Banyan Gold Looking For 5-6Moz Heap Leachable Gold In The Yukon

1. Introduction

In a time where sizable gold deposits are becoming increasingly rare, and Tier I deposits not in the hands of majors are almost unheard of, Banyan Gold (TSXV:BYN)(OTCQB:BYAGF) is quietly expanding an already delineated 4Moz Inferred gold deposit at their Aurmac project in the Yukon. The beauty of this project is the exploration upside, according to management there could very well be potential for a 6-7Moz Au resource, but also robust economics, as most of the open pit resource contains heap leachable ore and appears to have a low strip ratio. On top of this, Aurmac is located nearby the ramping up Eagle Gold Mine, owned by Victoria Gold, and as Banyan has a favorable earn-in agreement with Victoria Gold, it will probably be clear Banyan is looking to own Aurmac 100%, and besides this, a future consolidation of Aurmac and Eagle would definitely be a very interesting option for any major producer.

Although the current, volatile macro-economic environment with high inflation, mixed readings on growth, job numbers, consumer/purchasing managers confidence, cautious Fed rate hike policies, shortages everywhere and international conflicts like Russia-Ukraine exacerbating things, the stock markets seem to carefully recover from the June lows, with gold hovering around US$1800/oz. This gold price is relatively high, and will be good for future Aurmac economics, as I will show later on in this article.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Banyan Gold’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Banyan or Banyan’s management. Banyan Gold has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

2. Company

Discussing Banyan Gold (TSXV:BYN)(OTCQB:BYAGF) isn’t possible without mentioning nearby Victoria Gold (VGCX.TO). Banyan not only has strong ties to Victoria Gold (VGCX.TO), a relatively new gold producer (commercial production reached in 2020) which owns the 200koz Au producing Eagle Gold Mine in the Yukon, but also shares many similar characteristics. Notwithstanding this, it is firmly on its way to set itself apart in my view, but more on this later.

For starters, Banyan is a gold focused exploration and development company with 2 assets, Aurmac and Hyland, also located in the Yukon, a Canadian jurisdiction that is known for large gold, silver and base metals potential, and has seen lots of action recently after infrastructure spending finally shifted gears. Their former flagship Hyland project was explored for 5 years, and generated an open pittable, partly oxidized resource of 524koz @ 0.84g/t AuEq. Mineralized potential is believed to be substantial by management, but despite this all focus shifted towards the current flagship Aurmac project since the end of 2018, after Banyan hit several long intercepts near surface.

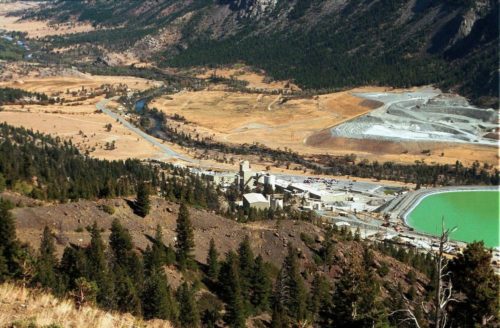

Aurmac is located directly adjacent to Victoria Gold’s Eagle Gold Mine. Both Aurmac and Eagle Gold are open pit and heap leachable, and both deposits are located in similar geology. Both deposits are sizable, as Aurmac already contains an Inferred 3.99Moz @ 0.60g/t Au resource and is growing, and Eagle Gold delineated a M&I resource of 3.6Moz @ 0.63g/t Au in 2019, of which 3.2Moz @ 0.65g/t Au were P&P reserves. Eagle Gold has an overall resource of 5.3Moz Au (M&I and Inf), which includes the reserves.

Regarding ownership, Banyan Gold has an option agreement with Victoria Gold on Aurmac, already owning 51%, and has already completed all exploration expenditures to earn 100%. By deliberately not forming the JV yet, which was possible at 51% ownership, it saves the additional time, legal and accounting costs of managing a JV, and according to management it is most likely that Banyan is on the path to earning into a 100% ownership..Banyan Gold retains this option by paying Victoria Gold C$2M in shares or cash for the underlying Aurex property and a further C$2.6M in shares or cash for the underlying McQuesten property, and complete a PEA by 2025. The PEA should be relatively straight forward given the comparable Eagle Gold Mine was recently built and provides actual operating costs for heap leach in this jurisdiction, so this will likely be achieved way ahead of schedule. On top of this, Victoria will be granted a 6% NSR on both properties, These two 6% royalties can be reduced to 1% regarding gold by paying C$7M per royalty.

