Who buys silver jewelry?

The World Gold Council found in a survey that Millennials (born in the 1980s to the late 1990s) buy more silver jewelry than other U.S. residents. In 2020, for example, women between the ages of 20 and 40 bought the most silver. The consumer trend seems to be toward quality and meaningful items. This was also the case during the pandemic period; branded jewelry is especially in demand, so growth rates of nine to twelve percent annually are expected in the coming years. The growth opportunities in the branded silver jewelry sector are therefore great, he said.

The society consists of five generations, the oldest of which, the so-called Silent Generation (born in 1945 or earlier) is small, but one of the richest generations. For each generational group, by the way, the way jewelry is advertised is naturally somewhat different. Baby boomers born between 1946 and 1965 are the heavyweights in terms of numbers and are thus the most important group, they also spend the most money. Generation X (born between 1965 and 1980) spends the second largest amount on silver jewelry. In addition to Millennials, there is also the group called Generation Z (1995 to 2000s), which makes up 32 percent of the world’s population.

Gold was the optimal luxury, but more and more silver jewelry is being viewed with an increasing sense of value. Those who value silver as jewelry, in the form of coins or bars, should also think about the function of silver in terms of industrial metal and get a few silver shares in the depot.

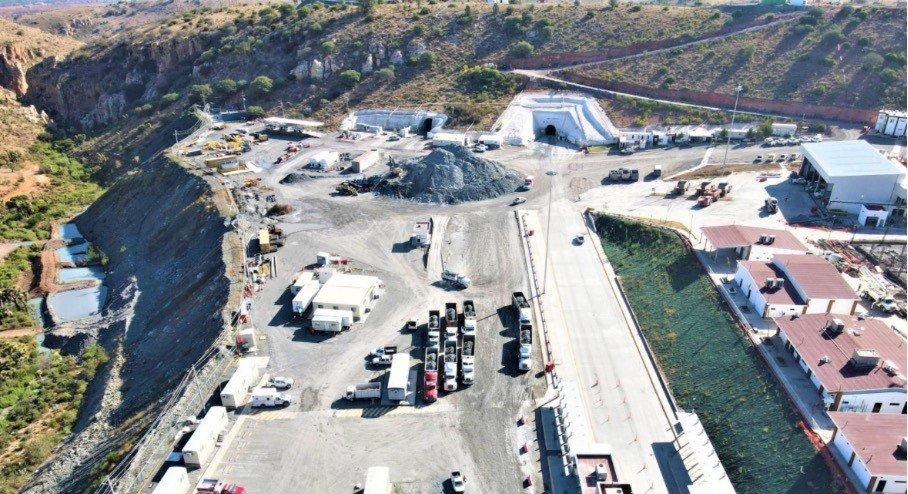

There is MAG Silver – https://www.youtube.com/watch?v=Ji1VkbzYjc0 -, for example, with its ambitions to become a primary silver company. The main project is the Juanicipio project in the Fresnillo Trend in Mexico, partnered by Fresnillo.

In Peru, Tier One Silver – https://www.youtube.com/watch?v=X7nDOPabASA&t=1s – is taking care of its flagship project Curibaya. The company is focusing on further silver, gold and base metal projects in Peru.

Current corporate information and press releases from MAG Silver (- https://www.resource-capital.ch/en/companies/mag-silver-corp/ -) and Tier One Silver (- https://www.resource-capital.ch/en/companies/tier-one-silver-inc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()