Karora Delivers Record Revenue of $264 Million and Cash Flow Provided by Operating Activities of $106 Million in 2021

Karora Resources Inc. (TSX:KRR; OTCQX:KRRGF) ("Karora" or the “Corporation" – https://www.commodity-tv.com/ondemand/companies/profil/karora-resources-inc/) is pleased to announce its financial results and review of activities for the three and twelve months ended December 31, 2021. All amounts are expressed in Canadian dollars, unless otherwise noted. For additional information please refer to Karora’s Management’s Discussion & Analysis ("MD&A") and audited consolidated financial statements for the years ended December 31, 2021 and 2020.

Highlights

- Record annual gold production of 112,814 ounces (including 27,925 ounces in the fourth quarter) achieving the upper end of 2021 guidance target of 105,000 – 115,000 ounces. Gold sales for 2021 were a record 113,628 ounces (28,734 ounces for the fourth quarter).

- AISC1 was US$1,012 per ounce for 2021, achieving the lower end of the 2021 guidance range of US$985 – US$1,085 per ounce sold (US$1,042 per ounce for the fourth quarter), representing an improvement compared to AISC of US$1,026 per ounce sold for 2020.

- Net earnings for 2021 of $27.5 million ($0.18 per share) was down compared to $88.1 million for 2020. Net earnings during the fourth quarter of 2021 were $6.1 million ($0.04 per share), compared to $42.9 million ($0.30 per share) for the fourth quarter of 2020. In 2020, Karora recorded a positive impact of an after-tax impairment reversal of property, plant and equipment of $25.3 million ($0.18 per share) and the fourth quarter of 2020 included a $26.1 million deferred tax benefit.

- Adjusted earnings1 for 2021 of $48.6 million ($0.33 per share) down $23.5 million compared to 2020. For the fourth quarter of 2021, adjusted earnings were $12.0 million ($0.08 per share) compared to $39.0 million ($0.27 per share) in 2020.

- Adjusted EBITDA1 for 2021 of $104.3 million ($0.70 per share) up $8.2 million compared to 2020. For the fourth quarter of 2021, Adjusted EBITDA was $25.0 million ($0.16 per share) compared to $31.7 million ($0.22 per share) in 2020.

- Cash flow from operating activities of $106.5 million, a 13% increase compared to 2020. For the fourth quarter of 2021, cash flow from operating activities was $33.5 million, a 12% decrease compared to $38.0 million in 2020.

- Karora increased its cash position to $91.0 million at December 31, 2021 after high utilization of capital at the new mining operations at Higginsville and accelerated exploration programs across operations.

- During 2021 Karora became one of the world’s first carbon neutral gold producers for emissions from its own operations (Scope 1 emissions) and purchased electricity consumption (Scope 2 emissions) following the purchase and retirement of verified carbon offset credits. The offset projects include reforestation and conservation initiatives in Australia, among other projects.

- Production commenced at the Spargos open pit mine in the fourth quarter of 2021 in line with schedule. Planning and approvals are underway to extend the open pit at depth.

- The fourth quarter saw the completion of the Phase I mill upgrade to 1.6 million tonnes per annum (“Mtpa”). Advanced engineering is underway for the Phase II mill expansion to 2.5 Mtpa.

- Beta Hunt Second Decline commenced waste development from underground in the fourth quarter of 2021, having advanced 60 metres as at December 31, 2021. The box cut and portal contracts were awarded in early 2022 and contractors have mobilized on site.