Last but not least, Banyan President and CEO Tara Christie is married to Victoria Gold President and CEO John McConnell, which in my view is a big advantage, as it seems unlikely in this case that Victoria wants to give Banyan a hard time, and probably is more inclined to share all sorts of knowledge and experience from their own operation (which experienced their fair share of ramping up issues but seems to have put those behind them now) enabling Banyan to delineate, expand and advance Aurmac in the best and most efficient way possible. Two of those similar, large deposits adjacent to each other indicate at a minimum lots of synergies in case of a future consolidation, and at best both companies are bought out at once by a major, as the combined resource potential certainly has Tier I written all over it, but more on this later.

Talking about management a bit more, the company is led as mentioned by President and CEO Tara Christie, MSc, a professional engineer with over 25 years of experience in the exploration and mining business. She came on board in 2016, and about half a year later the core properties of the Aurmac project (Aurex and McQuesten) were acquired from Victoria Gold and Alexco Resource. She is currently also a board member at Western Copper and Gold, and Osisko Green Acquisition. She is assisted by VP Exploration Paul Gray, who has over 17 years of experience as a geologist in Canada, the US, Asia and Central and South America, with extensive gold exploration experience in the Yukon. Notable names at the Board of Directors are Steve Burleton, the former President and CEO of GT Gold and former VP Corp Dev at Richmont Mines, and Marc Blythe, former VP Corp Dev of Nevsun Resources until acquisition by Zijin Mining for C$1.9B in 2018. As a professional engineer who managed mines in Australia for Placer Dome and WMC, and leading feasibility study teams, he has a strong understanding of most aspects of economic studies at any stage.

Experienced management, a pretty robust 2022 resource with lots of growth potential, and an adjacent, producing partner who can be bought out easily should provide for investor enthusiasm, and looking at the chart of Banyan this seems to be the case:

Investors bought up the share price in anticipating of the Inferred 4Moz resource estimate on Aurmac, which was released on May 17, 2022, well timed as it conveniently coincided with the first day of the Vancouver Resource Investment Conference (VRIC), making Banyan the talk of the town. This resource estimate was a considerable bump up compared to the former, maiden 2020 Inferred estimate of 904koz Au. The share price couldn’t maintain the 50-55c levels, but this had nothing to do with the quality of the resource or any other company-related fundamentals.

Unfortunately, the entire stockmarket worldwide went into risk-off mode during Q2, as inflation raced to percentages not seen in 4 decades, and the Federal Reserve reacted by a very hawkish policy switch, raising rates at almost unprecedented speed, spooking the stockmarkets. As the US Dollar gained strength, and fundamentals like China demand for commodities including metals faltered, metal prices went down despite shortages everywhere, and mining stocks dropped off even more in comparison. As the majority of junior mining stocks lost 50-80% from Q2 to now, Banyan has a very rare, healthy looking chart, and with cautiously recovering sentiment for support it seems one of the most robust juniors at the moment.

Some basic information on share structure: Banyan Gold has 258.4M shares outstanding, and trades at an average daily volume of 113.029k shares. There are zero warrants and 16.6M options (about half of them with a weighted average price of C$0.08, expiring between Sept 2022 and June 2025, and the other half with a weighted average price of 0.29, expiring between December 2025 and February 2027), meaning the fully diluted number of shares stands at 275M shares now.

The share structure isn’t exactly perfect, but keep in mind the company already did a lot of drilling and proved up a very significant resource, and doesn’t need lots of additional dilution before it could show something substantial to the market. Management and BoD hold 7.2% (with CEO Tara Christie at 4.5%), Victoria Gold holds 12%, Osisko Development holds 5%, insiders a combined 8.3%, institutionals like Franklin Gold & Precious Metals Fund own 9.8%, other institutions hold 18%, and retail holds the balance of 48%.

The cash position is estimated at a convenient C$18M after raising C$17M in June 2022, with no debt, and take Banyan well into the summer of 2023. Most of the current capital will be used for exploration and resource expansion, represented by their ongoing 60,000m drill program, but also geotechnical drilling, metallurgical test work, and environmental baseline data collection towards a resource update and commencement of a PEA. For the last 9 months ended June 30, 2022, G&A was C$1.8M, which was substantial, but still acceptable as C$734k of this was stockbased compensation, and more importantly exploration expenditures for the same period came in at C$12.8M, which is well over 85% of available cash put in the ground, for which 75% is an important threshold for juniors in my view.

