Gold is always in the interest of investors

Whether in the myth of King Midas, where everything he touched turned to gold, or in the treasure of the Nibelungen and in many fairy tales of the Brothers Grimm, gold plays a leading role. In real life, there is much of interest from the times when, driven by a gold rush, many set out to seek their fortune. Today, gold investments are part of an investor’s portfolio to a certain extent. Because it should never be put all on one card, but diversification is the keyword. In gold mining investment, royalty companies are special. Royalty companies secure royalties on mine output from mine operators through agreements. These are the so-called royalties. In return, they invest in the development or expansion of the mine operator’s production. The negotiated royalties are not always dependent on the gold price. They are often paid independently of production and development costs. The mining risk lies with the mine operators. And because a royalty company spreads the risk over several projects, which can also be in all phases of a mine’s life, the risk is spread.

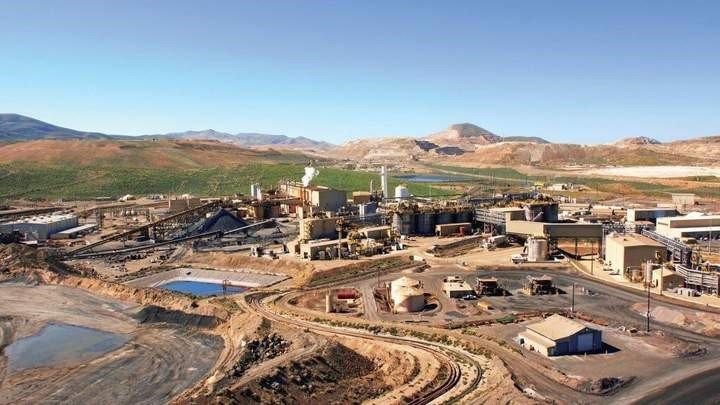

Gold Royalty serves as an example of a royalty company. The company owns more than 190 royalties in selected mining-friendly regions in the USA. The last six months brought Gold Royalty – https://www.youtube.com/watch?v=8RJs1mZ1ics – record sales.

Although not a royalty company, but a classic gold company, nevertheless of equal interest, is Osisko Development – https://www.youtube.com/watch?v=YWW7MwEbhmc -. The company is pursuing high-grade gold projects in Mexico and Canada. The flagship Cariboo project in British Columbia has already yielded excellent gold grades (in some cases up to 200 grams of gold per ton of rock).

Current corporate information and press releases from Gold Royalty (- https://www.resource-capital.ch/en/companies/gold-royalty-corp/ -) and Osisko Development (- https://www.resource-capital.ch/en/companies/osisko-development-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()