Canada Nickel Acquires Past Producing Texmont Mine, Highlights High Grade Potential of Regional Land Package

Highlights

- Provides potential for near-term open pit production from near-surface high grade mineralization at Texmont.

- High grade potential of regional package already demonstrated at multiple properties – Texmont, Sothman, Bannockburn. Mineralization outcrops at all three properties

- Texmont – Historic resource[1] of 3.2 million tonnes of 0.9% nickel hosted within bulk tonnage target.

- Sothman – Historic resource[2] of 190,000 tons grading 1.24% nickel

- Bannockburn – Historic drilling with multiples intervals greater than 2%

- Crawford PGM zone results include two holes with core length of 30 metres of 1.82 g/t palladium + platinum and 15.0 metres of 1.88 g/t platinum + palladium

Canada Nickel Company Inc. ("Canada Nickel" or the "Company" – https://www.commodity-tv.com/ondemand/companies/profil/canada-nickel-company-inc/) (TSXV: CNC) (OTCQX: CNIKF) today announced that it has signed a deal to acquire a 100% interest in the past producing Texmont property situated between the Company’s Deloro and Sothman properties south of Timmins, Ontario. The Company is also reporting results from the first four holes at Texmont and first five holes targeting higher grade mineralization at Sothman. All nine holes have assays pending.

Mark Selby, Chair & CEO of Canada Nickel Company, “The acquisition of the Texmont property provides near-term smaller scale production potential and is highly complementary to our large-scale Crawford and regional nickel sulphide projects. We are excited by the potential for leveraging the understanding of the geology at Texmont and additional high-grade areas at Sothman and Bannockburn and applying these learnings to our large regional property package. In our discussions with nickel consumers for the battery market, many of them are keen to have new nickel production that could come to market by 2025. Similarly, a number of investors have expressed interest in financing near-term production.”

