,147 g/t silver and 18.04 g/t gold over 2.31 mTW) hosted within a broader lower grade envelope up to 82 meters thick. To date, eight holes have encountered this mineralization (see press release dated January 19, 2022).

- Josephine: A silver–rich, sub-parallel vein situated ~150 meters west of the Napoleon discovery. The vein initially identified via fixed loop EM, is interpreted to have over 1.7 kilometers of strike, of which only 500 meters have been drilled to date in 18 holes. Josephine discovery hole NP-21-132 returned 797 g/t silver equivalent (AgEq) over 2.5 m, including 4,431 g/t AgEq over 0.30 m (see press release dated July 15, 2021).

- San Antonio: Drilling targeting the depth extension to the historic San Antonio vein, located in the Cordon de Oro Vein Corridor located in the central portion of the district, intersected 2,649 g/t AgEq over 0.78 m true width, contained within a broader interval grading 1,283 g/t AgEq over 2.07 m true width within a high angle splay off the main corridor (see press release dated July 28, 2021).

Note: All numbers are rounded. Silver equivalent is calculated using the following formula: Silver-equivalent = ((Au_g/t x 52.48) + (Ag_g/t x 0.5289) + (Pb_ppm x 0.0013) + (Zn_ppm x 0.0013)) / 0.5627. Metal price assumptions are $17.50 oz silver, $1,700 oz gold, $0.75 pound lead and $0.85 pound zinc, recoveries assumptions are 96% gold, 94% silver, 78% lead and 70% zinc based on similar deposit types.

Aside from resource/discovery focused drilling, Vizsla has completed several engineering and environmental programs throughout the year, effectively laying the foundation for future development and subsequent production at Panuco. Notable programs include:

- Preliminary Metallurgical Testing: With the support of Ausenco Engineering Canada Inc., Vizsla contracted ALS Canada Ltd in Kamloops, BC, Canada to conduct preliminary metallurgical testing on representative composited material sourced from the Napoleon vein (total sample size ~330 kilograms). The primary objective of the program was to determine basic metallurgical properties with a focus on geo-metallurgy characterization and assess potential processing/recovery options. Program results are expected to be reported in early Q1 2022.

- Initial Geotechnical and Hydrogeological Studies: In conjunction with ongoing exploration programs, Vizsla has initiated data capture of standard geotechnical parameters on all resource/exploration drilling. Vizsla has contracted SRK Consulting to design and lead the preliminary data collection program, with most of the work being carried out by Vizsla geologists. The data being captured will help inform future studies for mine design, including mining method selection, dilution estimates, production rates, mining layouts, etc.

Other notable project level accomplishments:

- Detailed geological mapping program focused on the western and central portions of the Panuco district

- Property expansion through acquisition, three claims for combined 782.9 ha.

- Advanced discussions with local Ejido communities, securing 30-year exploitation rights with two of the four primary groups

On the corporate side, Vizsla raised C$73.2M in two rounds of equity financings (see press releases dated June 3, 2021 & June 21, 2021) led by Canaccord Genuity, allowing for accelerated exploration of the district and provided the required capital to exercise its property earn in agreements, successfully consolidating the entire Panuco-Copala district, of which Vizsla now has 100% ownership (see press releases dated July 21, 2021 & August 19, 2021).

In 2021 Vizsla further strengthened its senior management team and board by adding several experienced mining professionals including, Charles Funk (promoted to Technical Director), Harry Pokrandt (Director), Martin Dupuis (promoted to VP, Technical Services), Hernando Rueda (Country Manager), and Michael Pettingell (VP, Business Development & Strategy).

Vizsla remains committed to further establishing and maintaining mutually respectful and beneficial relationships with all local communities and stakeholders. This includes ongoing infrastructure improvement, water supply maintenance, road maintenance, and health support. During the year, Vizsla expanded the onsite workforce to >100 people (~70% are members of the local community).

