Canada Nickel Completes Additional Property Acquisitions

Mark Selby, Chair and Chief Executive Officer said, “The acquisition of Bannockburn is highly complementary to our southern cluster of properties at Sothman, Midlothian, and Powell.

The Bannockburn “B” zone has already been successfully tested for 600 metres of its total 1.3 kilometre strike length with multiple intervals in excess of 0.3% nickel and has smaller, higher grade potential at other zones on the property. Historical mineral processing work confirmed presence of heazlewoodite, similar to Crawford, and the ability to generate a 35% nickel concentrate.”

Mr. Selby continued “This transaction, in combination with our acquisition of the Newmarket property – another very large ultramafic target adjacent to our Mann properties, conclude our consolidation of large Crawford-type targets in the Timmins region. We have been very pleased with our ongoing regional drilling program and look forward to sharing results on these regional properties through the year as assays become available.”

Bannockburn Property

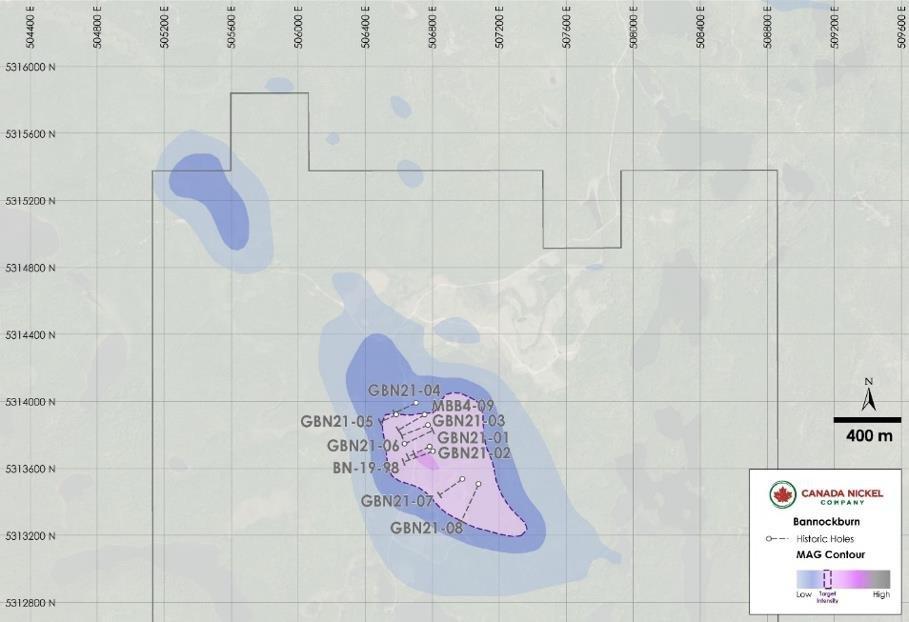

The Bannockburn Property is located 100 kilometres south of Timmins and consists of 125 contiguous unpatented mining claims totaling 2,700 hectares. Bannockburn is in close proximity to the Company’s Sothman, Midlothian, and Powell properties. The property contains at least two ultramafic units with the larger one representing the “B” Zone, a large, lower-grade mineralized ultramafic measuring 1.3 kilometres along strike by up to 700 metres across strike (based on its magnetic response) that had yielded similar intervals to Canada Nickel’s Crawford Deposit.

The “B” Zone was drilled in 2021 by Grid to a depth of 340 metres, with the best hole, GBN21-03, intersecting 342 metres of 0.28% nickel. Previous drilling by Outokumpu Oyj (“Outokumpu”) intersected 203 metres of 0.33% nickel in MBB4-09 and 25 metres of 0.46% nickel in BN-19-98. Preliminary mineral processing testing in 2005 on the “B” Zone showed that a 0.33% nickel grade sample indicated a recovery of 52% to a 35% nickel concentrate.

Previous drilling within the high-grade zones intersected up to 5% nickel in the “C” Zone, which averages 2.5 metres in true thickness, 0.85% nickel over 4.27 metres in the “D” Zone, which remains open and up to 4.54% nickel in the “F” Zone with widths ranging from 0.25 metres to 17.6 metres.

Canada Nickel is acquiring a 100% interest in Bannockburn, which is subject to an existing 2.0% net smelter return royalty with Outokumpu, in exchange for two million common shares of the Company. Closing of the transaction is subject to the satisfaction of certain customary conditions, including the approval of the TSX Venture Exchange.

