Gold is like an anchor in a sea of speculative assets

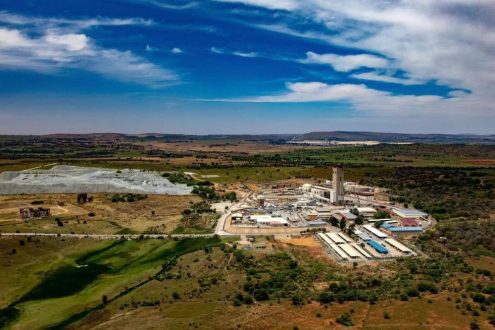

The monetary anchor gold also works when asset bubbles burst. Gold experienced a long correction phase from August 2020 to 2021, when there was a boom in equities and cyclical commodities. During an economic crisis, the "real price" of gold rises. It is now time to look ahead, as the potential of a longer-term bull market in gold is present, especially if the Fed-created 2020 bubble now recedes. Inflation is still high, with overall inflation in the U.S. at 8.5 percent and core inflation at 5.9 percent, but if price pressures ease, this could bring increased gold buyers into the fold. Gold serves as a retirement asset and it proves its worth in times of crisis. When there is economic or political volatility, the price of the precious metal usually rises. Gold stocks belong in every well-diversified portfolio. These could be Golden Rim Resources – https://youtu.be/jKqyxVf1lpI – or GCM Mining – https://youtu.be/F_nfBdS8N08 -. As a West African gold explorer, Golden Rim Resources scores with its prospective main Kada project in Guinea. It also has projects in Chile. GCM Mining produced about 103,000 ounces of gold at its Segovia operations in Colombia in the first half of 2022. In addition, there is the Toroparu gold-copper project in Guyana, among others, which is expected to start production in 2024.

Current corporate information and press releases from GCM Mining (https://www.resource-capital.ch/de/unternehmen/gcm-mining-corp/ ).

In accordance with §34 of the German Securities Trading Act (WpHG), I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and that there is therefore a possible conflict of interest. No guarantee for the translation into German. Only the English version of this news is valid.

Disclaimer: The information provided does not constitute any form of recommendation or advice. Express reference is made to the risks involved in securities trading. No liability can be accepted for any damages arising from the use of this blog. I would like to point out that shares and especially warrant investments are fundamentally associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make a mistake, especially with regard to figures and prices. The information contained is taken from sources that are considered reliable, but in no way claim to be correct or complete. Due to judicial decisions the contents of linked external pages are to be answered for (so among other things regional court Hamburg, in the judgement of 12.05.1998 – 312 O 85/98), as long as no explicit dissociation from these takes place. Despite careful control of the contents, I do not assume any liability for the contents of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG applies additionally: https://www.resource-capital.ch/de/disclaimer-agb/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()