On April 20, 2021, Vizsla announced its intentions to spin-out the Company’s early-stage non-core copper assets in British Columbia to Vizsla Copper Corp. Following the spin out, with an effective date of September 20, 2021, Vizsla Silver shareholders received one Vizsla Copper share for every three common shares of Vizsla Silver held.

2022 Outlook

While 2021 set the foundation to estimate maiden resources and advance project development at Panuco, the primary focus for 2022 is exploration and growth. With +120,000 meter fully funded drill program designed to 1) further expand the Project’s maiden resource base on the western portion of the property and 2) test high priority targets on the central and eastern portions of the district, Vizsla aims to identify new centers of mineralization from which to delineate additional resources while simultaneously investigating accelerated development opportunities.

In 2022, a total of 13 rigs will be active on the property (six focused on upgrading and expanding the maiden resource and seven devoted to exploration). Exploration drills will be spread across the district, starting with four in the West, two in the Central area and one in the East.

Key objectives for 2022

- Deliver maiden resources at both Napoleon and Tajitos in Q1 2022

- Conduct property wide EM and airborne magnetic surveys in February 2022

- Add three drill rigs, increasing the total rig count to 13

- Report preliminary metallurgical testing on representative samples from Napoleon (anticipated in the coming weeks)

- Report preliminary metallurgical testing on representative samples from Tajitos in Q1 2022

- Complete +120,000 meters of resource/discovery focused drilling

- Resource update in H2 2022

About the Panuco project

The newly consolidated Panuco silver-gold project is an emerging high-grade discovery located in southern Sinaloa, Mexico, near the city of Mazatlán. The 6,754-hectare, past producing district benefits from over 75 kilometres of total vein extent, a 500 ton per day mill, 35 kilometres of underground mines, tailings facilities, roads, power and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

About Vizsla Silver

Vizsla Silver is a Canadian mineral exploration and development company headquartered in Vancouver, BC, focused on advancing its flagship, 100%-owned Panuco silver-gold project located in Sinaloa, Mexico. To date, Vizsla has completed over 120,000 meters of drilling at Panuco leading to the discovery of several new high-grade veins. With an ongoing fully funded +100,000-meter drill program, the Company is well positioned to deliver a maiden project resource in the first quarter of 2022 while in parallel continuing to explore the significant upside potential remaining in the district.

Quality Assurance / Quality Control

Drill core and rock samples were shipped to ALS Limited in Zacatecas, Zacatecas, Mexico and in North Vancouver, Canada for sample preparation and for analysis at the ALS laboratory in North Vancouver. The ALS Zacatecas and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Silver and base metals were analyzed using a four-acid digestion with an ICP finish and gold was assayed by 30-gram fire assay with atomic absorption (“AA”) spectroscopy finish. Over limit analyses for silver, lead and zinc were re-assayed using an ore-grade four-acid digestion with AA finish.

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s quality assurance / quality control protocol.

Qualified Person

The Company’s disclosure of technical or scientific information in this press release has been reviewed and approved by Martin Dupuis, P.Geo., Vice President of Technical Services for Vizsla Silver. Mr. Dupuis is a Qualified Person as defined under the terms of National Instrument 43-101.

Contact Information: For more information and to sign-up to the mailing list, please contact:

Michael Konnert, President and Chief Executive Officer

Website: www.vizslasilvercorp.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain “Forward‐Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward‐looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward‐looking statements or information. These forward‐looking statements or information relate to, among other things: the commencement of trading on the NYSE American, the ceasing of trading o the OTCQB, the exploration, development and production at Panuco, including drilling programs and mobilization of drill rigs; and completion of a maiden resource estimate.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Vizsla Silver, future growth potential for Vizsla Silver and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Vizsla Silver’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Vizsla Silver’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and Vizsla Silver has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company’s dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company’s mining activities in Mexico; regulatory, consent or permitting delays; risks relating to reliance on the Company’s management team and outside contractors; risks regarding mineral resources and reserves; the Company’s inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company’s interactions with surrounding communities and artisanal miners; the Company’s ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption “Risk Factors” in Vizsla Silver’s management discussion and analysis. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although Vizsla has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Vizsla does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()