The current share price is C$0.43, resulting in a current market cap of C$110.77M, and although this already indicates a well-advanced junior, the resource- and economic potential could be colossal, and Banyan could easily become a multi-bagger from here in a year or two. Let’s have a look at their project to see why I believe this kind of potential could be there.

3. Aurmac Gold Project

The company’s primary project is the Aurmac gold project, located in the Mayo Mining district in the Yukon, contains the Aurex and McQuesten properties, and totals 173 square kilometers. Aurmac consists of 3 mineralized deposits: Aurex Hill, Airstrip and Powerline, and together they host a 2022 NI43-101 compliant, Inferred 3.99Moz @ 0.6g/t Au deposit. Over 3Moz Au was added since the 2020 maiden resource after 35,000m of drilling:

The individual deposits represent a pit constrained 2.9Moz @ 0.59g/t Au resource for Powerline, a 215koz @ 0.53g/t Au resource for Aurex Hill, and a 874koz @ 0.64g/t Au resource estimate for Airstrip, announced recently on May 17, 2022. These resources were defined with a 0.2 and 0.3 g/tAu cut-off. Of interest here of course is the fact the company has hit solid mineralization in the red colored drill collars, which weren’t included in the 2022 resource estimate, substantially expanding the interpreted zones of mineralization (in blue). The “red” results could indicate a current resource of 5-5.5Moz in my view, and if the upcoming “green” collars generate results anywhere close to the previous results, the 6Moz Au resource target as shared by CEO Tara Christie in a recent interview could very well become a reality.

After studying the NI43-101 resource report, I noticed that the so called coefficient of variation (CV), a way to indicate relative precision error, had pretty healthy, low values for the three deposits, indicating relatively high continuity:

Everything up to a CV of 1.00 is considered solid, for high grade vein deposits even 2.00 is acceptable. To get an idea of the disposition of various grade blocks, I included a block grade model of Powerline:

At first sight this seems to make for an interesting piece of artwork, but what is important here is that there are not many zones below the 0.2g/t Au cut-off, making the deposit highly continuous. When looking at the sensitivity table for different cut-off grades, it can be seen why Aurmac is such a robust project:

Increasing the cut-off grade of the two main deposits to 0.3 g/t Au doesn’t have much of an impact on total ounces, but increases the average grade to 0.72g/t Au, which is very good for a heap leachable deposit, assuming normal recoveries of course. So far, 2021 metallurgical studies (bottle rolls on pulps) indicated an average recovery of 90% for Powerline and Airstrip, although the company has planned more met work for 2022 and 2023 for the PEA. Since typical heap leachable deposits hardly surpass 75-80% recoveries, and the adjacent Eagle Mine is based on 74%, I wondered how to interpret such preliminary rates. According to CEO Tara Christie, “Bottle rolls are a first step to determine amenability to heap leaching and we were pleased to see both the Sulphide and Oxide leach at similar rates. We are continuing our metallurgical work with VAT tests, gold deportment studies and Column testing which will help us understand what the optimal crush size and actual heap leach recoveries might be. This work takes time and we have engaged experts that are not only working with similar material at Victoria Gold but who have worked at heap leach and other projects worldwide.”

As these resources are pit constrained and heap leachable, the relatively low grade doesn’t prevent Aurmac from being hypothetically very economic, as the estimated overall strip ratio will likely come in around 1 : 1, with Powerline being the main driver for this, as can be seen here:

The NI43-101 report even uses a strip ratio of 1 : 0.34 for the Powerline deposit which is very low. As can be seen, the main Powerline deposit is a collection of stacked layers, running almost horizontally, and well beyond current pit resource outlines. Another good aspect is the presence of higher grade gold near surface, enabling starter pits with extreme returns on investment, which is always a positive for mine financiers. Management sees lots of exploration potential, and has high hopes of expanding Aurmac with a target of to 6-7Moz Au after this 60,000 m of drilling , which would make this a real Tier I asset. A consolidation with the Eagle Gold Mine, or with someone purchasing both seems logical, creating a Tier I gold district with lots of synergy potential.

The ongoing 2022 drill program, aiming for 60,000m in total (~240holes) with 3 rigs in operation at the moment (100 holes drilled already this year for 36,000m), is focused on expanding near surface mineralization along strike to the east and west of Powerline. As per the 2022 NI43-101 report:

“A two phase C$22,5M exploration program is recommended for the AurMac Project. Phase I will consist of: 1) 5,000 m of step-out drilling down-dip and along strike at the Airstrip Zone; 2) 40,000 m of step-out drilling at the Powerline Zone; and 3) 5,000 m of exploratory drilling at the Aurex Hill Zone at an estimated cost of $18,750,000. Phase II will consist of:10,000 m of in-fill drilling and metallurgical testing at the Powerline Zone at an estimated cost of $3,750,000.”

