Gold demand at new decade high in 2022

The World Gold Council has again published the latest data on the gold market.

Gold demand increased by 18 percent last year compared to the previous year. 4,741 tons of gold were demanded in 2022, more than at any time since 2011. Central banks were responsible for this, among other things. They bought around twice as much gold as in 2021, a new 55-year record high. Buyers of coins and bars have also been eager to buy gold, especially in Europe and particularly in Germany. This even offset weaker demand in China. At the same time, ETF outflows have slowed. Corona restrictions in China caused a decline in jewelry demand there. There could be pent-up demand in that sector. Overall, jewelry demand posted a three percent decline last year.

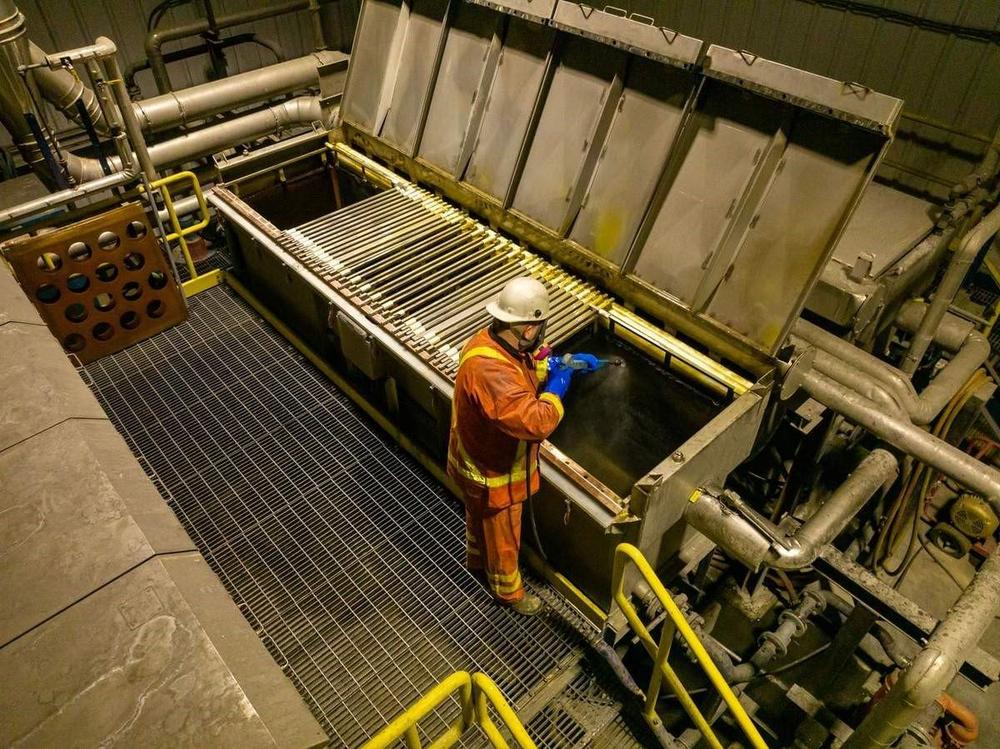

On the supply side, there was a two percent year-on-year increase to 4,755 tons of gold. Gold mines produced 3,612 tons of gold. High inflation rates and the search for a safe haven spurred gold buyers. The fact that ETFs saw outflows was certainly also due to high interest rates. If the current year brings a recession and inflation goes down, then this could be rather negative for investments in coins and bars. In contrast, ETFs should benefit from a weak U.S. dollar and lower interest rate hikes. In any case, according to the World Gold Council, gold has proven its value as a long-term asset in these turbulent times. Therefore, gold stocks should not be missing in the stock portfolio, such as the shares of Victoria Gold or Trillium Gold Mines.

Victoria Gold – https://www.commodity-tv.com/play/newsflash-with-victoria-gold-calibre-mining-consolidated-uranium-cypress-development-and-alpha-lithium/ – is already producing successfully at its Eagle Gold Mine in the Yukon. Further exploration potential exists.

Trillium Gold Mines owns a large property package in the Red Lake mining district in Ontario. In addition, there are properties in Larder Lake, Ontario.

Current corporate information and press releases from Victoria Gold (- https://www.resource-capital.ch/en/companies/victoria-gold-corp/ -) and Trillium Gold Mines (- https://www.resource-capital.ch/en/companies/trillium-gold-mines-inc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()