GoldMining Intersects 118 m grading 1.01 g/t AuEq at its La Garrucha Target, La Mina Project, Colombia

Highlights

Drill Hole LME1111 results include;

- 46 m @ 0.60 g/t Au and 0.08% Cu, or alternatively expressed as 0.72 g/t gold equivalent (AuEq), from 166.04 m; including

- 31 m @ 0.89 g/t Au and 0.08% Cu, or 1.01 g/t AuEq from 256.85 m

Including higher-grade intersections:

- 55 m @ 1.32 g/t Au and 0.10% Cu, or 1.47 g/t AuEq from 266.85 m

- 80 m @ 1.10 g/t Au and 0.07% Cu, or 1.20 g/t AuEq from 297.95 m

- 49 m @ 1.03 g/t Au and 0.11% Cu, or 1.19 g/t AuEq from 339.67 m

Alastair Still, CEO, commented, "The 2022 drilling program has successfully discovered extensions of previously identified gold-copper porphyry mineralization at the La Garrucha target and has almost doubled the strike and depth of the system, which remains open to the southeast and at depth. The latest drill results help demonstrate the geological continuity and higher-grade core of this mineralized system. These results along with drilling from historic exploration programs will be used to initiate an updated mineral resource estimate for the La Mina Project in the fourth quarter of 2022 with the intention to complete an updated Preliminary Economic Assessment ("PEA") in 2023.”

Tim Smith, VP Exploration, commented, "LME1111 provides geological continuity between the previous Bellhaven drill holes and the recently announced step out drill holes completed by GoldMining, which include intercepts of 207.95 m at 0.62 g/t AuEq in LME1107 and 431.23 m at 0.73 g/t AuEq in LME1108. LME1111 intersected the hanging wall of the La Garrucha porphyry at the depth modelled, providing confirmation of our three-dimensional geological model and adding confidence to future mineral resource estimation including the presence of a higher-grade core of the system."

Drill Program Details and Geological Description

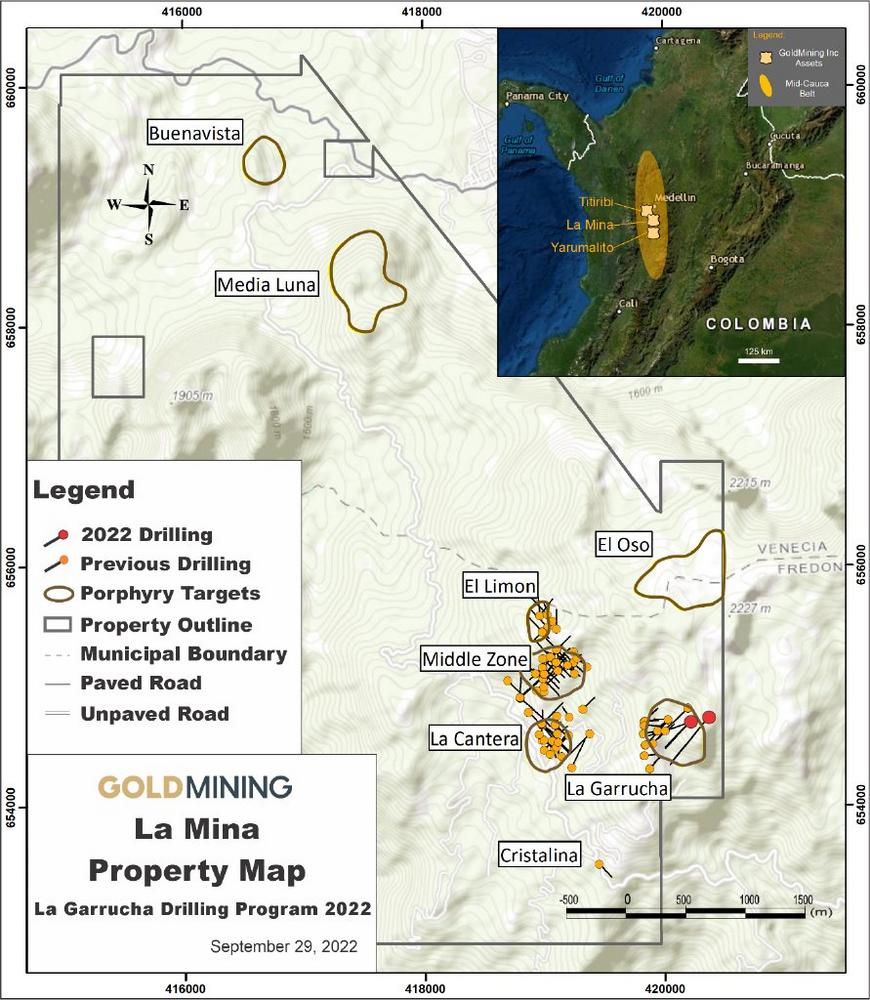

From late March through to mid-August 2022, GoldMining completed a diamond core drilling program comprising five drill holes for 3,485 m at its La Garrucha target within the La Mina Project (see Figures 1 & 2). Comprehensive assay intercepts for the entire drill program, including the last hole of program LME1111, can be found in Table 1.

LME1111 was drilled to improve confidence in the continuity of the porphyry mineral system between the previous Bellhaven drilling and the recently completed GoldMining step out drilling (see Figure 2). Additionally, LME1111, was oriented to drill orthogonally across the steep easterly dip of the overall system compared with previous Bellhaven drilling, which drilled obliquely. LME1111 intersected the core of the porphyry system providing important information about the continuity and geometry of the higher-grade portions of the porphyry system.