Keep in mind that of this C$22.5M budget about C$9M goes directly into drilling, and lots of other related work like geochemical analysis, staff, diesel, met work, contingencies etc etc need to be taken into account as well, resulting in an all-in drilling cost of C$375/m, which is reasonable for the Yukon.

Banyan Gold is expecting lots of drill results, and CEO Tara Christie is cautiously expecting them to come back from the labs and ready for publication after compiling and interpreting them through the fall and into the spring.

Another interesting thing is that soil sampling and resistivity data even indicate a lot more potential beyond the immediate boundaries of the current drill program:

Banyan’s geologists identified a siliceous belt of rocks with high resistivity over 16.5km, of which Powerline and Aurex Hill just occupy 3km of strike length. Especially intriguing are the white resistivity areas to the east, and the high grade soil sampling areas south/south east of Aurex Hill. Management thinks so too, as it already planned 12 potential drill collars to target several areas (collar locations subject to change):

Banyan plans to drill 20% or 12,000m on these regional targets, and I wondered when drilling would begin here. CEO Tara Christie stated drilling is starting to the East the last week of August and into September and drilling on Nitra will begin in mid-September.

4. Potential economics

Having discussed exploration at Aurmac, let’s have a look at potential economics now. It is interesting to keep the Eagle Mine performance in mind, who had its fair share of delays (declaring commercial production 6 months later than anticipated), lower recoveries, higher strip ratio and lower gold production during ramp up in 2020-2021. As the Yukon climate is pretty harsh, Eagle can’t stack ore on its leach pad during the winter for the first few years, but it can proceed with mining and stockpiling ore in this period. As a consequence, gold production in Q1 and Q2 usually is substantially lower compared to the other quarters, at higher costs.

For example, cash costs came in at US$618/oz Au for Q1 2022 and US$828/oz Au for Q2 2022, and AISC at US$1504/oz Au and US$1371/oz Au, compared to US$539/oz Au and US$638/oz Au in the FS (hopelessly outdated for costs of course as last updated in 2019), For Q3 and Q4, 2021, production was substantially higher and average costs lower (cash cost for FY 2021 came in at US$725/oz Au and AISC was US$1193/oz Au). The strip ratio for FY 2021 came in at 1.58:1 (for FY 2020 this was 1.64:1), whereas the 2019 FS used a 0.1.56:1 figure for 2021 which is very close, but for 2020 the 2019 FS used 1.23:1, and reality came in at 1.64. For 2022 a strip ratio of 1.24 is planned, so it will be interesting to see if this figure can be achieved. According to the FS, the strip ratio will go down substantially next year and beyond, in order to arrive at the average strip ratio of 0.97:1. Let’s see if Victoria can rely on it’s FS to this extent.

These are just a few examples showing the ramp-up of a new mine isn’t a walk in the park. Many new mines failed completely over the last 5 years, destroying incredible amounts of mine financiers capital and shareholder equity, but at least Eagle Gold seems on its way to make it as it doesn’t have excessive debt, enjoys elevated gold prices and is looking to expand the operation to 250koz Au per annum, to incorporate newly found ounces, increase cash flow and thus enhance value for investors.

Of course it takes a while for most mining operations, and certainly heap leach operations, to settle down after grinding through their almost inevitable share of teething problems, and I expect Victoria Gold to do the same at their Eagle Gold Mine. Notwithstanding this, with current extreme inflation in mind, it is a good thing to be conservative at estimates, now more than ever.

Although the current resource is still Inferred, the continuity of mineralization seems to be very solid, and as Banyan already seems to be sitting at an estimated 5Moz Au, their idea of a mine plan based on a 10 year life of mine (LOM) and 200koz Au average annual production seems to be conservative, as it just uses most of the current Powerline/Airstrip resource at a 0.2g/t Au cut-off. I wondered why they picked these numbers, as they also communicated to the markets that a substantially higher resource number is in the cards soon.

CEO Tara Christie was happy to enlighten me: “It is still early days and we anticipated continued resource growth with all of the resources continuing to be open, with blue sky exploration potential on our properties. Knowledgeable investors dig into the sensitivity tables themselves to see the potential for using higher or lower cut off grades and our job is simply to continue exploration and grow the resource.”

