The Putin Effect

The world needs affordable energy for prosperity.

This statement was just made by the Minister of Energy of the United Arab Emirates, this at the Saudi "World Government Summit" 2022. The summit will be held at the Expo in Dubai, receiving more than 4,000 people from 190 countries. The challenges are global, and a sustainable world is to be built. Affordable energy is not easy, especially in light of high energy prices. Putin’s policies entail multiple negative effects. Wars lead to economically difficult consequences. The theme of the summit is the fourth industrial revolution and the transformation of society with transhumanism and artificial intelligence.

When it comes to energy, nuclear power is coming more into play again. Nuclear power not only reduces the use of fossil fuels, but also emissions such as carbon dioxide. Large amounts of energy can be produced with relatively little fuel. This in turn has a positive effect on costs. The fact that uranium is as expensive today as it has been for about ten years is obvious. There are concerns that uranium from Russia could disappear. And with current energy prices, nuclear power has come into sharper focus. There is also the desire for less energy dependence. Belgium, for example, has just postponed its nuclear phase-out by ten years. The high uranium price is naturally also boosting uranium shares, especially when it comes to companies whose projects have no connection to the war zone.

Labrador Uranium – https://www.youtube.com/watch?v=S5hRQCfVWnU – focuses on the exploration, consolidation and development of uranium and vanadium projects in Labrador and Newfoundland. A substantial project portfolio already exists.

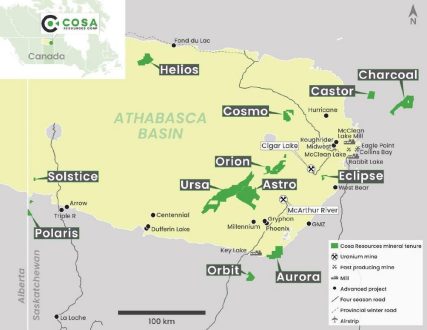

In the Athabasca Basin in Saskatchewan, IsoEnergy – https://www.youtube.com/watch?v=gn9fk-ARE8A&t=4s – has prospective uranium projects. These include the significant Hurricane zone in the Laroque East property.

Current corporate information and press releases from IsoEnergy (- https://www.resource-capital.ch/en/companies/iso-energy-ltd/ -) and Labrador Uranium (- https://www.resource-capital.ch/en/companies/labrador-uranium-inc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()