Vizsla Silver drills new vein at Tajitos-Copala – intersects 2,913 g/t AgEq over 1.46 metres

Highlights

- CS-22-182 returned 2,913 grams per tonne (g/t) silver equivalent (AgEq) over 46 metres true width (mTW) (1,935 g/t silver and 15.47 g/t gold)

- CS-22-128 returned 427 g/t AgEq over 2.50 mTW (299 g/t silver and 2.08 g/t gold)

- Including 1,472 g/t AgEq over 0.46 mTW (995 g/t silver and 7.60 g/t gold)

- CS-22-185A returned 426 g/t AgEq over 1.00 mTW (302 g/t silver and 2.02 g/t gold)

- CS-22-196 returned 426 g/t AgEq over 2.16 mTW (278 g/t silver and 2.33 g/t gold)

“The Cristiano Vein, located to the adjacent southwest of Copala is now a priority target for resource expansion within the Tajitos-Copala resource area,” commented Michael Konnert, President and CEO. “We initially discovered the Cristiano structure while testing the expansion potential of Tajitos. Similar to other proximal veins within the Tajitos-Copala Vein Corridor, Cristiano is predominately silver and gold rich with only trace amounts of base metals. We continue to be encouraged by the high-grade intercepts located in this area of the district, where mineralization remains open in all directions. Cristiano is yet another vein along this very productive corridor with the potential to host new resources.

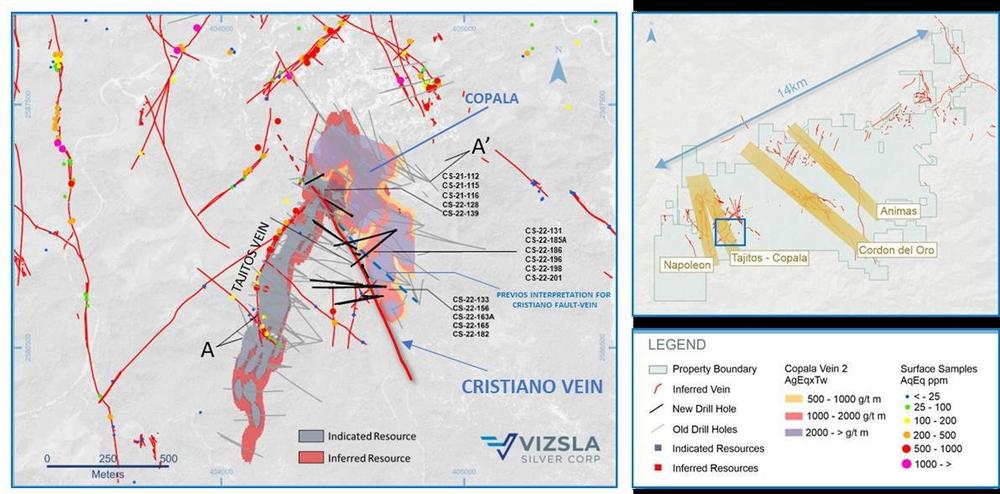

The Cristiano Vein is a precious metals rich structure located at the southwestern margin of the Copala structure, in the western portion of the Panuco district. Cristiano is marked by a quartz-carbonate epithermal-vein striking N25°W that dips sub-vertical (85°) to the NE. Drill holes intersecting Cristiano to date, highlight a high-grade zone plunging to the NW, with an average vertical extent of 250 metres and approximate strike length of 500 metres. The Cristiano Vein has an estimated true thickness of 1.88 metres with a weighted average grade of 841 g/t silver equivalent.

The Cristiano Vein was initially discovered in while targeting the Tajitos veins, where drilling intercepted the well-mineralized, NW-SE trending fault. Ongoing drilling has now led to new observations and interpretations allowing Vizsla geologists to plan drill holes specifically designed to explore Cristiano along strike and to depth. To the northwest, Cristiano intersects and offsets the Tajitos Vein, suggesting Cristiano post-dates Tajitos mineralization, thus creating a drill target on the footwall of Tajitos (Figure 2). Additionally, open ended intercepts to the southeast suggest mineralization continues in this direction.

Further Informartion is attached

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTSThis news release includes certain “Forward‐Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward‐looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward‐looking statements or information. These forward‐looking statements or information relate to, among other things: the exploration, development, and production at Panuco, including plans for resource/discovery-based drilling, designed to upgrade, and expand the maiden resource as well as test other high priority targets across the district.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Vizsla Silver, future growth potential for Vizsla Silver and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold, and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Vizsla Silver’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Vizsla Silver’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and Vizsla Silver has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company’s dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company’s mining activities in Mexico; regulatory, consent or permitting delays; risks relating to reliance on the Company’s management team and outside contractors; risks regarding mineral resources and reserves; the Company’s inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company’s interactions with surrounding communities and artisanal miners; the Company’s ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption “Risk Factors” in Vizsla Silver’s management discussion and analysis. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although Vizsla Silver has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Vizsla Silver does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

President and Chief Executive Officer

Telefon: +49 (604) 364-2215

E-Mail: info@vizslasilver.ca

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()