Notwithstanding this, and I like conservative approaches, I do believe Banyan is heading towards 6Moz, and the resource envelopes have a much more efficient shape and position compared to for example Eagle Gold, where mineralization is more vertically oriented and is mined out much deeper. Banyan Gold elected not to drill deeper than about 200m vertical, as this depth already provides the company with enough mineralization, but since 200m depth is the standard depth of an economic 1Moz open pit operation and mineralization at Powerline appears to extend at depth, there could be a much larger deposit suitable for an extended mine life similar to Victoria Gold. They are exploring at depth after commencing production, but according to management the market would be unlikely to reward Banyan Gold for a deep deposit at this stage, and deep drilling is more costly of course.

All in all, after raising the cut-off to 0.30g/t as contemplated earlier, I feel safe to use 3Moz Au @ 0.70g/t Au as Powerline and Airstrip combined have 3.4Moz @ 0.72g/t Au. Aurex Hill is too small and low grade to include at this point. As management seems very confident in growing Aurmac into 5.5-6Moz Au and potentially more, I will also include a scenario estimating a 5Moz @ 0.68g/t resource at a cut-off of 0.3g/t Au as the Aurex Hill zone to the south seems to be incorporated with the current drilling, is lower grade and could lower the average grade somewhat.

Before I proceed further with my assumptions, it is a good thing to get an impression of peer projects, so I selected a few heap leach projects, of which of course the inevitable Eagle Gold is the only one in production (using 2016 FS and 2019 FS figures here):

I discussed some production data from Eagle Gold earlier on, but it will be clear one cannot be conservative enough when modeling a heap leach operation.

As always, a peer comparison based on discounted cash flow analysis (DCF) is of course the most useful if the projects selected are as close as possible on parameters, but as no project is exactly the same, a sub-optimal comparison is the inevitable result directing our assumptions. Although inherently flawed, DCF provides at least some meaningful guidance, way beyond simple metrics like EV/oz or critically flawed metrics like "gross metal values compared to market cap”. The minute you see people talking about billions of dollars of metal value as their main thesis, run for the hills if you value your hard earned dollars. Of course keep in mind that Banyan Gold just established an Inferred resource at Aurmac, and although it is perfectly possible to engineer a PEA based on just Inferred resources, all numbers based on Inferred resources are highly speculative as these resources aren’t economic per NI43-101 definitions.

According to test results, oxidized holes generated extremely good 90% recoveries. As this is bottle roll leach testing and not exactly heap leaching, but still believed to be above average, I assume an overall recovery of 70% since the Eagle Gold Mine had issues reporting recoveries above 70% although planned higher.

With some dilution/ore loss/pit outlines etc etc taking into account, I expect 2.8Moz Au to be mined and processed before recoveries. A minimal life of mine of 10 years generates 280koz Au ore per annum, at an average mill feed grade of 0.67g/t Au this would result in 13Mt ore mined per annum, and assuming a 365 day per annum operation like Eagle this would mean a 35,600 tpd throughput. At 70% recovery, Aurmac could produce 200koz Au per annum, meaning a LOM production of 2Moz Au.

The scenario involving a resource of 5Moz @ 0.68g/t Au at a 0.3g/t Au cut-off generates the following numbers: I assume 4Moz Au to be mined and processed before recoveries. A minimal life of mine of 12 years generates 333koz Au ore per annum, at an average mill feed grade of 0.65g/t Au this would result in 16Mt ore mined per annum, and assuming a 365 day per annum operation like Eagle this would mean a 43700 tpd throughput. At 70% recovery, Aurmac could produce 233koz Au per annum, meaning a LOM production of 2.8Moz Au.

The capex and opex assumptions will be based on averages while taking into account scale and location, but the current rampant inflation makes any assumption pretty difficult, so I allow for a substantial margin for error. For capex, 2 of the analyzed peer projects have almost the same size of operation, with 18ktpd throughput. As the South Railroad FS is from February this year, I consider the much higher capex/tpd number (compared to the 2019 Eagle Mine study) much more reliable. Despite the harsh Yukon conditions, the Eagle Mine was completed on time and with relatively modest cost over runs complicated by COVID to reach commercial production in July 2020., so it seems possible to budget a Yukon mine quite reliably. Aurmac is about twice the size of South Railroad, I have no issues increasing the capex/tpd number to US$11,000/tpd to also capture inflation, but on the other hand considering that AurMac has a lot better infrastructure than Victoria Gold started with, which could shave off roughly US$50-80M. This results in a capex of US$392M.