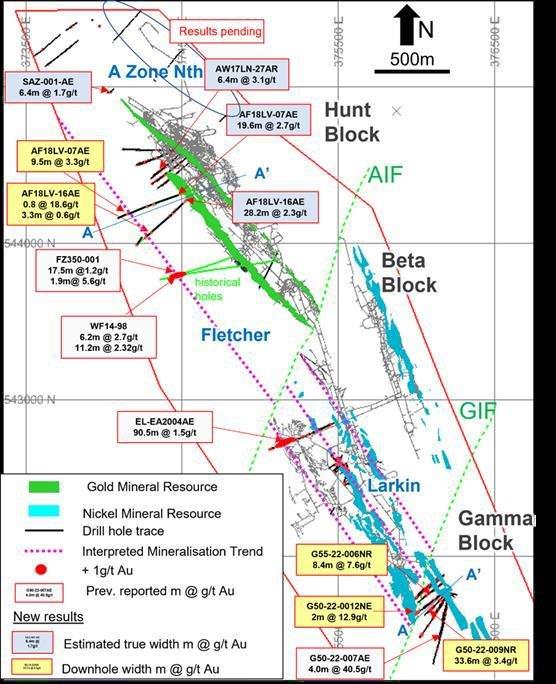

- Drilling at Beta Hunt has extended Fletcher Shear Zone (Beta Hunt) gold mineralization to over 500 metres along strike and 150 metres in vertical extent. Potential exists for gold mineralization to extend for up to 2 kilometres of strike length. New results include 3.3 g/t over 9.5 metres, including 5.5 g/t over 4.4 metres and 18.5 g/t over 0.8 metres.

- Results received early 2022 for Gamma Block (Beta Hunt) drilling completed in 2021 show the 50C nickel trough extends greater than 200 metres in strike and up to 120 metres in width. In addition to the discovery intersection of 11.6% Ni over 4.6 metres, recent drilling intersected 3.2% Ni over 3.1 metres and 5.1% Ni over 2.1 metres.

- New gold mineralized setting intersected beneath the 50C nickel trough in the Gamma Block (Beta Hunt) where drilling has confirmed significant mineralization over a 200 metre strike length including intercepts of returned an intercepts of 40.5 g/t over 4.0 metres, 3.4 g/t over 33.6 metres (including 6.0 g/t over 10.5 metres), and 7.6 g/t over 4.6 metres.

- West of the Larkin Gold Zone (Beta Hunt), drilling returned the widest ever mineralized interval ever recorded at Beta Hunt of 1.5 g/t over 90.0 metres, including 50.9 g/t over 0.4 metres.

Paul Andre Huet, Chairman & CEO, commented: “During 2021 we produced a record 112,814 ounces of gold placing us in the upper end our guidance range of 105,000 -115,000 ounces. AISC1 costs for 2021 were very strong at US$1,012 per ounce sold, despite numerous headwinds, placing us at the lower end of our guidance range of US$985 -US$1,085 for 2021. The fact that we were able to achieve guidance for production and costs is an accomplishment our team is very proud of given all the uncertainties due to Covid-19 pressures that impacted labour availability and caused numerous supply chain issues that are certainly well known. Over the last two years, we have demonstrated an ability to overcome many challenges and I am confident we will continue to do so with whatever 2022 brings. I am also proud that that Karora became one of the first junior gold producers to achieve carbon neutrality in 2021 for Scope 1 and 2 at its own operations following the purchase and retirement of verified carbon offset credits. We continue to be focused on our efforts in this area across the organization and we are now developing a pathway to a long-term carbon emissions reduction strategy. We will include more information on our strategy development in our inaugural ESG report expected in the coming weeks.

Karora delivered solid financial performance in 2021 with Adjusted EBITDA1 of $104.3 million or $0.70 per share and operating cash flow of $106.5 million or $0.71 per share. Our 2021 Adjusted earnings1 were $48.6 million or $0.33 per share. Karora ended 2021 with a strong cash balance of $91.0 million. With a very healthy balance sheet, we are well positioned to deliver our fully funded organic growth plan to double production from approximately 100,000 gold ounces in 2020 to approximately 200,000 ounces in 2024.

Given the recent increased nickel market activity, I am particularly excited about our prospects to increase our nickel production, having recently provided Karora’s first payable nickel production guidance of 450 – 550 tonnes in 2022. With our recent nickel exploration successes, we look forward to nickel production increases beginning in 2023 that I expect will be a real differentiator for Karora going forward. With the current strong nickel price environment, we expect to see increase by-product credits to lower our gold production costs. We are making every effort to capitalize on this opportunity and are moving as quickly as possible to bring new nickel areas such as the 50C and 30C discoveries into production early next year. Additionally, we will be providing an updated nickel resource at Beta Hunt around mid year."

