Preliminary results for 2021: Hamburg Commercial Bank completes transformation with strong Group net result

• Net income before taxes of EUR 299 (previous year: 257) million and Group net result of EUR 351 (102) million exceed forecasts

• CEO Ermisch: “Transformation completed more quickly than expected and with excellent financial ratios”

• RoE after taxes2 18.4% – CET1 ratio 28.9% – CIR 50%

Hamburg Commercial Bank (HCOB) presented its preliminary IFRS figures for fiscal year 2021 on Thursday, reporting net income before taxes of EUR 299 (previous year: 257) million. The strong result in the final year of transformation is primarily due to good profitability in the operating business based on a focused balance sheet structure, positive risk provisioning and a significantly reduced cost base. Despite a market environment still influenced by the pandemic, HCOB once again strengthened its excellent capital position and further improved its already good credit quality. The comprehensive transformation of HCOB was successfully completed at yearend 2021 with the seamless switch to the Deposit Protection Fund of private banks (Bundesverband deutscher Banken).

“Over the past three years, we have purposefully restructured and repositioned Hamburg Commercial Bank more quickly than originally planned. The far-reaching restructuring is now bearing fruit, as shown by our strong preliminary results for the past fiscal year, which were well above expectations,” said Stefan Ermisch, CEO of Hamburg Commercial Bank. “With a clear competency profile and a solid market position, HCOB has established a good basis for its longterm future success as a specialist financier. We now want to build on this carefully, aiming for moderate and prudent growth in the coming years. The very strong capital position gives the bank a high degree of strategic flexibility.”

Results exceed expectations – total income stable with significantly reduced total assets

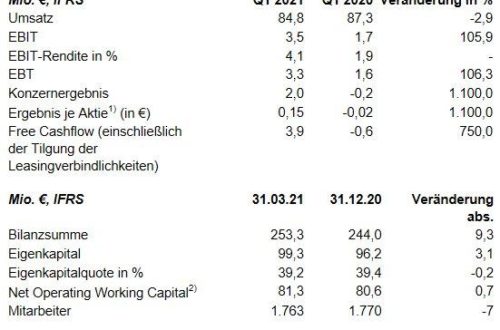

The strong preliminary net income before taxes of EUR 299 (257) million was driven in particular by a more profitable operating business, a positive fair value result, reductions in risk provisioning and tangible cost savings. After one-off effects having a major positive impact on results in fiscal 2020, in fiscal 2021 there were no significant one-off effects. The Group net result amounted to EUR 351 (102) million, thus significantly exceeding the raised forecast of above EUR 250 million issued at half-year 2021. Income tax expenses contributed EUR 52 (-155) million to the Group net result due to the effects of deferred taxes. The RoE (return on equity after taxes2) calculated on the basis of the Group net result improved to a strong 18.4% (4.3%), demonstrating the progress made in realigning the bank’s portfolio, and profitability.

At EUR 642 (656) million, total income was noticeably higher than expected and almost on par with the previous year, although total assets were reduced to the targeted level of EUR 30.3 (31/12/2020: 33.8) billion and average total assets in 2021 were as much as one fifth lower at EUR 32 (41) billion. Net interest income, which declined as planned in this context to EUR 526 (629) million, benefited from the positive development in net interest margins, which improved further in the wake of lower refinancing costs and a higher-margin operating business. In the previous year, one-offs from valuation effects on hybrid financial instruments had a noticeable impact of EUR 72 million on net interest income. The result from financial instruments categorised as FVPL contributed EUR 37 (-93) million to total income. The cost-income ratio (CIR) is 50% (42%), whereby income in the previous year included significant positive one-off effects.

Net reversals of loan loss provisions – Costs further reduced

In an overall improving macroeconomic environment, loan loss provisions developed positively in the reporting year at EUR 32 (-188) million. Moderate additions for Stage 3 (SLLP) were more than offset by reversals in Stage 1 and 2 (GLLP) and by recoveries on receivables written off. HCOB is very well positioned with a solid stock of loan loss provisions and will continue its prudent risk provisioning policy, also with a view to the potential consequences of the ongoing pandemic.

Administrative expenses fell appreciably by 10% to EUR -328 (-365) million. The main factor in this cost reduction were personnel expenses, which fell by around one fifth. The number of employees (full-time equivalents, FTEs) decreased in the year under review as planned by 203 to 919 (-18%). Despite high investments in IT and digital transformation, operating expenses remained at prior-year level.

As expected, the other operating result, at EUR 14 (205) million, was significantly lower than in the previous year, in which high positive one-off effects were realized from the sale of buildings as part of the consolidation of locations.

Portfolio quality improved – Capital position at high level

Thanks to consistent risk management and a low number of new defaults, portfolio quality improved, leading to a lower NPE ratio (non-performing exposure) of 1.4% as at 31/12/2021 (31/12/2020: 1.8%). The NPE volume was noticeably reduced to EUR 467 (31/12/2020: 624) million, which is a proportionately larger reduction than the total exposure. The NPE coverage ratio (based on Stage 3 SLLP) for non-performing loans was a very solid 56% at year-end (31/12/2020: 48%), including collaterals, the ratio was 136% (31/12/2020: 118%). Additionally existing overlays for portfolio risks are not included in these coverage ratios.

The bank’s balance sheet structure was further optimized and risk-weighted assets (RWA) fell to EUR 14.0 (31/12/2020: 15.5) billion as a result of continued de-risking. Resulting from this noticeable reduction, the CET1 ratio further improved from an already high level to 28.9% (31/12/2020: 27.0%) The very solid leverage ratio of 12.7% (31/12/2020: 12.2%) also demonstrates the bank’s extremely robust capital position.

New business moderately expanded and increasingly profitable

New business in the market segments, which picked up in the second half-year in particular, was selectively expanded and, at EUR 5.4 (2.9) billion, was noticeably up from the previous year. Especially pleasing is the further improvement in profitability, which was achieved through a riskand profitability-oriented approach to new business and enhancements to portfolio allocation.

The bank is expected to publish its full and final annual report on April 6, 2022

Hamburg Commercial Bank AG

Gerhart-Hauptmann-Platz 50

20095 Hamburg

Telefon: +49 (40) 33330

https://www.hcob-bank.com

Head of Press

Telefon: +49 (40) 3333-11130

E-Mail: katrin.steinbacher@hcob- bank.com

![]()