For mining cost I like to assume a higher US$1.7/t as oil consumption is a big part of open pit mining, but the oil price hovers at the same levels like in February at the time of of the South Railroad FS. Mining costs mined, processed and processing is anybody’s guess, but overall salaries haven’t increased as much as goods. Overall opex should be significantly lower than South Railroad, as the strip ratio for Aurmac is much lower, but the high opex at the Eagle Mine, although ramping up, has made me cautious. Sustaining capital is a difficult one, but I would like to follow the Eagle Mine here. Corporate taxes in Canada are 26.5%. This all results in the following numbers for both production scenarios:

The hypothetical, solid and conservative after-tax NPV5 number of US$517M @ US$1500 gold indicates why I think Aurmac is a very robust project, and this NPV5 number was calculated through this simplified DCF model:

Keep in mind I used conservative amounts for opex and capex. When inflation and subsequent pricing normalizes again in the future, capex will probably go down and economics will improve from here. A sensitivity to the gold price for both scenarios looks like this (as the IRR is almost the same for both I just used the IRR for the 2 Moz Au scenario):

An after-tax IRR of 30.6% @US$1500/oz is very robust these days with elevated costs, and well above the institutional threshold of 20%. Before I started calculating it felt like this project should break the US$1B threshold no matter what because of size, grade, heap leaching and strip ratio, but the current high opex and capex prevented this for the 2Moz Au scenario. It is good to see the 2.8Moz Au scenario convincingly breaking through the US$1B number at US$1600 gold on my conservative parameters, I’m sure management and its engineering firm will be able to optimize enough to reach this number at US$1500 gold.

With a current market cap of around C$100M in mind, the 2Moz Au NPV5 of US$517M @ US$1500 gold equals C$689M, which would almost be a sevenfold NPV, which implies healthy upside potential for me at least. The 2.8Moz scenario implies a tenfold NPV, and as management is convinced they can get to 5.5-6Moz, I do believe, also based on exploration potential, that further upside is realistic. Still early days of course, and although I believe my guesstimates to be conservative, many things can go wrong in the interim, starting with the resource expansion number, inherently to junior mining as it is no exact science.

Let’s see where Banyan Gold would end up across some of its peers, if aforementioned guesstimates were to be realized. Several heap leach gold operations in the Americas were selected, one better suitable than the other as always with peer comparisons:

Most importantly I tried to find peers with fairly recent economic studies:

Banyan Gold is already trading at an EV/oz metric of 21, which is on the high side of their peers with just a resource, but still with lots of room for improvement towards the advanced economic study stage, and certainly towards production, as the EV/oz figure of Victoria Gold proves, standing at 88 (being much higher even before stocks started crashing this summer, around 160-165). When looking at the economic studies below, it is very likely that most studies need significant updates in the cost department, resulting in lower NPVs and IRRs.

If Banyan Gold could in fact generate a PEA on Aurmac with a NPV5 close to C$689M as I estimated, a P/NAV of 0.13 would still be on the low side, except outliers like Kore Mining, which has to deal with California permitting under a Democrat government which is no fun. All things considered, I like the prospects of Banyan Gold, especially since their exploration- and economic upside, low risk jurisdiction and nearby Victoria Gold who just paved the way for them regarding permitting and infrastructure.

It will hopefully be clear by now, that Banyan Gold is something special, as it is pursuing a real shot at a potentially very economic 6-7Moz heap leachable gold deposit in the Yukon. Aurmac being such a deposit has Tier I written all over it, and either as a stand alone operation or consolidated with the adjacent Eagle Gold Mine, creating a potential 11-12Moz+ Au monster, my guess is Banyan will not be around anymore shortly after mining permits are granted, and potentially taken out even sooner.

5. Conclusion

Banyan Gold actually was the very last company I talked to in person at the last PDAC, amidst all booths being taken down, but they turned out to be the developer with potentially the most robust gold project and the most low risk/value upside of all. It rarely happens that a Tier I project in the making is still available these days, let alone trading for a C$107M market cap, with relatively little fuss being made about it. A potentially pretty economic 6-7Moz heap leachable gold asset is something that should not only be on the radar of every investor, but also mid-tier and major producer, and Aurmac probably is. And this is not the whole story, as Banyan will be exploring good-looking regional targets as well this year, so management and investors will know soon enough if there is even double digit resource potential or not. Stay tuned for this intriguing story!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Banyan Gold is a sponsoring company. All facts are to be checked by the reader. For more information go to www.banyangold.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()