First Tin Plc Delivers Positive Intercepts from Gottesberg in Germany

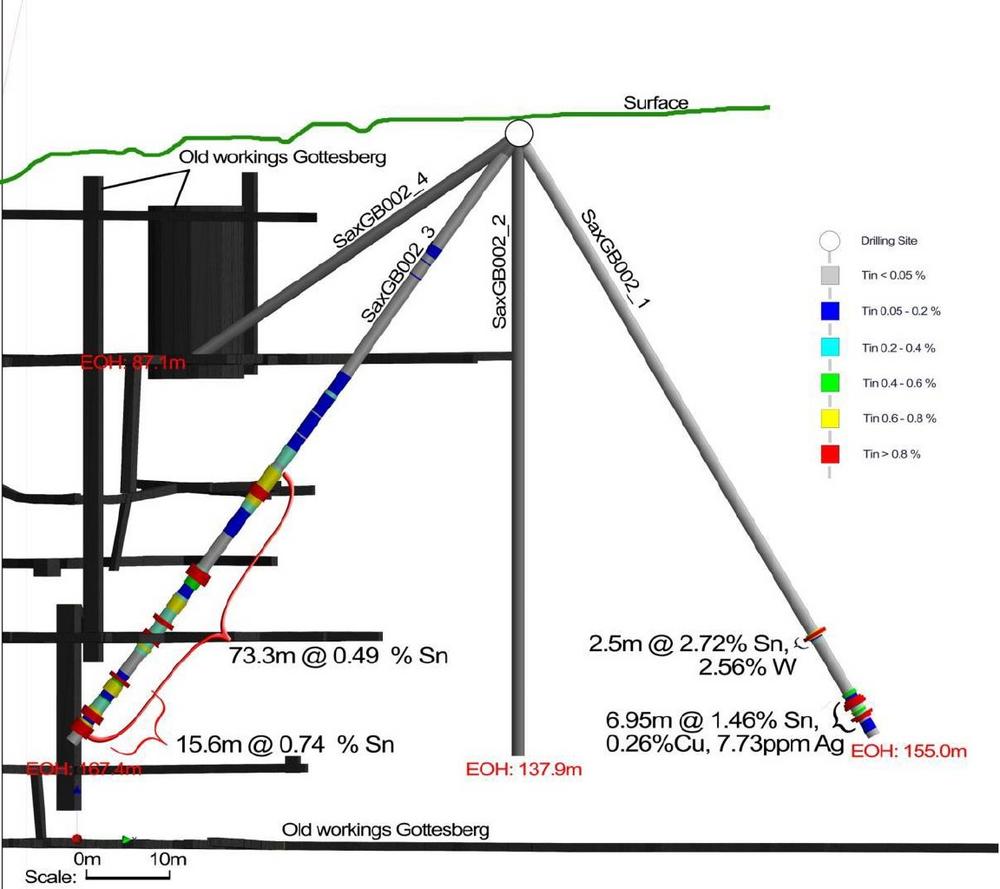

Results from drillholes SaxGB002_1 and SaxGB002_3 have been returned (see Figure 1) with significant intercepts including:

- 3m @ 0.49% tin (“Sn”) from 91.7m including 15.6m @ 0.74% Sn from 149.4m

- 5m @ 2.72% Sn, 2.56% W from 128.2m followed by

- 95m @ 1.46% Sn, 0.26% Cu, 7.7g/t Ag from 143.65m

These results, further details on which can be found below, follow on from the previously reported intercept of 6.5m @ 0.98% Sn from 124.7m announced on 20 June 2022, and are significantly higher than the average resource grade at Gottesberg, which contains 42.1Mt grading 0.27% Sn (114,000t tin) as reported under JORC 2012 guidelines (see www.firsttin.com for details).

Combined, the results to date validate the Board’s belief that a higher grade core exists within the large but moderate grade Gottesberg deposit. During the programme, undertaken between, 24 November 2021 and 30 March 2022, 16 drillholes for a total length of 2080.5m were drilled from seven drill sites in the project area. Results have now been returned from 10 drillholes with six drillholes remaining outstanding.

Gottesberg is of particular interest as a potential source of high-grade mineralisation that may be able to be pre-concentrated and transported to a central milling facility at the Tellerhäuser project, which is approximately 25km away, for additional processing.

First Tin CEO Thomas Buenger said, “These results confirm that broad zones of significantly higher grade material are present within the overall moderate grade Gottesberg deposit. This confirms our exploration model and supports our vision of implementing a possible hub and spoke approach in the broader Tellerhäuser project area. I am eagerly awaiting results of the remaining drillholes at Gottesberg so we can combine the data and plan additional drilling that will enable us to update the existing resource under JORC 2012 guidelines.”

Further Information regarding the latest results

The intercept of 73.3m @ 0.49% Sn is from within the main part of the Gottesberg deposit where several higher grade sub-zones have combined to form a significantly higher than average grade zone that could potentially be mineable as a bulk underground deposit. The higher grade zone of 15.6m @ 0.74% Sn appears to be along strike of the intercept announced in June, assuming an approximately east-west trend. This may be related to controlling structures for the mineralisation and may form a discrete higher grade target.

The intercepts of 2.5m @ 2.72% Sn, 2.56% W and 6.95m @ 1.46% Sn, 0.26% Cu, 7.7g/t Ag are outside the main resource area but below old surface tin workings and associated with a strong IP chargeability anomaly. The copper and silver are associated with sulphides which may be the source of the IP anomaly. The high tungsten is unusual in this district and may be related to a separate mineralising event.

Results from the remaining two drillholes on this section are awaited and may help clarify the morphology of mineralisation. These results are expected to be received within the next few weeks.

Results from the third and final fence of drilling (four drillholes) have now been despatched to the laboratory and results are expected within 6-8 weeks.

Enquiries:

First Tin

Via SEC Newgate below

Thomas Buenger – Chief Executive Officer

Arlington Group Asset Management Limited (Financial Advisor and Joint Broker)

Simon Catt

020 7389 5016

WH Ireland Limited (Joint Broker)

Harry Ansell

020 7220 1670

SEC Newgate (Financial Communications)

Elisabeth Cowell / Axaule Shukanayeva /

07900 248 213

Molly Gretton

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

Notes to Editors

First Tin is an ethical, reliable, and sustainable tin production company led by a team of renowned tin specialists. The Company is focused on becoming a tin supplier in conflict-free, low political risk jurisdictions through the rapid development of high value, low capex tin assets in Germany and Australia.

Tin is a critical metal, vital in any plan to decarbonise and electrify the world, yet Europe has very little supply. Rising demand, together with shortages, is expected to lead tin to experience sustained deficit markets for the foreseeable future. Its assets have been de-risked significantly, with extensive work undertaken to date.

First Tin’s goal is to use best-in-class environmental standards to bring two tin mines into production in three years, providing provenance of supply to support the current global clean energy and technological revolutions.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()