1. Non-IFRS: the definition and reconciliation of these measures are included in the Non-IFRS Measures section of this news release and Karora’s MD&A dated March 14, 2022.

COVID-19 Protocols

In response to the global COVID-19 pandemic, protocols and contingency plans have been established by Karora to comply with government actions and mitigate operational impacts which include the charter of our own aircraft to service our operations, review of staff rostering to run two distinctive crews, employment of a full time medical team to oversee screening and testing protocols on site and the immunization of our workforce. Karora’s management has maintained its Run of Mine (“ROM”) stockpile levels should disruptions to the mining operations or supply chain occur in the future.

Management continues to monitor developments in order to be in a position to take appropriate actions to minimize any significant impact on the Corporation’s operations including with respect to suppliers, service providers and employees due to the ongoing global COVID-19 pandemic.

Results of Operations

Table 1 – Highlights of operational results for the periods ended September 30, 2021 and 2020

Consolidated Operations

For 2021, Karora’s gold operations milled 1,441,000 tonnes of material at an average grade of 2.60 g/t to produce 112,814 ounces of gold. Tonnes milled were 9% higher in 2021 compared to 2020 primarily due to increase throughput resulting from the Phase I expansion of the milling capacity of approximately 15%, or 550 tonnes per day, to 1.6 million tonnes per annum from the prior capacity which was completed in the fourth quarter of 2021. For the fourth quarter, tonnes milled were 367,000 tonnes at a grade of 2.53 g/t for gold production of 27,925 ounces.

For 2021, the mill feed was made up of approximately 61% material from the Beta Hunt underground and 39% material from Higginsville Central and Spargos, in line with the expected feed ratios for the year.

Beta Hunt

For 2021, 884,000 tonnes of material was milled at a grade of 2.95 g/t, increases of 19% and 6%, respectively, compared to 2020. For the fourth quarter of 2021, 206,000 tonnes were milled at a grade of 2.61 g/t.

Beta Hunt continued its staged fleet replacement program during the fourth quarter with the acquisition of two new AD60 trucks, and a new jumbo drill was acquired which will be delivered in the second quarter of 2022. The replacement program is aimed at improving equipment reliability and positioning the Company for increased production as Karora moves forward with its growth plan. The stage 1 ventilation upgrade was also delivered after completion of two underground raise bores and associated development and infrastructure. Increased ventilation capacity is a critical component for future higher mining rates. With these two investments complete, Karora’s growth plan remains on schedule.

Currently, nickel production at Beta Hunt is limited to remnant nickel Mineral Resources south of the Alpha Island Fault, which is the source of 2022 planned nickel production of between 450 – 550 tonnes of payable nickel. In the future, nickel production is expected to increase as new nickel areas such as the 30C and 50C discoveries are developed for mining. A resource update for these areas is expected by mid year 2022.

Higginsville (“HGO”) Central

HGO material milled during 2021 was 557,000 tonnes at a grade of 2.05 g/t, a 2% decrease and 8% increase, respectively compared to 2020. For the fourth quarter, 161,000 tonnes of HGO material was milled at an average grade of 2.43 g/t.

Hidden Secret was the main source of ore for processing during the fourth quarter at HGO. Mine production from Hidden Secret is expected to end in the first quarter of 2022 as it will be replaced with production from the new Spargos open pit, which began ramping up production in the fourth quarter of 2021.

At Spargos, the initial pre-strip development was completed during the fourth quarter and all infrastructure is in place for the Stage 1 open pit to continue ramping up mine production. Preparations for Stage 2 of the mine are in progress to extend the pit at depth ahead of future potential underground operations.

