Trillium Gold Signs Purchase Option Agreements Extending its Dominant Confederation Belt Land Position in Red Lake, Ontario

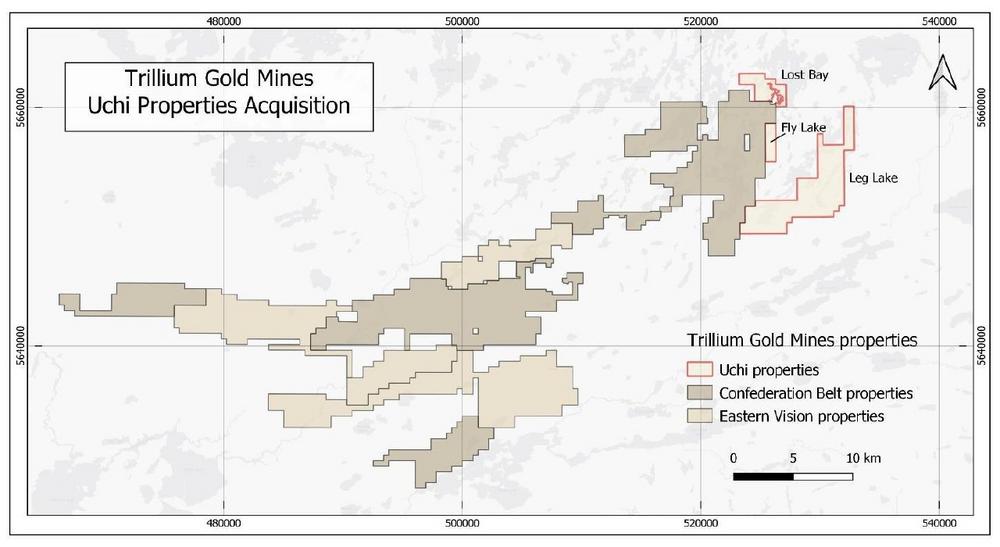

The Agreements are considered significant steps in strengthening Trillium Gold’s strategic objective to consolidate the Confederation belt and Birch-Uchi greenstone belts, positioning it as the most dominant exploration company in the Red Lake Mining District.

The Uchi Gold Agreement comprises one hundred eighty-two (182) unpatented mining claims covering 4,189 hectares immediately adjacent to and adjoining the Company’s Confederation belt land position. The Satterly Gold Agreement comprises five (5) unpatented mining claims covering 565 hectares adjoining the Company’s Satterly Lake properties located to the northeast of the Confederation belt land package.

Uchi Gold Agreement

The Uchi gold properties comprise the contiguous and complementary Lost Bay, Fly East and Leg Lake mining claims that extend the Company’s existing Confederation belt property assemblage to the northeast towards the Satterly Lake property, and add to Trillium’s already dominant position over 100km of favourable structure on trend with Kinross Gold’s Dixie deposit (see Figures 1 & 2 below).

The Fly East and Leg Lake properties have seen limited reconnaissance type exploration in the past and were primarily explored for base metals in the 1970’s and 1980’s, which comprised only eight drill holes over the properties. Platinum group mineralization was explored for in the early 2000’s with results of up to 1 g/t PGMs and 1.8% copper.(1) Some minor gold exploration had taken place on Fly East but only as a carry-over from the Bobjo Mine property to the north and the Uchi Mine to the east. Both properties contain favourable structures and lithologies for both gold and base metals.

The Lost Bay property is located in the vicinity of the historic Bobjo Mine which produced 362 ounces of gold in 1929(2). The Lost Bay property contains NE-SW trending felsic and mafic volcanic rocks with gold mineralization appearing to follow a preferred orientation trending west-northwest, corresponding to the orientation of the D2 deformation within the Red Lake District. While some gold exploration was undertaken during the mid-1930’s along with base metals targeting South Bay Mine analogues, these D2 structures were not considered to be important in the base metal context and will be a key exploration strategy for Trillium Gold. This property is prospective for gold, base metals (copper/zinc) and PGMs.

Satterly Gold Agreement

The Satterly Lake properties comprise twenty-eight (28) claim cells in five (5) claims covering 565 hectares. The area has seen sporadic exploration from the 1930’s with renewed gold exploration in the 1990’s and again from 2009. The area is underlain by a variety of rock types including mafic volcanics and intrusives, sediments and lamprophyre dykes. Cominco performed a local basal till sampling program in the northeast corner of the property, receiving a number of anomalous results (see Figure 2 below).

Terms of Agreements

Uchi Gold Agreement: Pursuant to the Uchi Gold Agreement, in order to keep the option thereunder in good standing Trillium Gold is required to pay an aggregate consideration of $115,000 over a period of three years, issue an aggregate 300,000 common shares, and grant to the vendors a 2.0% net smelter returns royalty on each purchased asset. The Company has the right to repurchase 50% of each royalty (being 1.0%) by paying the holders an aggregate amount equal to $1,000,000.

Satterly Gold Agreement: Pursuant to the Satterly Gold Agreement, in order to keep the option thereunder in good standing Trillium Gold is required to pay an aggregate consideration of $63,500 over a period of three years, issue an aggregate 100,000 common shares, and grant to the vendors a 1.5% net smelter returns royalty on each purchased asset. The Company has the right to repurchase 50% of each royalty (being 0.75%) by paying the holders an aggregate amount equal to $500,000.

The common shares issuable pursuant to the foregoing Agreements will be subject to a four month hold period pursuant to applicable securities laws. The completion of the transactions contemplated by the Agreements is subject to TSXV approval.

The technical information presented in this news release has been reviewed and approved by William Paterson QP, P.Geo, Vice President of Exploration of Trillium Gold Mines., as defined by NI 43-101.

About Trillium Gold Mines Inc.

Trillium Gold Mines Inc. is a growth focused company engaged in the business of acquisition, exploration and development of mineral properties located in the Red Lake Mining District of Northern Ontario. As part of its regional-scale consolidation strategy, the Company has assembled the largest prospective land package in and around the Red Lake mining district in proximity to major mines and deposits, as well as the Confederation Lake and Birch-Uchi greenstone belts. Recent examples are the acquisition of the Willis property southwest of and contiguous to the Newman Todd complex, and a definitive agreement giving the Company control over a significant portion of the Confederation Lake Greenstone Belt to more than 100 km in length. In addition, the Company has interests in highly prospective properties in Larder Lake, Ontario.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary note regarding forward-looking statements

This news release contains forward-looking information, which involves known and unknown risks, uncertainties and other factors that may cause actual events to differ materially from current expectations.

Forward-looking information is based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Such factors, among others, include: impacts arising from the global disruption caused by the Covid-19 coronavirus outbreak, business integration risks; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold or certain other commodities; change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company disclaims any intention or obligation, except to the extent required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

VP Corporate Development and Investor Relations

Telefon: +1 (416) 722-2456

E-Mail: dyoshimatsu@trilliumgold.com

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()