Invest in gold or silver

Various factors exist in connection with gold and silver. It is best to own both.

Silver is more strongly tied to the economy, as a good half of it is demanded by industry. Among other things, the precious metal is used in high technology, for example in tablets, smartphones, solar cells and cars. As a result, silver reacts more strongly to economic events than gold. This makes silver more volatile than gold. Gold is used for investment purposes and as a jewelry material; it is used less in industry. If the economy is doing well, silver is used more. When inflation has risen in the past, both gold and silver have made gains. Both precious metals are valued in U.S. dollars. If the U.S. dollar is weak, gold and silver generally rise in value. This is because they can then be had more cheaply in other currencies. When inflation is high, the price of silver usually rises more than the price of gold.

In the portfolio, silver serves as a good diversifier. However, gold has a stronger effect, because gold is less affected by periods of economic weakness. Another point: silver is significantly cheaper than gold, making it more accessible to private investors who do not want to invest so much. This could make silver a particularly interesting investment. Currently, everything is looking at the inflation data, which is now around eight percent. By the way, from a statistical point of view, June is the second worst month of the year for the gold price. May already brought a loss of five percent. Nevertheless, in euro terms, gold has become ten percent more expensive in the last twelve months. Favorable prices should now be observed and used for an entry.

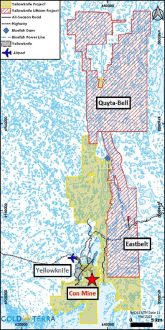

Values of mining companies such as Victoria Gold – https://www.youtube.com/watch?v=8RJs1mZ1ics – are also suitable for this purpose. The already producing company owns the Dublin Gulch property in the Yukon, which includes the Eagle and Olive gold projects.

In the silver sector, MAG Silver – https://www.youtube.com/watch?v=DHxF_-3tU1c – is pleasing. With its partner Fresnillo, MAG Silver is active in Mexico at the Juanicipio project. Material has been mined underground since the end of 2020.

Latest corporate information and press releases from Victoria Gold (- https://www.resource-capital.ch/en/companies/victoria-gold-corp/ -) and MAG Silver (- https://www.resource-capital.ch/en/companies/mag-silver-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()