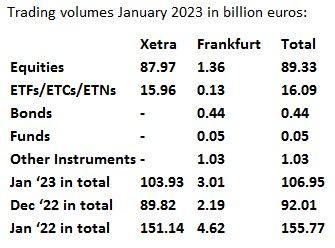

Cash market trading volumes in January 2023

€103.93 billion were attributable to Xetra (previous year: €151.14 billion / previous month €89.82 billion), bringing the average daily Xetra trading volume to €4.72 billion (previous year: €7.20 billion / previous month: €4.28 billion). Trading volumes on Börse Frankfurt were €3.01 billion (previous year: €4.62 billion / previous month: €2.19 billion).

By type of asset class, equities accounted for €89.33 billion in the entire cash market. Trading in ETFs/ETCs/ETNs generated a turnover of €16.09 billion. Turnover in bonds was €0.44 billion, in certificates €1.03 billion and in funds €0.05 billion.

The DAX stock with the highest turnover on Xetra in January was Linde plc with €5.18 billion. Rheinmetall AG led the MDAX with €1.17 billion, while Nordex SE led the SDAX index with €256.24 million. In the ETF segment the iShares Core DAX UCITS ETF generated the largest volume with €485.95 million.

Further details are available in Deutsche Börse’s cash market statistics. For a pan-European comparison of trading venues, see the statistics provided by the Federation of European Securities Exchanges (FESE).

Due to adjustments in the ownership structure of Tradegate Exchange with effect from July 2022, the trading volumes of Tradegate Exchange will no longer be reported in Deutsche Börse Group’s cash market statistics. The trading volumes of Tradegate Exchange will be published by the company itself and can be found on Tradegate Exchange.

Deutsche Börse AG

Neue Börsenstr. 1

60487 Frankfurt am Main

Telefon: +49 (69) 211-0

Telefax: +49 (69) 211-12005

http://www.deutsche-boerse.com

Media contact

Telefon: +49 (69) 211162-77

E-Mail: media-relations@deutsche-boerse.com

![]()