Already invested in gold or gold stocks?

If the price of the precious metal was very low a few weeks ago, it now looks very different. The short trend may now be over, gold has turned long. Gold has finally undergone a revaluation. Looking at the contract volume traded in gold last week, it was the highest since mid-August 2020. Looking back at the 1,159 weeks since the beginning of the century, the volume reached 19th place. And that begs the question, what will happen to the price of gold once the Fed stops its rate hikes?

If you look at the stock market over a longer period of time, it has never and permanently gone down. Over the last 100 years, the stock market has generally been in an uptrend. The longest bear market was from 2000 to 2009, with gold’s recent rally above $1,900 per ounce (last Monday gold briefly rose above $2,000 per ounce) driven by financial market stress, recession risk and increased volatility. Many experts now expect gold to test the US$2,000 mark again soon. When the banking sector slid into the crisis, the gold price recovered, whereas in the past this was just different in similar situations, the gold price tended more downward. The problem was liquidity shortages among market participants, who had to sell what was still the only stable asset to raise liquidity. It hasn’t gotten that far in this crisis cycle. But today, inflation concerns exist in addition to the geopolitical malaise, not to mention central banks are busy buying gold. Good, who is already invested in gold and gold shares. Among others, the gold producers Caledonia Mining and Calibre Mining are particularly appealing.

At Caledonia Mining – https://www.commodity-tv.com/ondemand/companies/profil/caledonia-mining-corporation-plc/ -, the Blanket gold mine in Zimbabwe (64 percent owned by the company) provides gold production. Local investors stand for acceptance.

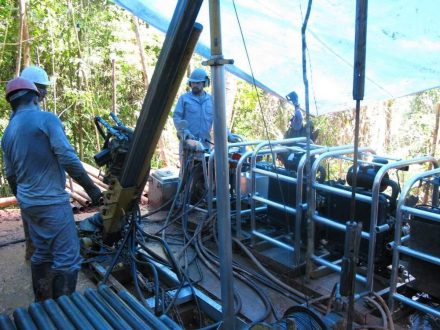

Calibre Mining – https://www.commodity-tv.com/play/calibre-mining-creating-a-growth-oriented-mid-tier-gold-producer/ – is producing successfully, with projects located in North and South America. In 2022, a 170,000-meter drill program was conducted across all assets.

Current corporate information and press releases from Caledonia Mining (- https://www.resource-capital.ch/en/companies/caledonia-mining-corp/ -) and Calibre Mining (- https://www.resource-capital.ch/en/companies/calibre-mining-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()