Gold as insurance

From a chart perspective, there is a support line at $1,720. Although recession worries, war and inflation persist, the price of gold has been heading downward lately. However, this could be the last downward movement since the high at 2,070 U.S. dollars per troy ounce. And if the price of the precious metal rises above 1,755 U.S. dollars, according to the chart technicians, then an easing would be in order for the time being. At a price above 1,755 U.S. dollars per ounce, the way would then be paved for a further price recovery. However, if the price falls below about 1,700 U.S. dollars, then further losses threaten.

Some analysts are expecting a banking crisis. This is because there are major risks if companies are unable to repay their loans. The downward trend of the euro against the dollar is also worrying, as are the bonds accumulated by the European Union. Voices are being raised calling the Eurosystem broke. Economists expect a recession in this country in the second half of the year. Some kind of shakeout and realignment will come, they say. High energy prices in particular will lead to company bankruptcies. Consumers are also already saving, as inflation and high energy prices mean a harsh winter is on the horizon. These two factors in particular will lead to a painful loss of purchasing power for everyone. Opposing voices don’t see the situation quite as bleak because, on the one hand, the price of crude oil has already become cheaper and the disruption to supply chains is also easing. No matter how much this coming winter eats away at purchasing power, the only proven means of countering demonetization is gold. That’s why gold mining stocks also belong in a well-diversified portfolio.

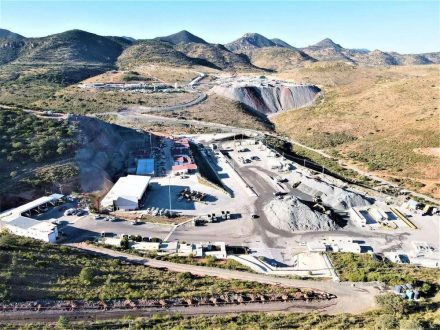

Here, Skeena Resources – https://www.youtube.com/watch?v=AzNGdVvJQvM – would be an option. The company is reviving the formerly producing gold-silver mine Eskay Creek in the Golden Triangle in British Columbia.

Revival Gold – https://www.youtube.com/watch?v=4me-aChLDiE – is working on the drill program at its Beartrack-Arnett gold project in Idaho. This is also a property that has produced previously.

Current corporate information and press releases from Skeena Resources (- https://www.resource-capital.ch/en/companies/skeena-resources-ltd/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()