Silver is also an important investment instrument

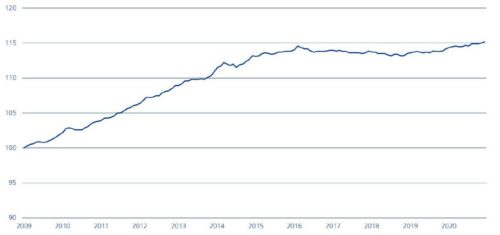

According to a study by the independent economic consultancy Oxford Economics, multi-asset portfolios would benefit from a four to six percent addition of silver. In most cases, however, both private investors and institutional investors have only 0.2 percent invested in silver. This study was initiated by the Silver Institute, with the result that silver is unfortunately often overlooked. This is because silver has its own return characteristics because more than 50 percent of it is an industrial metal. This is also why the silver price is more sensitive to industrial trends. For the study, the development of silver in a portfolio was compared with gold, other commodities, stocks and bonds, and this was done from January 1999 to June 2022. The result was a valuable diversification potential in silver investment. For the future, the forecasts look even better, as the demand outlook for the precious metal is very good in the next decade.

Silver is the metal in the global automotive industry. Silver has the highest electrical conductivity. According to forecasts, the demand for the indispensable metal is expected to grow strongly in the coming years. In addition, silver is needed in many areas, whether electronics, optics or in solar energy, as well as for bars and coins. The antibacterial effect is used in medicine. From all this it follows that investors should reconsider their silver weighting in the portfolio and then perhaps increase it. For example, with stocks like Discovery Silver or Summa Silver.

Summa Silver – https://www.youtube.com/watch?v=2i-e-fH8jZM – owns interests in the Hughes property (100 percent) in Nevada and an option on the Mogollon property (100 percent) in New Mexico. Both properties have previously produced very successfully.

Discovery Silver – https://www.youtube.com/watch?v=MzLKx2HriOw – also scores with a prospective silver project, the Codero Silver Project in Mexico. A positive pre-feasibility study is available.

Current corporate information and press releases from Discovery Silver (- https://www.resource-capital.ch/en/companies/discovery-silver-corp/ -) and Summa Silver (- https://www.resource-capital.ch/en/companies/summa-silver-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()