Mine production from the Two Boys Mine continued in the fourth quarter. Mine development is ongoing and will provide underground drilling access to upper levels of the mine, along with rehabilitation activities to enable access to the higher grade mineralized zones at depth.

At the Aquarius underground mine, decline development continued, advancing to approximately 200 metres during the fourth quarter. First mineralized material from development is expected to be delivered to the mill in the first quarter of 2022, to be followed by stope production.

Cash Operating Costs and AISC1

The AISC1 cost performance for 2021 of US$1,012 per ounce sold was at the lower end of the full year 2021 AISC1 guidance range of US$985-$1,085 per ounce. For the fourth quarter, consolidated cash operating costs1 and AISC1 were US$961 and US$1,042 per ounce sold, increases of 14% and decrease of 14%, respectively relative to the comparable 2020 periods, primarily due to Covid-19 related cost pressures including a tight labour market. Karora is pleased with the announcement of the Western Australia border opening which, over time, is expected to alleviate some of the labour availability issues experienced across the region.

Outlook

On June 28, 2021 Karora announced three-year production guidance as part of a multi-year growth plan that is expected to see gold production increase from 99,249 ounces in 2020 to a range of 185,000 – 205,000 ounces in 2024 at an AISC of US$885 – US$985 per ounce sold. On February 7, 2022 Karora announced production guidance for 2022 of between 110,000 to 135,000 ounces of gold at an AISC of US$950 to US$1,050 per ounce sold. Payable nickel production guidance for 2022 is between 450 to 550 tonnes and is treated as a by-product credit that is reflected in AISC. The growth plan and 2022 guidance assumes no significant disruption in operations as a result of the COVID-19 virus and any associated regulatory actions.

Table 2 below outlines production, cost and capital investment guidance for 2022-2024.

The growth plan will be driven by an expansion of Beta Hunt underground mine production to 2.0 Mtpa by 2024, from 886 Mt recorded in 2021. Increased production from Beta Hunt will be complemented by ore from Spargos and HGO Central. The increased tonnage will be processed by the Higginsville mill, which will be expanded to a capacity of 2.5 Mtpa by 2024 (Phase II). This Phase II expansion follows the recent Phase I expansion to 1.6 Mtpa from 1.4 Mtpa.

Exploration and Resource Definition Drilling

At Beta Hunt, almost 10,000 metres of exploration and resource development drilling was completed during the fourth quarter. Drilling during the quarter was focused on 1) extensional and infill drilling from underground aimed at extending and upgrading the Western Flanks along the northern and southern margin of the current Mineral Resource; 2) extensional drilling from the surface, targeting A Zone North; 3) nickel drilling directed at outlining the strike extent of the 50C Gamma Block and upgrading the parallel 10C nickel Mineral Resource; and 4) gold exploration holes targeting new and parallel gold mineralized systems in the Hunt, Beta and Gamma Blocks (see figure 1 for location references).

Drilling at Beta Hunt is primarily directed at supporting Karora’s multi-year growth plan and continues to deliver strong results, with the aim to upgrade and extend the gold mineralized shear zones. Results are to be incorporated into a gold Mineral Resource update planned for early 2022. With respect to nickel, drilling at the 50C nickel trough discovery in the Gamma Block has extended the strike length to over 200 metres and up to 120 metres in width in just 10 months since the discovery hole, leveraging the significant advantage of the extensive infrastructure in place at Beta Hunt. The 50C nickel discovery remains open to the southeast for up to 2.6 kilometres of potential strike length, including a historical of 11.1% Ni over 9.5 metres located 1 kilometre to the southeast of the discovery hole. An updated nickel Mineral Resource incorporating the 50C discovery, 30C discovery and 10C upgrade and extension is expected to be completed by mid year 2022.

At Higginsville, resource definition drilling totaled 16,334 metres during the fourth quarter of 2021 and for the full year exploration and resource definition drilling totaled 79,408 metres. Drilling operations utilized up to five rigs operating at any one time during the quarter.