Newmarket Property

The Newmarket Property is located 34 kilometres east of Canada Nickel’s Crawford Deposit and consists of 93 contiguous mining claims totaling 1,488 hectares. The property is thought to contain the extension of an ultramafic sill located in Mann Township that Canada Nickel previously optioned from Noble Mineral Exploration. The ultramafic in Newmarket Township measures approximately 8.4 kilometres along strike and up to 600 metres across strike (as estimated from its magnetic footprint).

Exploration of the ultramafic within Newmarket dates to 1947 when International Nickel Co. drilled a series of six short holes to a maximum length of 488 feet (149 metres) and intersected serpentinized ultramafic rocks (no assays provided). In 1995, Falconbridge Ltd. conducted ground geophysics and drilling. Hole MAN35-01 drilled just off the edge of Newmarket property intersected serpentinized ultramafic across entire core length to end of hole. Three three-metre assays at 47, 71, and 105 metres yielded nickel intervals in excess of 0.31% nickel. Hole NEW22-01 intersected a coarse-grained peridotite with an assay value of 0.248% nickel over 3 metres reported by the Ontario Geological Survey.

Consideration for the acquisition of the Newmarket property was included in the property transactions press released on November 22, 2021.

Other Property Acquisitions

The Company is also pleased to announce that it has entered into two purchase agreements to acquire certain minor properties located in the Timmins, Ontario nickel-sulphide mining district. Under these agreements, Canada Nickel has agreed, subject to the approval of the TSX Venture Exchange, to issue a total of 17,000 common shares and has agreed that each of the sellers will retain a net smelter royalty of 2%, with Canada Nickel having the right to re-purchase 50% of the royalty.

Canada Nickel also wishes to clarify, further to the acquisition of certain other properties located in the Timmins, Ontario nickel-sulphide mining district described in its April 20, 2022 news release, that in addition to the share consideration described in such prior release, the Company also agreed to pay $75,000 to the seller and grant the seller a 0.5% net smelter royalty on the property, half of which may be bought back for $500,000. In addition, in the event gold mineralization is discovered on the properties, the seller has the right to elect to form a 50% joint venture with the Company to join in the exploration and development of the gold mineralization on the properties.

The common shares described in this news release are subject to a four-month hold period from the date of their respective issuances.

Statement Regarding TSX Venture

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The completion of any transactions mentioned in this release is subject to customary closing conditions, including final TSX Venture Exchange approval. The common shares issued pursuant to the above noted acquisitions will be subject to a four month hold period under applicable Canadian securities laws. Some transactions may have been approved prior to this release.

Qualified Person and Data Verification

Stephen J. Balch P.Geo. (ON), VP Exploration of Canada Nickel and a "qualified person" as such term is defined by National Instrument 43-101, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Canada Nickel Company Inc.

About Canada Nickel Company

Canada Nickel Company Inc. is advancing the next generation of nickel-sulphide projects to deliver nickel required to feed the high growth electric vehicle and stainless steel markets. Canada Nickel Company has applied in multiple jurisdictions to trademark the terms NetZero NickelTM, NetZero CobaltTM, NetZero IronTM and is pursuing the development of processes to allow the production of net zero carbon nickel, cobalt, and iron products. Canada Nickel provides investors with leverage to nickel in low political risk jurisdictions. Canada Nickel is currently anchored by its 100% owned flagship Crawford Nickel-Cobalt Sulphide Project in the heart of the prolific Timmins-Cochrane mining camp. For more information, please visit www.canadanickel.com.

Cautionary Statement Concerning Forward-Looking Statements

This press release contains certain information that may constitute "forward-looking information" under applicable Canadian securities legislation. Forward looking information includes, but is not limited to, drill and exploration results relating to the target properties described herein (the "Properties"), the potential of the Crawford Nickel Sulphide Project and the Properties, timing of economic studies and mineral resource estimates, the ability to sell marketable materials, strategic plans, including future exploration and development results, and corporate and technical objectives. Forward-looking information is necessarily based upon several assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Factors that could affect the outcome include, among others: future prices and the supply of metals, the future demand for metals, the results of drilling, inability to raise the money necessary to incur the expenditures required to retain and advance the property, environmental liabilities (known and unknown), general business, economic, competitive, political and social uncertainties, results of exploration programs, risks of the mining industry, delays in obtaining governmental approvals, failure to obtain regulatory or shareholder approvals, and the impact of COVID-19 related disruptions in relation to the Company’s business operations including upon its employees, suppliers, facilities and other stakeholders. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. All forward-looking information contained in this press release is given as of the date hereof and is based upon the opinions and estimates of management and information available to management as at the date hereof. Canada Nickel disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, except as required by law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Chair and CEO

Telefon: 1 (647) 256-1954

E-Mail: info@canadanickel.com

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()