Texmont Property

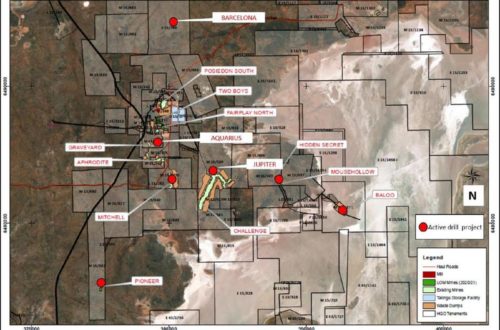

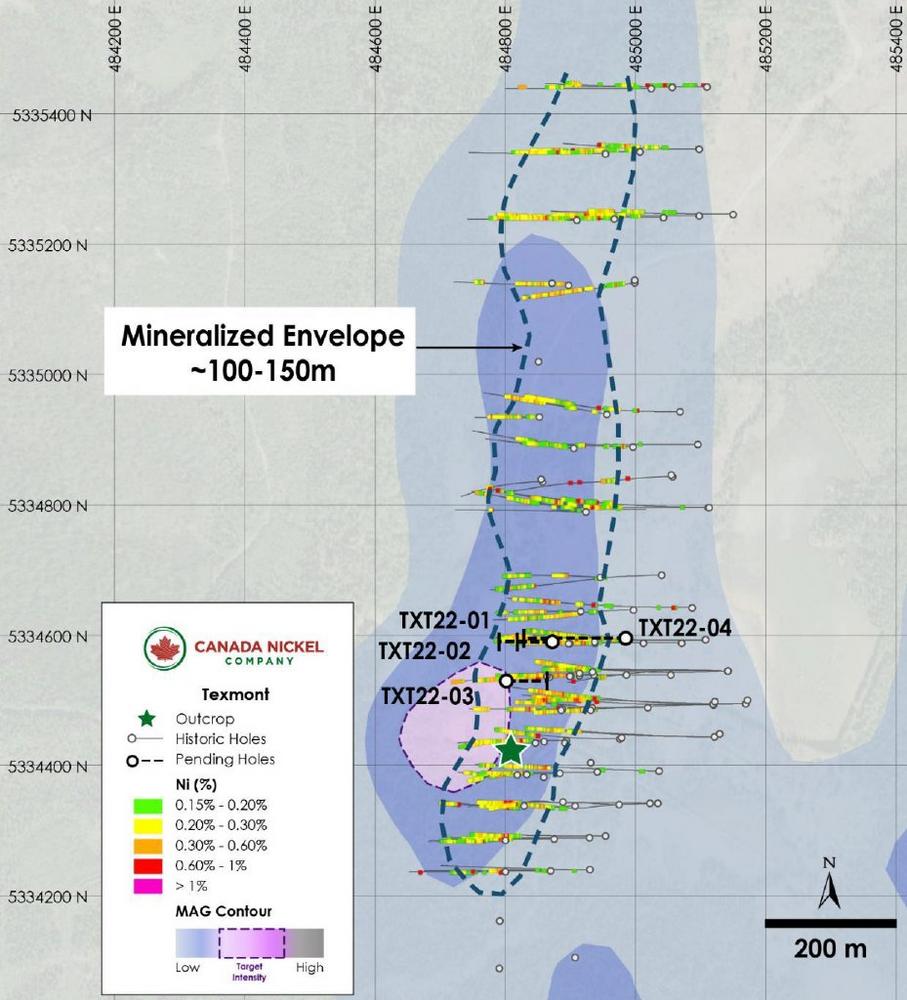

The Texmont Property is located 36 kilometres south of Timmins and contains an ultramafic body with a target geophysical footprint approximately 1.2 kilometres long by 150 metres wide (see Figure 1). A historic resource estimate of 3.2 million tonnes grading 0.9 % nickel was reported (Leigh, 1971) (See note above regarding Texmont historical resource estimate). A mine and mill operated on the site from July 1971 to December 1972 at a rated capacity of 500 tons per day. The total amount milled cannot be confirmed as the data and final stope plans are not available. The mine targeted narrow nickel mineralization in excess of 1.0%. Canada Nickel believes that this high-grade mineralization is contained within a larger bulk tonnage deposit that extends to surface. Initial drilling results from our ongoing drilling program confirms the presence of high-grade mineralization in ultramafic rock, as well as currently undefined lower grade, wider intervals, that were disregarded during previous mining. To date, Canada Nickel has drilled four drill holes, all intersecting significant intervals of mineralization within the target ultramafic (see Tables 1 & 2). From 2006-2008, Fletcher Nickel drilled 28,883 metres and filed a technical report published June 25th, 2009, which has not been incorporated into a resource estimate. Drilling continues at Texmont with several holes planned for winter 2023, with the goal of producing a current resource estimate using historic and new data, as the basis for an open pit mine plan to support a potential restart by 2025 or provide a source of higher-grade feed for the Crawford Nickel Sulphide project.

Texmont Historic Drilling[3]Drilling in the 2000’s intersected well mineralized and serpentinized ultramafic rocks described as predominantly komatiites-peridotites. The drilling produced several significant intersects. For example, hole TEX07-13 intersected 1.23% nickel over 28.0 metres, including 2.45% nickel over 7.0 metres. A sample of historical drill results is shown in Table 3. Groundwork performed by Canada Nickel has followed up on the location of this high-grade intersections, with the sampling on surface of strongly mineralized horizons. (Figure 2)

Recent Activity

This release provides an update with logging information from the first four holes in our ongoing drill program at Texmont. True widths are unknown at this point.

The first three holes intersected mineralization immediately after overburden, confirming its continuation to surface. Higher sulphide mineralization was intersected as expected over intervals of 16.0-25.0 metres in all three holes within overall mineralized intervals of whole core lengths, and was found in outcrop. (See Figure 2).

Holes TXT22-01 and TXT22-02 collared on the same setup with both holes drilling to the west. TXT22-01 collared in ultramafic containing strongly disseminated, blebby nickel sulphide mineralization, to the end of hole at 249 metres (Figure 3). TXT22-02 drilled at a shallower angle (-45) on the same section and intersected moderate to strongly mineralized ultramafic to the end of hole at 126 metres. Both holes were interrupted only by minor late gabbro dykes.

TXT22-03 drilling to the east, collared in peridotite at 1.7 metres and continued in mineralized peridotite for 150 meters to the end of hole. Mineralization consisted of moderate to strongly disseminated, blebby nickel sulphide mineralization.

TXT22-04 collared off the anomaly in mafic volcanics with the target of delineating the potential wider resource envelopes of low to moderate grade (Figure 3). The hole targeted to cut across all hanging wall and footwall stratigraphy to gain an understanding of geology, structure, and grade variation outside of the higher-grade core. The hole intersected a mineralized peridotite at 127.3 metres and continued in variably mineralized peridotite to 308 metres with only minor intervening dykes. The hole ended in volcanic footwall rock at 343 metres.

Transaction terms

The Company has entered into a binding agreement to acquire a 100% interest (subject to certain third-party rights described below) in 14 mining leases in exchange for a $250,000 cash payment and issuing a non-interest bearing promissory note of $3.75 million due March 14, 2023. At closing, the seller will be granted a 2% net smelter returns royalty, which can be bought down to 1% for $2.5 million at the Company’s option. The property has a legacy ownership interest of 15% and net profits interest of 10%. The Company intends to determine whether these interests are still valid. The Company had previously acquired 14 claims surrounding these mining leases in 2022 as part of its regional property consolidation.Red Cloud Securities Inc. acted as financial advisor on behalf of Canada Nickel with respect to the Transaction.