Resource definition drilling programs at HGO were implemented to support life of mine objectives for the active Two Boys, Aquarius and Hidden Secret mines. Drilling was focused on extensions and upgrades to the Two Boys and Aquarius deposits and extensions to the Hidden Secret open pit and Mousehollow open pit Mineral Resources.

Financial Highlights

Table 3 – 2021 Financial Highlights

(in thousands of dollars except per share amounts)

For the year ended December 31, 2021, Karora generated revenue of $264.2 million compared to 2020 revenue of $239.1 million. The increase in revenue in 2021 was the result of higher gold ounces sold and higher average realized prices on ounces sold which increased by 15% and 21%, respectively.

Revenue for the fourth quarter of 2021 was $67.0 million. During the comparable period in 2020, Karora generated revenue of $69.3 million. The slight decrease in year-over-year revenue in 2021 was the primarily due to lower 4% lower average realized prices on ounces sold in the 2021 fourth quarter compared to the fourth quarter of 2020.

Net earnings for the 2021 were $27.5 million, or $0.18 per share compared to net earnings of $88.1 million, or $0.63 per share, for the comparable period in 2020. The year-over-year decrease is primarily due to the impairment reversal on property, plant and equipment of $36.1 million recorded in 2020 as well as a tax restructuring recovery within the Australian operations of $26.1 million during the comparable 2020 period.

Net earnings for the fourth quarter of 2021 were $6.1 million, or $0.04 per share compared to $42.9 million, or $0.30 per share for the comparable period in 2020, a decrease of $36.1 million. The decrease was mainly attributable to a decrease in operating earnings of $8.1 million as well as a tax restructuring recovery within the Australian operations of $26.1 million during the comparable 2020 period.

Adjusted net earnings1 for 2021 were $48.6 million or $0.33 per share. Compared to $72.1 million or $0.52 per share in 2020. Adjusted net earnings1 for the fourth quarter were $12.0 million, or $0.08 per share, compared to $39.0 million or $0.27 per share in the comparable period in 2020.

Adjusted EBITDA1 for 2021 was $104.3 million, or $0.70 per share, an $8.3 million increase compared to $96.0 million, or $0.69 per share, in 2020. Adjusted EBITDA1 for the fourth quarter of 2021 was $25.0 million, or $0.16 per share, $6.7 million lower compared to $31.7 million, or $0.22 per share, in the fourth quarter of 2020.

1. Non-IFRS: the definition and reconciliation of these measures are included in the Non-IFRS Measures section of this news release and Karora’s MD&A dated March 14, 2022.

Table 4 – Highlights of Karora’s Financial Position

(in thousands of dollars):

Karora’s cash position increased to $91.0 million as at December 31, 2021, an increase $11.3 million compared to December 31, 2020. Karora’s working capital was $64.4 million as of December 31, 2021.

For a complete discussion of financial results, refer to Karora’s MD&A and audited consolidated financial statements for the years ended December 31, 2021 and 2020.

Conference Call / Webcast

Karora will be hosting a conference call and webcast today beginning at 10:00 a.m. (Eastern time). A copy of the accompanying presentation can be found on Karora’s website at www.karoraresources.com.

Live Conference Call and Webcast Access Information:

North American callers please dial: 1-888-664-6392

Local and international callers please dial: 647-764-8659

A live webcast of the call will be available through Cision’s website at:

Webcast Link (https://produceredition.webcasts.com/starthere.jsp?ei=1532514&tp_key=a7ec892a2f)

A recording of the conference call will be available for replay through the webcast link, or for a one-week period beginning at approximately 1:00 p.m. (Eastern Time) on March 14, 2022, through the following dial in numbers:

North American callers please dial: 1-888-390-0541; Pass Code: 834178 #

Local and international callers please dial: 416-764-8677; Pass Code: 834178 #

Non-IFRS Measures

This news release refers to cash operating cost, cash operating cost per ounce, all-in sustaining cost, EBITDA, adjusted EBITDA and adjusted EBITDA per share, adjusted earnings, adjusted earnings per share and working capital which are not recognized measures under IFRS. Such non-IFRS financial measures do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. Management uses these measures internally. The use of these measures enables management to better assess performance trends. Management understands that a number of investors and others who follow the Corporation’s performance assess performance in this way. Management believes that these measures better reflect the Corporation’s performance and are better indications of its expected performance in future periods. This data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

