Gold outperforms other assets

After all, gold is a physical asset with no liabilities. Inflation can therefore diminish the value of gold, just as it can do to bonds and stocks when inflation prevails. Even without the dreaded recession, inflation will remain. High commodity costs and general price pressures are responsible. Inflation was further accelerated by the Ukraine war.

In addition to the known uncertainties, the mid-term elections in the USA will take place in November. The loss of purchasing power, which no citizen can escape anymore, leads to lower consumer confidence. Profit expectations are being scaled back and weak economic data should make gold attractive as a safe haven. The significant economic slowdown can also be seen in the development of the stock markets, which disappoints investors.

The focus should be more on the tried-and-tested gold, which is an important component in hedging against risks. In terms of prices, a turnaround in the price of gold may also have occurred. After the price of the precious metal crashed to 1,780 U.S. dollars, a recovery to over 1,800 U.S. dollars began. Experts see here the chance that a final point behind the downward movement since June was set. In chart terms, the next hurdle for the gold price is at 1,820 U.S. dollars per ounce. If the price of the precious metal rises above this level, a recovery rally could start. Gold mining stocks are therefore coming into focus right now. For example, CanaGold or Chesapeake Gold.

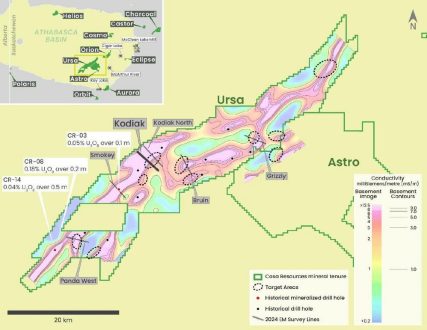

CanaGold – https://www.youtube.com/watch?v=470uITYna_E – owns 100 percent of the prospective New Polaris gold project in British Columbia. Drilling returned up to a good 37 grams of gold per ton of rock.

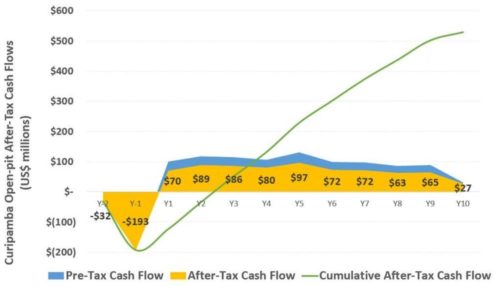

Chesapeake Gold – https://www.youtube.com/watch?v=DHxF_-3tU1c – is focused on South and North America. The main project is the Metates property (gold, silver and zinc) in Durango, Mexico.

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()