Sothman Nickel Property

The Sothman property is approximately 1,100 hectares, located 70 km south of Timmins and contains an ultramafic target that measures 2.2 kilometres east-west by 200 metres north-south (Figure 5).

Ten drillholes have been drilled to date. Information for the first five holes is found in previous release (December 1st, 2022). The next five holes reported in this release were drilled on the western end of the target anomaly, where the historical resource was located, to confirm the high-grade mineralization and the potential for larger, adjacent intervals of lower grade mineralization (Table 4). These holes succeeded in confirming the presence of high-grade mineralization within wider intervals of 100 to 120 metres of mineralization throughout (see Table 5). Assays from all holes are pending.

Drilling continues in the Sothman property with one hole planned for downhole geophysics to aid in the understanding and targeting the centre of the higher-grade core as the Company believes that these geological structures have the potential for additional nickel lenses, particularly given the last geophysical and drilling work took place in the early 1970s. Assays from all holes are pending SOT22-06, SOT22-07 and SOT22-08 collared in volcanics on the same setup behind an outcrop with high-grade mineralization (Figure 6). SOT22-08 exited the dunite into volcanics and suggests the high-grade zone pinches out quickly to the east. SOT22-06 and SOT22-07 remained in moderate to strongly serpentinized and mineralized dunite to the end of hole, indicating the high-grade host rock expands to 150 metres in thickness westward across most of its estimated strike length of 300 metres.

SOT22-08 is drilled to the southeast in semi-parallel orientation to strike but perpendicular to measured high-grade shoots. Strong nickel mineralization occurs in pervasive disseminated sulphides as well as patchy blebs with a sharp lower contact against mafic volcanics.

SOT22-09 and SOT22-10 are drilled 50 metres northwest of SOT22-08 collaring in mafic volcanics, both drilling to the south. Both holes intersected serpentinized dunite and peridotite with varying amounts of mineralization predominantly pyrrhotite and pentlandite.

Sothman Historic Drilling

Drilling by previous owners in the 1950’s and 1970’s produced several significant intersections. For example, hole DG50-S04 intersected 1.58% nickel over 12.2 metres (8.6 metres estimated true width) from 41.2 metres downhole including 4.6 metres (3.2 metres estimated true width) of 2.31% nickel and 0.19% copper.[1]

An unclassified historical resource estimate[2] reported 189,753 tons grading 1.24% nickel (the Sothman West Zone) is centred 500 metres west of the main sill (the 2.2 km dunite sill is largely untested). The Sothman West Zone occurs at the north ultramafic contact within a footwall embayment approximately 300 metres wide and open at depth.

A sample of historical drill results is shown in Table 6. Two drillholes intersected a deeper zone of similar sulphide mineralization (3.4 metres of 1.32% nickel from 398 metres in SM71-1 and 5.5 metres of 0.49% nickel from 353.2 metres in SM71-2) outside of the resource during the last drill program in 1971. The limited drilling in 1971 proved the high-grade zone remains open at depth. See previous release November 22, 2021.

Bannockburn Nickel Property

The Bannockburn Property is located 65 kilometres southeast of Timmins and approximately 27 kilometres northeast of the Sothman Property, and 30 km southeast of Texmont. The property contains at least two ultramafic units, the “B” Zone, a large, predominantly bulk tonnage mineralized ultramafic which has been recently tested and smaller, high-grade zones in the “C”, “D” and “F” zones. (Figure 7). See previous release June 7, 2022.

Previous drilling within the high-grade zones intersected up to 5% nickel in the “C” Zone, which averages 2.5 metres in true thickness, 0.85% nickel over 4.27 metres in the “D” Zone, which remains open and up to 4.54% nickel in the “F” Zone with widths ranging from 0.25 metres to 17.6 metres (Table 7 and 8) which also remains open.

Canada Nickel has recovered high-grade samples from outcrop (Figure 8) and identified several targets to follow up with a drilling campaign in 2023 to better define the geological and mineralogical continuation on strike and dip of these zones.

Crawford PGM

Crawford also contains an area of higher-grade mineralization outside the bulk tonnage Main Zone and East Zone resources. During the most recently completed drilling, the Company intersected several significant PGM intervals in the northwest area of the deposit. Hole CR22-234 yielded 30 metres of 1.82 g/t palladium + platinum. Hole CR22-236 yielded 15.0 metres of 1.88 g/t platinum + palladium (Table 9). PGEs have been found generally at the contacts of peridotite and pyroxenites, continuing with anomalous values within the pyroxenites, around Crawford Main zone and East zone, but not at these grade/thicknesses.

