Uranium investments gain in attractiveness

To achieve decarbonization goals, to fight climate change, nuclear power is an important tool. More and more are recognizing this, and so the price of uranium is moving upward. After all, the last two years brought a deficit in the uranium market, while at the same time demand is increasing. That’s when it’s worth taking a look at the world’s uranium mines. Most of the best uranium mines are in Kazakhstan, Canada and Australia. The largest, however, are often in other countries. The Investing News Network has listed the ten largest uranium mines in the world. It was based on information and statistics from the World Nuclear Association.

The number one uranium mine in the world is led by the Cigar Lake Uranium Mine in Saskatchewan, because it is the highest-grade uranium mine. Commercial uranium production began there in 2015. Saskatchewan in the Athabasca Basin is also home to IsoEnergy’s – https://www.youtube.com/watch?v=V8f3dibYi68 – uranium projects. The Laroque East property is producing particularly high-grade results.

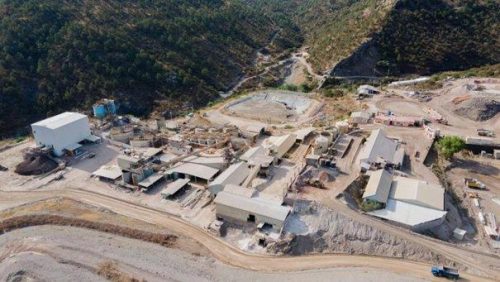

Other large uranium mines include the Husab uranium mine in Namibia, discovered in 2008, and BHP’s Olympic Dam mine in Australia. In addition to uranium, the latter also produces copper, silver and gold. The Inkai uranium mine in Kazakhstan is also important, although according to the operators, the planned production level will fall by around 20 percent by 2022. Many countries have recognized the importance of sufficient uranium supplies for the future, including the USA.

Uranium Energy – https://www.youtube.com/watch?v=OO8J0EVpuk8 -, for example, is the largest uranium company there. Its portfolio includes several uranium projects, some of which have been approved, as well as a processing plant in South Texas and equity interests.

Current company information and press releases from IsoEnergy (-https://www.resource-capital.ch/en/companies/iso-energy-ltd/ -) and Uranium Energy (- https://www.resource-capital.ch/en/companies/uranium-energy-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()