Golden Hopes 2023

Looking at the S&P stock index, it had set a new intraday record high in January 2022. In the rest of 2022, it lost 19 percent. This was thus the worst year since 2008, when gold held up much better, ending neutral in price, while other assets took losses. Some analysts expect lows to continue in early 2023. Because still the monetary policy of most central banks (higher interest rates) and fears about the economy in the U.S., the European Union and China. And the war between Russia and Ukraine continues unabated. But gold should thus live up to its function as a safe haven. Many see the gold market at the beginning of a new bull market. The reason lies, among other things, in the solid gains of the last month. After all, the gold price has gone up significantly, almost 13 percent, since its low of 1,618 U.S. dollars per ounce in November.

At 1,810 U.S. dollars per ounce of gold is a support, the gold price could currently hold this well, there is a further price increase to be expected. The experts, such as the Royal Bank of Canada, expect gold prices to rise this year and next. Because a weakening US dollar and again sinking interest rates will give the price of the precious metal a boost. Incidentally, silver could even outperform gold at the end of 2022 with an increase of over two percent.

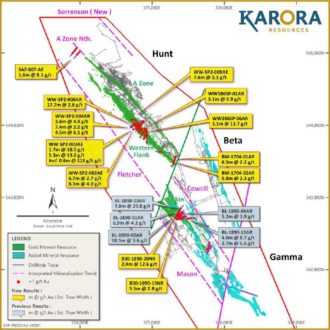

In the gold sector, for example, Trillium Gold Mines is attractive. The company owns an immense property package in the Red Lake mining district in Ontario, and in addition, properties in Larder Lake, Ontario, provide opportunities.

When it comes to silver investments, MAG Silver – https://www.commodity-tv.com/play/mag-silver-starting-to-ramp-up-the-juanicipio-mill-soon-more-exploration-at-deer-trail/ – could be worth a look. Together with its partner Fresnillo, MAG Silver is developing the Juanicipio project in Mexico, and mine production has already started.

Latest corporate information and press releases from MAG Silver (- https://www.resource-capital.ch/en/companies/mag-silver-corp/ -) and Trillium Gold Mines (- https://www.resource-capital.ch/en/companies/trillium-gold-mines-inc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()