Assays, Quality Assurance/Quality Control and Drilling and Assay

Edwin Escarraga, MSc, P.Geo., a "qualified person" as defined by National Instrument 43-101, is responsible for the on-going drilling and sampling program, including quality assurance (QA) and quality control (QC). The core is collected from the drill in sealed core trays and transported to the core logging facility. The core is marked and sampled at 1.5 metre lengths and cut with a diamond blade saw. One set of samples is transported in secured bags directly from the Canada Nickel core shack to Actlabs Timmins, while a second set of samples is securely shipped to SGS Lakefield for preparation, with analysis performed at SGS Burnaby or SGS Callao (Peru). All are ISO/IEC 17025 accredited labs. Analysis for precious metals (gold, platinum, and palladium) are completed by Fire Assay while analysis for nickel, cobalt, sulphur and other elements are performed using a peroxide fusion and ICP-OES analysis. Certified standards and blanks are inserted at a rate of 3 QA/QC samples per 20 core samples making a batch of 60 samples that are submitted for analysis.

Qualified Person and Data Verification

Stephen J. Balch P.Geo. (ON), VP Exploration of Canada Nickel and a "qualified person" as is defined by National Instrument 43-101, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Canada Nickel Company Inc. The magnetic images shown in this press release were created from Canada Nickel’s interpretation of datasets provided by the Ontario Geological Survey.

Issuance of Shares to Service Provider

Canada Nickel also announces today that, subject to the approval of the TSX Venture Exchange, it has agreed to issue an aggregate of 86,337 common shares of Canada Nickel in satisfaction of an aggregate of $123,463 in obligations due to a service provider. The common shares will be subject to a four-month hold period under applicable securities laws.

About Canada Nickel Company

Canada Nickel Company Inc. is advancing the next generation of nickel-sulphide projects to deliver nickel required to feed the high growth electric vehicle and stainless-steel markets. Canada Nickel Company has applied in multiple jurisdictions to trademark the terms NetZero NickelTM, NetZero CobaltTM, NetZero IronTM and is pursuing the development of processes to allow the production of net zero carbon nickel, cobalt, and iron products. Canada Nickel provides investors with leverage to nickel in low political risk jurisdictions. Canada Nickel is currently anchored by its 100% owned flagship Crawford Nickel-Cobalt Sulphide Project in the heart of the prolific Timmins-Cochrane mining camp. For more information, please visit www.canadanickel.com.

For further information, please contact:

Mark Selby

Chair and CEO

Phone: 647-256-1954

Email: info@canadanickel.com

Cautionary Statement Concerning Forward-Looking Statements

This press release contains certain information that may constitute "forward-looking information" under applicable Canadian securities legislation. Forward looking information includes, but is not limited to, drill and exploration results relating to the target properties described herein (the "Properties"), the potential of the Crawford Nickel Sulphide Project and the Properties, timing of economic studies and mineral resource estimates, the ability to sell marketable materials, strategic plans, including future exploration and development results, and corporate and technical objectives. Forward-looking information is necessarily based upon several assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Factors that could affect the outcome include, among others: future prices and the supply of metals, the future demand for metals, the results of drilling, inability to raise the money necessary to incur the expenditures required to retain and advance the property, environmental liabilities (known and unknown), general business, economic, competitive, political and social uncertainties, results of exploration programs, risks of the mining industry, delays in obtaining governmental approvals, failure to obtain regulatory or shareholder approvals, and the impact of COVID-19 related disruptions in relation to the Company’s business operations including upon its employees, suppliers, facilities and other stakeholders. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. All forward-looking information contained in this press release is given as of the date hereof and is based upon the opinions and estimates of management and information available to management as at the date hereof. Canada Nickel disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, except as required by law.

[1] The Texmont historical resource estimate is unclassified and does not comply with CIM Definition Standards on Mineral Resources and Mineral Reserves as required by NI-43-101. The historical resource was reported by Fletcher Nickel Inc. at page 22 (“Texmont Historic Reports – Leigh 1971 Report”) of its amended and restated prospectus dated October 25, 2007.

[2] The Sothman historical resource estimate is unclassified and does not comply with CIM Definition Standards on Mineral Resources and Mineral Reserves as required by NI 43-101. The historical resource was reported by D. R. Bell for Sothman Mines Limited on Oct. 1, 1969, as 189,753 tons of 1.24% nickel using a 1.00% nickel cut-off.

The reliability of these historical resources is considered reasonable, but a qualified person has not done sufficient work to classify the historical resource estimate as a current mineral resource and the Company is not treating the historical resource estimate as a current resource. The Company plans on conducting an exploration program to redefine the historical resource as a current mineral resource category

[3] See note above regarding historical Texmont resource estimate. A qualified person has not done sufficient work on behalf of Canada Nickel to verify the data.

[4] See note above regarding historical Sothman resource estimate. A qualified person has not done sufficient work on behalf of Canada Nickel to verify the data.

[5] See note above regarding historical Sothman resource estimate. A qualified person has not done sufficient work on behalf of Canada Nickel to verify the data.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +41 (71) 354-8501

E-Mail: mo@resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()