Karora Resources Announces Inclusion in the GDX® (VanEck Gold Miners ETF)

Paul Andre Huet, Chairman & CEO, commented: "We are very pleased to have met the market capitalization and liquidity requirements for inclusion in the NYSE Arca Gold Miners Index, which represents further validation of our success in building a strong foundation for Karora as a growing gold miner. Inclusion on this major gold index has the potential to attract additional institutional investment into the company and increase liquidity, as the GDX is an important benchmark requirement for many large investment funds.

Following our record 2021 gold production of 112,814 ounces, we remain focused on our goal to reach production of approximately 200,000 ounces annually by 2024.”

The NYSE Arca Gold Miners Index (GDMNTR) is a rules-based index designed to measure the performance of highly capitalized companies in the Gold Mining industry. Index composition and corporate actions, including rebalance information, can be accessed from NYSE Market Data at www.nyse.com/….

The VanEck Gold Miners ETF (GDX®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the NYSE Arca Gold Miners Index (GDMNTR), which is intended to track the overall performance of companies involved in the gold mining industry.

About Karora Resources

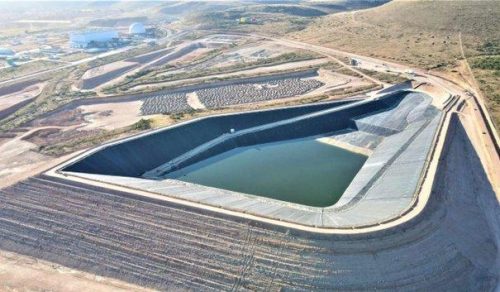

Karora is focused on doubling gold production to 200,000 ounces by 2024 compared to 2020 and reducing costs at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations (“HGO”) in Western Australia. The Higginsville treatment facility is a low-cost 1.6 Mtpa processing plant, expanding to a planned 2.5 Mtpa by 2024, which is fed at capacity from Karora’s underground Beta Hunt mine and Higginsville mines. At Beta Hunt, a robust gold Mineral Resource and Reserve is hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial Mineral gold Resource and Reserve and prospective land package totaling approximately 1,800 square kilometers. The Company also owns the high grade Spargos Reward project, which came into production in 2021. Karora has a strong Board and management team focused on delivering shareholder value and responsible mining, as demonstrated by Karora’s commitment to reducing emissions across its operations. Karora’s common shares trade on the TSX under the symbol KRR and also trade on the OTCQX market under the symbol KRRGF.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to the timing for the completion of technical studies, , the new nickel exploration results at Beta Hunt, the timing of the updated resource estimate and additional production of nickel, at Beta Hunt, production guidance and the potential of the Beta Hunt Mine, Higginsville Gold Operation, the Aquarius Project and the Spargos Gold Project.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora ’s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Cautionary Statement Regarding the Higginsville Mining Operations

A production decision at the Higginsville gold operations was made by previous operators of the mine, prior to the completion of the acquisition of the Higginsville gold operations by Karora and Karora made a decision to continue production subsequent to the acquisition. This decision by Karora to continue production and, to the knowledge of Karora, the prior production decision were not based on a feasibility study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, which include increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that anticipated production costs will be achieved. Failure to achieve the anticipated production costs would have a material adverse impact on the Corporation’s cash flow and future profitability. Readers are cautioned that there is increased uncertainty and higher risk of economic and technical failure associated with such production decisions.

For more information, please contact:

Rob Buchanan

Director, Investor Relations

T: (416) 363-0649

www.karoraresources.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()