Indians buy gold again

In May, India’s gold imports increased by a staggering 677 percent over the same month last year. Imports totaled 101 tons of gold, compared with only 13 tons a year earlier in May. That’s the highest level in a year. So, a lot of gold went over the counter in the retail sector. Indeed, the price of gold corrected during the Akshaya Tritiya festival and already Indians were rushing to the jewelry stores. The annual Hindu and Jain festival, which is celebrated in the first week of May, is considered particularly favorable for the purchase of gold.

India is the second largest consumer of precious metals in the world and the current trend can support the gold price. Also, many weddings have been postponed to 2022 due to the Corona pandemic. A major component of the bride’s dowry in India is gold. And the precious metal represents a popular gift from guests and family. Even if some analysts see a stronger U.S. dollar due to the tightening plans of the major central banks and thus a headwind for the gold price, gold is and remains the tried and tested means of building up or preserving wealth. And this is necessary, as the World Bank recently warned of above-average inflation and below-average economic growth for several years. From a global perspective, it lowered its forecast for economic growth in the current year to 2.9 percent.

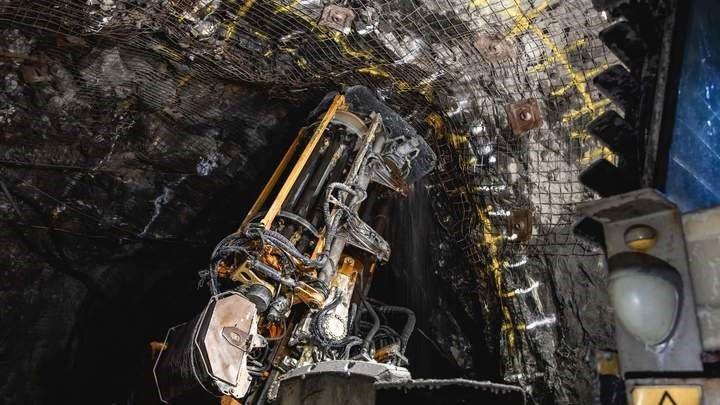

These circumstances speak for gold, thus also for investments in gold shares, for example in Karora Resources – https://www.youtube.com/watch?v=uByunotmKIw -. The gold company, which produces successfully in Western Australia, has recently added a second processing plant. It expects to produce 185,000 to 205,000 ounces of gold in the current year.

Skeena Resources – https://www.youtube.com/watch?v=uByunotmKIw – is reviving the formerly producing Eskay Creek gold-silver property in British Columbia. This has just been approved by the indigenous government.

Current corporate information and press releases from Karora Resources (- https://www.resource-capital.ch/en/companies/karora-resources-inc/ -) and Skeena Resources (- https://www.resource-capital.ch/en/companies/skeena-resources-ltd/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()