In November 2018, the World Gold Council (“WGC”) published its guidelines for reporting all-in sustaining costs and all-in costs. The WGC is a market development organization for the gold industry and is an association whose membership comprises leading gold mining companies. Although the WGC is not a mining industry regulatory organization, it worked closely with its member companies to develop these non-IFRS measures. Adoption of the all-in sustaining cost and all-in cost metrics is voluntary and not necessarily standard, and therefore, these measures presented by the Corporation may not be comparable to similar measures presented by other issuers.

The following tables reconcile these non-IFRS measures to the most directly comparable IFRS measures:

Mining Operations

Cash Operating and All-in Sustaining Costs

The Corporation uses these measures internally to evaluate the underlying operating performance of the Australian Operations. Management believes that providing cash operating cost data allows the reader the ability to better evaluate the results of the underlying operations.

Australian Mining Operations

Consolidated Mining Operations

Adjusted EBITDA, Adjusted Earnings and Working Capital

Management believes that adjusted EBITDA and adjusted earnings are valuable indicators of the Corporation’s ability to generate operating cash flows to fund working capital needs, service debt obligations, and fund exploration and evaluation, and capital expenditures. Adjusted EBITDA and adjusted earnings exclude the impact of certain items and therefore is not necessarily indicative of operating profit or cash flows from operating activities as determined under IFRS. Other companies may calculate adjusted EBITDA and adjusted earnings differently.

Adjusted EBITDA is a non-IFRS measure, which excludes the following from comprehensive earnings (loss): income tax expense (recovery); interest expense and other finance-related costs; depreciation and amortization; non-cash other expenses, net; non-cash impairment charges and reversals; non-cash portion of share-based payments; acquisition costs; derivatives and foreign exchange loss; sustainability initiatives.

Adjusted earnings is a non-IFRS measure, which excludes the following from comprehensive earnings (loss): non-cash portion of share-based payments; revaluation of marketable securities; derivatives and foreign exchange loss; tax effects of adjustments; sustainability initiatives.

Working capital is calculated as current assets (including cash and cash equivalents) less current liabilities.

Compliance Statement (JORC 2012 and NI 43-101)

The disclosure of scientific and technical information contained in this news release has been reviewed and approved by Stephen Devlin, FAusIMM, Group Geologist, Karora Resources Inc., a Qualified Person for the purposes of NI 43-101.

About Karora Resources

Karora is focused on doubling gold production to 200,000 ounces by 2024 compared to 2020 and reducing costs at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations ("HGO") in Western Australia. The Higginsville treatment facility is a low-cost 1.6 Mtpa processing plant, expanding to a planned 2.5 Mtpa by 2024, which is fed at capacity from Karora’s underground Beta Hunt mine and Higginsville mines. At Beta Hunt, a robust gold Mineral Resource and Reserve is hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial gold Mineral Resource and Reserve and prospective land package totaling approximately 1,900 square kilometers. The Company also owns the high grade Spargos Reward project which is anticipated to begin mining in 2021. Karora has a strong Board and management team focused on delivering shareholder value and responsible mining, as demonstrated by Karora’s commitment to reducing emissions across its operations. Karora’s common shares trade on the TSX under the symbol KRR and also trade on the OTCQX market under the symbol KRRGF.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to the liquidity and capital resources of Karora, production guidance and the potential of the Beta Hunt Mine, Higginsville Gold Operation, the Aquarius Project and the Spargos Gold Project, the commencement of mining at the Spargos Gold Project and the completion of the resource estimate.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora ’s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

For more information, please contact:

Rob Buchanan

Director, Investor Relations

T: (416) 363-0649

www.karoraresources.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()