Gold and copper mineralization in the La Garrucha porphyry intrusive complex is accompanied by strong potassic alteration, characterized by secondary potassium feldspar and biotite, disseminated and vein magnetite, quartz stockwork veining and both vein-hosted and disseminated sulphides that include pyrite, chalcopyrite and lesser bornite. LME1111 intersected a core zone of more intensive A-vein type quartz veining associated with higher gold grades.

The La Garrucha porphyry mineral system now measures over 400 m in strike length by 300 m in width and deeper drilling has extended mineralization from a previously intersected maximum depth of 450 m to approximately 775 m below surface where the porphyry mineral system remains open.

Geological interpretation of the La Garrucha drilling program is now underway and includes comprehensive lithological, alteration and structural logging of new core and re-logging of historic Bellhaven core. This work will be used to place the copper and gold mineralization in spatial and temporal context with the hosting La Garrucha porphyry intrusive complex and other La Mina porphyry deposits at La Cantera and Middle Zone. Metallurgical testwork, three-dimensional modelling of geology and subsequent geostatistical modelling will be completed during fourth quarter 2022 to initiate an updated pit constrained mineral resource estimate by year-end. Current plans are to complete an updated PEA for La Mina in 2023 that will include resources outlined at Middle Zone, La Cantera and La Garrucha.

Additional information regarding the La Mina Project, including existing resource estimates and historical work at the project, is set out in the technical report titled "NI 43-101 Technical Report and Preliminary Economic Assessment, La Mina Project, Antioquia, Republic of Colombia" with an effective date of January 12, 2022 (“La Mina Technical Report and PEA”), which is available on the Company’s website at www.goldmining.com and under the Company’s profile on www.sedar.com.

Qualified Person

Paulo Pereira, P. Geo., President of GoldMining, has reviewed and approved the technical information contained in this news release. Mr. Pereira is a Qualified Person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Data Verification

For this drill core sampling program, samples were taken from the NQ/HQ core by sawing the drill core in half, with one-half sent to ALS Colombia LTDA in Medellín for assaying and the other half retained for future reference. Sample lengths downhole range from a minimum of 0.50 m to a maximum of 2.10 m. ALS Colombia LTDA is a certified commercial laboratory located in Medellín, Antioquia, Colombia, independent of GoldMining. GoldMining has implemented a stringent quality assurance and quality-control (QA/QC) program for the sampling and analysis of drill core including insertion of duplicates, mineralized standards and blank samples for each batch of 100 samples. The gold analyses were completed by ALS Au-AA23 method (fire-assay with an atomic absorption finish on 30 grams of material). Copper analyses were completed by ALS ME-ICP61 method (four acid digest with ICP analysis).

About GoldMining Inc.

GoldMining Inc. is a public mineral exploration company focused on the acquisition and development of gold assets in the Americas. Through its disciplined acquisition strategy, GoldMining now controls a diversified portfolio of resource-stage gold and gold-copper projects in Canada, U.S.A., Brazil, Colombia, and Peru. The Company also owns more than 20 million shares of Gold Royalty Corp. (NYSE American: GROY).

Abbreviations

Gold Au

Grams per tonne g/t

Copper Cu

Gold equivalent AuEq

Metres m

For additional information, please contact:

GoldMining Inc.

Amir Adnani, Chairman

Alastair Still, CEO

Telephone: (855) 630-1001

Email: info@goldmining.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Forward-looking Statements

This document contains certain ‘forward-looking information’ and ‘forward-looking statements’ within the meaning of applicable Canadian and U.S. securities laws (“forward-looking statements”) that reflect the current views and/or expectations, including statements regarding the future work programs and planned activities and studies at the Company’s La Mina Project and expectations regarding the La Mina Project. Forward-looking statements are based on the then-current expectations, beliefs, assumptions, estimates and forecasts about the business and the markets in which GoldMining operates. Investors are cautioned that all forward-looking statements involve risks and uncertainties, including: delays to plans caused by restrictions and other future impacts of COVID-19 or any other inability of the Company to meet expected timelines for planned project activities; results of exploration programs may not confirm expectations; the inherent risks involved in the exploration and development of mineral properties, fluctuating metal prices, unanticipated costs and expenses, risks related to government and environmental regulation, social, permitting and licensing matters, and uncertainties relating to the availability and costs of financing needed in the future. These risks, as well as others, including those set forth in GoldMiningꞌs Annual Information Form for the year ended November 30, 2021, and other filings with Canadian securities regulators and the U.S. Securities and Exchange Commission (the “SEC”), could cause actual results and events to vary significantly. Accordingly, readers should not place undue reliance on forward-looking statements and information. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward-looking information, will prove to be accurate. The Company does not undertake any obligations to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law.

Cautionary Note to US Investors

The disclosure in this news release and referred to herein was prepared in accordance with NI 43-101 which differs significantly from the requirements of the SEC. The terms “proven mineral reserve”, “probable mineral reserve” and “mineral reserves” used in this news release are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum Standards (the “CIM Definition Standards”), which definitions have been adopted by NI 43-101. Accordingly, information contained in this news release providing descriptions of our mineral deposits in accordance with NI 43-101 may not be comparable to similar information made public by other U.S. companies subject to the United States federal securities laws and the rules and regulations thereunder.

Investors are cautioned not to assume that any part or all of mineral resources will ever be converted into reserves. Pursuant to CIM Definition Standards, “Inferred mineral resources” are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Canadian standards, including the CIM Definition Standards and NI 43-101, differ significantly from standards in the SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the “SEC Modernization Rules”), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to corresponding definitions under the CIM Definition Standards. During the period leading up to the compliance date of the SEC Modernization Rules, information regarding mineral resources or reserves contained or referenced in this news release may not be comparable to similar information made public by companies that report according to U.S. standards. While the SEC Modernization Rules are purported to be “substantially similar” to the CIM Definition Standards, readers are cautioned that there are differences between the SEC Modernization Rules and the CIM Definitions Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()